Buy ICICI Prudential Life Insurance Ltd For Target Rs. 680 by Motilal Oswal Financial Services Ltd

APE and VNB in line; margin expands to 22.7%

Enhancing products to boost product-level margins

* ICICI Prudential Life Insurance (IPRU) reported a slight decline of 3% YoY in new business APE to INR35b (in line) in 4QFY25. For FY25, APE grew 15% YoY to INR104.1b.

* VNB margin for the quarter stood at 22.7% vs. our estimate of 21.9% (21.5% in 4QFY24). Absolute VNB grew 2% YoY to INR 8b (in line). For FY25, VNB was at INR23.7b (+6%) and margin stood at 22.8% vs. 24.6% in FY24.

* For 4QFY25, IPRU reported a 122% YoY jump in shareholder PAT to INR3.9b (32% beat). For FY25, PAT grew 39% YoY to INR11.9b.

* Management aims to achieve higher VNB growth compared to APE growth, driven by 1) improvement in protection segment margin by repricing group term products, and 2) sustaining higher margins in ULIPs through rider attachments and higher sum insured. While there is no specific APE growth guidance, the aim is to grow higher than estimated industry growth of 15% in FY26.

* We trim our APE growth estimates for FY26 from 18% to 14% while retaining FY27E growth at 16%. For VNB margins, we build in about 70bp/50bp expansion in FY26/FY27 to 23.5%/24% due to better ULIP and protection margins. Reiterate BUY with a TP of INR680 (based on 1.6x FY27E EV).

Margin expansion driven by revival of non-linked business

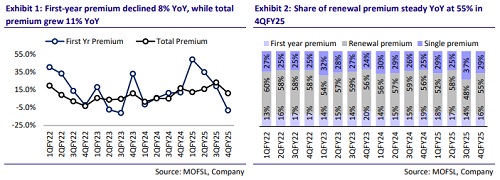

* IPRU’s gross premium grew 11% YoY to INR168.3b (in line) in 4QFY25 and grew 15% YoY to INR498.5b for FY25. Renewal premium grew 9% YoY (in line) to INR92.1b.

* APE declined 3% YoY in 4QFY25, largely due to 3%/16% YoY decline in ULIP/ Non-PAR segments. However, the introduction of a new guaranteed product in 4QFY25 led to strong traction in the non-par segment. The decline was offset by 115% and 9% YoY growth in the lumpy group business and protection business, respectively.

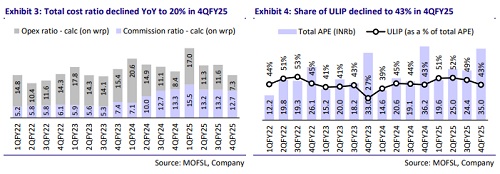

* The 120bp YoY expansion in VNB margin to 22.7% was due to a higher share of non-linked business and a higher contribution of ULIPs with higher sum assured and rider attachments (~10%).

* Retail protection and annuity, the key focus areas for IPRU, witnessed mixed performance in 4QFY25. While retail protection maintained strong growth momentum (+26.5% YoY), annuity witnessed a decline of 57.8% YoY due to the base effect.

* Commission expenses were flat YoY at INR15.8b, while operating expenses declined 8% YoY owing to the focus on operational efficiency. Total expenses declined 33% YoY to INR149.7b, largely due to changes in actuarial liabilities.

* On the distribution front, agency/direct channels saw a decline of 20%/8% YoY due to weak demand for ULIPs during the quarter. Bancassurance channel grew 7% YoY, with the share of ICICI Bank stable during the year at 14%. Group business posted strong growth of 33% YoY, largely due to lumpy group business during the quarter.

* On a premium basis, persistency was mixed in FY25, with 13th/37th month improving to 89.1%/75.2% and 61st month declining YoY to 64.1%.

* As of FY25, EV stood at INR479.5b, reflecting RoEV of 13.1% and EVOP of INR55.3b. RoEV was impacted by the INR2.5b hit in EV owing to operating assumption changes pertaining to mortality in group business.

* AUM grew 5% YoY to INR3.1t, while the solvency ratio stood at 212.2%

Highlights from the management commentary

* Management expects stable market conditions to support the revival of a wellrounded product pipeline. Focus will be on (1) enhancing guaranteed products with additional features to attract customer interest, and (2) launching highersum-assured ULIP products, offering differentiated solutions beyond standard ULIPs.

* Non-par segment has declined through the year but witnessed resurgence in 4QFY25 due to the launch of Gift Select product, which is expected to perform well in the current volatile market conditions.

* The quick uptake of the new guaranteed product by the agency channel reflects agility in adopting new products depending on the market environment, giving confidence about continued growth of the proprietary channel, as per the management.

Valuation and view

IPRU’s VNB margin has been under pressure even before 4QFY25, mainly owing to a shift in the product mix (higher share of ULIPs). However, the revival of non-linked business and momentum in higher-margin ULIP products have led to margin expansion in 4QFY25. We trim our APE growth estimates for FY26 from 18% to 14% while retaining our FY27 growth at 16%. For VNB margins, we build in about 70bp/50bp increase in FY26/FY27 to 23.5%/24%. The increase in margin assumption is premised on 1) improvement in protection segment margins as the company reprices group term products and 2) sustainability of higher ULIP margins owing to higher rider attachment and an increase in sum assured. Reiterate BUY with a TP of INR680 (based on 1.6x FY27E EV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412