Buy Biocon Ltd for the Target Rs. 400 by Motilal Oswal Financial Services Ltd

Generics drives earnings; Biosimilars progressing steadily

Product pipeline remains promising for the next 12-24M

* Biocon (BIOS) delivered a beat on 4QFY25 estimates, driven by strong execution in the Generics segment and steady progress in the Biosimilars segment. Syngene continued to improve its revenue run rate for 4QFY25, crossing the INR10b mark.

* We raise our earnings estimate for FY26 by 10%, factoring in: a) niche launches in the Generics and Biologics segments and b) better operating leverage. We value BIOS on an SOTP basis (20x 12M forward EV/EBITDA for 73% stake in Biocon Biologics, 53% stake in Syngene, and 14x EV/EBITDA for the Generics business) to arrive at a TP of INR400.

* FY25 was a mixed bag for BIOS. The company achieved successful compliance at its Malaysia and Biocon Park sites, while gradually recovering from challenges in biotech funding that had constrained business prospects for research services.

* We expect improved traction from niche launches in the Biosimilars and Generics segments to drive strong earnings growth over the next 2-3 years. Accordingly, we project a PAT of INR11b in FY27 vs INR2.5b in FY25. Reiterate BUY.

Generics/Research Services drive margins YoY

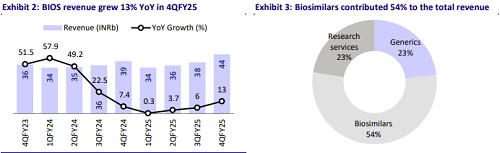

* 4QFY25 revenue grew 12.8% YoY to INR44.2b (est. INR41b).

* Generics sales were up 46% YoY to INR10.5b (23% of sales). Research services (23% of sales) were up 11% YoY to INR10.2b. Biosimilars (54% of sales) were up 5% YoY to INR24.5b.

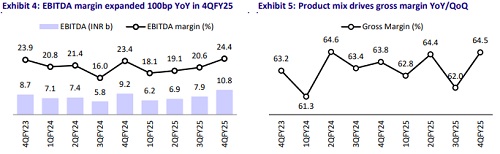

* Gross Margin (GM) expanded 70bp YoY to 64.5%, driven by its product mix.

* EBITDA margin expanded 100bp YoY to 24.4% (est: 20.8%) due to lower R&D/other expenses (-100bp/-300bp YoY as a % of sales), though offset by higher employee costs (+370bp YoY as % of sales).

* The EBITDA margin for Biocon Biologics was 21.9% in 4QFY25 (down 210bp YoY/up 70bp QoQ). Meanwhile, the EBITDA margin for Syngene stood at 35.7% (up 110bp YoY/560bp QoQ). The Generics business registered an EBITDA margin of 23.2% vs 4.6% YoY (2.8% QoQ).

* EBITDA grew 18% YoY to INR10.8b (est: INR8.5b) for the quarter.

* Adj. PAT grew 128% YoY to INR3.3b, supported by better operational performance and lower tax rate for the quarter.

* During FY25, Revenue/EBITDA/PAT grew 6%/7.6%/13.2% YoY to INR152b/INR32b/INR2.4b.

Highlights from the management commentary

* BIOS has a Target Action Date (TAD) for g-Copaxone in the next few months and for Insulin Aspart in about a month. The TAD for Liraglutide is set for 2HCY25.

* BIOS is scaling up production of Bevacizumab and is expected to launch it soon.

* BIOS indicated that a large part of g-Revlimid is being supplied under a settlement agreement with the innovator, which is expected to be lumpy in nature going forward.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412