Sell Eicher Motors Ltd for the Target Rs. 4,649 by Motilal Oswal Financial Services Ltd

Focus on growth continues to hurt margins

Margin pressure to result in slower earnings growth

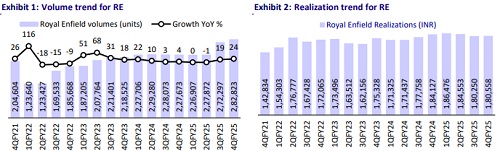

* Eicher Motors (EIM)’s 4QFY25 PAT at INR13.6b came in ahead of our estimates of INR12.8b, led by higher other income and a lower tax rate, even as operational performance was below our estimate. Management has indicated that it would continue to invest in demand-generation activities, including brand building, to help drive growth going forward.

* We expect RE to deliver a 7% earnings CAGR over FY25-27E. Given the expected slower earnings growth, we see no reason for the stock to trade at premium valuations. Reiterate Sell with a TP of INR4,649 (premised on FY27E SoTP).

Focus on growth continues to hurt margins

* EIM’s 4Q PAT at INR13.6b came in ahead of our estimates of INR12.8b led by higher other income and a lower tax rate, even as operational performance was below our estimates

* The key highlight in the quarter was that the standalone EBITDA margin continued to be under pressure (down 40bp QoQ) despite the 4% increase in volumes QoQ.

* Its 4Q margin stood at 24.7%, down 290bp YoY and below our estimate of 25.5%. 4Q margin was hit by: 1) adverse model mix (30bp), 2) rise in input costs like steel and Al (20bp), and 3) provision for clearing old stock (20bp).

* Margins dipped QoQ despite the INR300m reduction in marketing spend in 4Q, as this was offset by management’s focus on spending to drive volume growth (INR200m). Margin was also hit by ~INR190m for settlements towards a few European distributors who were under liquidation.

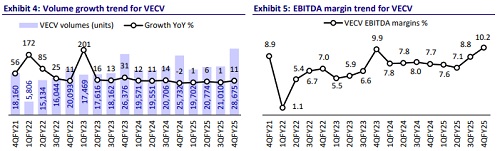

* VECV delivered another quarter of healthy performance by posting 270bp YoY increase in EBITDA margin to 10.4% (ahead of our estimate of 9.7%). As a result, VECV PAT grew 87% YoY to INR4.5b.

* For FY25, standalone margins have declined 140bp YoY to 25.8% as management’s focus on driving volumes over profitability has continued to hurt margins. Hence, despite the 15% YoY growth in revenues in FY25, EBITDA has grown at just 9%. Overall, PAT grew 14% YoY due to higher other income and a lower tax rate.

* VECV margins have improved 80bp YoY to 8.6% in FY25. Overall, PAT grew 56% YoY to INR12.8b.

* For FY25, the consolidated entity generated an FCF of INR29.5b post-capex of INR10.2b.

Highlights from the management commentary

* RE expects volume growth to continue in FY26 as well. While rural areas continue to see positive sentiments, they are now seeing initial signs of recovery in urban regions, which would bode well for players like RE.

* As indicated in the prior quarters, management continues to focus on absolute growth in profitability. For the same reason, their focus has been to provide value-added features to customers at affordable price points. Hence, for the recent variant launches of Classic, Battalion Black, and Hunter, which came in with a lot of feature additions, they have just passed on the cost increase to customers.

* In exports, RE remains among the top 4 brands in many countries globally in the middle-weight motorcycle segment. For instance, it is No. 1 in the UK, No. 2 in Argentina, and No. 3 in Brazil in this segment.

* Capex plans for FY26 stand at INR12-13b and would be invested in EV manufacturing facility, new product development, etc.

* Margin improvement at VECV has been a result of multiple factors, such as better price management, operating leverage benefits, and reduced discounts.

Valuation and view

We factor in a 10% volume CAGR for RE over FY25-27E as the company plans to continue prioritizing growth over margins. Hence, we expect margins to remain under pressure, as any benefit from an improving mix (higher spares and apparel sales) is likely to be invested by RE in demand-generation activities. This is clearly visible in the past two quarters, where volume has seen a healthy pick-up, albeit at the expense of margins. Hence, we expect RE to deliver a much slower 7% earnings CAGR over FY25- 27E. Given the expected slower earnings growth, we see no reason for the stock to trade at premium valuations. Reiterate Sell with a TP of INR4,649 (FY27E SoTP). We value RE at 24x FY27E EPS and VECV at 10x EV EBITDA on FY27E.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412