Buy Grasim Industries Ltd for the Target Rs. 3,550 by Motilal Oswal Financial Services Ltd

Market share gain in paints a key near-term priority

Digital certificate and financing scheme now offered for paints

Grasim Industries (GRASIM) organized an interaction with senior management, who shared their perspectives on the Paints business and highlighted new initiatives being implemented in this segment. Management emphasized that gaining market share is a near-term priority, supported by unique industry offerings in product warranties and financing schemes. It believes that offering financing schemes and digital certificates will attract more customers. Further, it remains committed to achieving INR100b in revenue by FY28E (third year of full-scale operations), along with profitability at the operating level.

Introduction of digital certificates: ‘Opus Assurance’.

* GRASIM has launched an initiative called ‘Opus Assurance’, aimed at providing improved warranty terms to consumers. Under this initiative, the company will allot a digital certificate to consumers who avail painting services for a paintable area of 2,000 sq. ft. (roughly the size of a 1BHK house in cities like Mumbai).

* Other companies, including GRASIM, have offered warranties on paints; however, these were never registered. Additionally, warranties often came with restrictive terms (e.g., a minimum usage requirement of 40 litres of exterior paint at a particular site), which were frequently difficult to fulfill.

* This scheme will cover the entire painting cost (including labor cost) in the event of paint failure within the covered areas during a certain time period.

* Contractors are required to scan the paint boxes and upload the details on the website; only then will the Opus Assurance certificate be issued.

Financing scheme introduced for painting services

* Birla Opus has introduced financing schemes similar to the models adopted by white goods companies. The company will offer a tax compliance certificate for painting services, which customers can use to avail financing options.

* The company has initially launched financing schemes in its franchisee stores (approximately 350, but will grow to 1,000 in the near future), spread across 500-600 towns. It plans to extend the scheme to contractors later.

* This financing will cover either the complete painting services or just the product. The base interest rate will be 8-9%, and the company has arranged subvention schemes with two banks, allowing customers to pay zero interest when using these schemes. Customers can choose to make payments at the shop or through a payment link.

* In the industry, painting charges are typically ad hoc. Management believes its pricing will remain competitive even after factoring in the GST charges on services (60% of the total painting cost is typically directed towards labor). Management also indicated that it is receiving a large number of leads, with strong conversion rates for customers using the financing schemes.

* The company conducted in-depth studies of painting services even prior to its entry into the paints business. This enabled it to offer competitive rates compared to its peers.

Other key points from the discussion

* The organized decorative paints industry is sized at INR560-570b. The unorganized segment’s share has declined from ~30% a few years ago to ~25% currently. A large number of industry players hold 1-5% market share, indicating significant scope for industry consolidation. Additionally, many capacities were commissioned long ago, making it challenging to sustain operations at these plants in the long run. Favorable commodity prices over the past year have benefited unorganized players.

* There has been no escalation in the paints business project cost of INR100b. The company maintains its guidance to achieve INR100b in revenue by FY28, and at that scale, the business is expected to be profitable at the operating level. Reaching this scale will position the company as the No. 2 player in the decorative paints segment. The short- to medium-term focus will remain on gaining market share.

* The Opus team is training contractors to improve efficiencies and optimize their time. A new laser measurement is being used, which provides a higher accuracy (94-95%) in area measurement.

* Premium products (including the total product portfolio) contribute 65% to the company’s revenue. The company continues to offer 10% extra paint in each box, with no changes to this promotion.

* The company’s footprint has expanded to over 8,000 towns, reaching around 50,000 dealers. Going forward, the pace of dealer additions will be slow, with a greater focus on increasing revenue per outlet.

* Birla Opus is available in 2,300 color shades with 216 iconic exclusive colors. These exclusive colors carry the essence of different cities.

Valuation and view

* Traction in the paints and B2B e-commerce businesses has exceeded our expectations, with steady revenues and market share growth over the past few quarters. Although losses in these new business verticals seem to have peaked, the key monitorable for us will be the reduction of losses over the next few quarters.

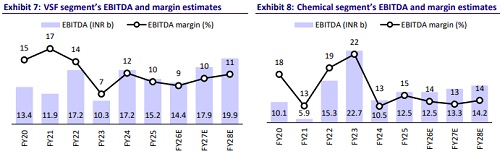

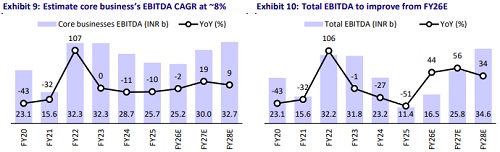

* We expect the combined EBITDA of the VSF and chemical business segments to clock a CAGR of ~8% over FY25-28. We have projected the chemical segment’s OPM at 13.7%/13.2%/13.8% in FY26/27/28E vs 14.7% in FY25. We have estimated EBITDA/kg of VSF at INR12.7/INR15.9/INR17.7 in FY26/27/28E vs INR14.7 in FY25.

* We reiterate our BUY rating on the stock with a TP of INR3,550, as we value its: 1) holdings in listed subsidiary companies by assigning a discount of 35%, 2) standalone business at 6x Sep’27E EV/EBITDA, 3) paints business at 2.0x of investments, 4) renewables business at 10x EV/EBITDA, and 5) B2B e-commerce at 1.5x of Sep’27E revenue

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412