Reduce Container Corporation of India Ltd For Target Rs. 520 By JM Financial Services Ltd

Margins improve but originating volumes still weak

CCRI results were ahead on EBITDA (8% vs consensus/20% JMFe) despite a revenue miss. Realizations were largely on expected lines with EBITDA beat driven by higher EXIM margin. Management attributed the EXIM margin beat to higher operational efficiencies (double stacking/lower empties). However, originating volumes remain muted (missed our estimates by 4%) which coupled with market share loss in Mundra (on aggressive price competition) paints a challenging picture. We raise our FY26E EBITDA/EPS by 5% factoring in the 2Q beat but largely retain our FY27/28E EBITDA and PAT estimates. TP raised to INR520 (lower risk free rate) with rating at REDUCE.

* 2QFY26 results ahead of estimates led by EXIM profitability, EXIM volume guidance maintained but underlying originating volumes weak: EBITDA at INR5.7bn (-3% YoY, +33%QoQ) beat JMFe by 20% and consensus by 8%. This was driven by EXIM profitability (EBIT/TEU) at INR3,877 which was 25% higher than our estimates. Management attributed this increase to operational efficiencies leading to decline in empty running costs. Furthermore, management has maintained the growth guidance of 10% for EXIM handling volumes. With 1HFY26 EXIM volume growth at 10.2%, we view the guidance to be achievable. The underlying EXIM originating volume trailed handling growth at 7.5% YoY in 1HFY26 leading to a flattish EBITDA YoY despite the growth in handling volumes.

* Loss of market share at Mundra is concerning as JNPT has limited scope of volume growth: CCRI lost market share in Mundra by ~260bps YoY which the management attributed to aggressive price competition. This was partly offset by market share gain at JNPT. However, we note JNPT port container volumes are already trending at high capacity utilisations and should reach peak capacity potentially in FY27 limiting scope for rail container volume growth unless there is a material modal shift (1HFY26 volumes at ~4mm TEUs vs annual capacity of 10mm TEUs). It is widely believed that connection of WDFC (Western Dedicated Freight Corridor) by Mar’26 (Govt est revised from Dec’25) can boost rail modal share but our analysis shows that rail modal share may be limited to 22-24% (vs. 16% in FY25) due to increasing shift of EXIM container traffic towards Nagpur, Hyderabad and North Karnataka belt, which reduces the share of north-bound or WDFC-aligned traffic in the overall port EXIM cargo mix.

* Raise EBITDA estimates for FY26, largely unchanged for FY27/28, expect medium term challenges to persist: We raise our EBITDA/EPS estimates by ~5% each for FY26 led by rise in EXIM profitability. We retain our estimates for FY27/28. Over the medium term, we maintain our view that pricing aggression by well-funded peers is likely to weigh on CCRI’s pricing, EXIM margin and market share. CCRI’s initiatives to become an integrated logistics play by investing in first mile last mile (FMLM) logistics has been at a slower rate vs peers. CCRI seeks to increase domestic volumes (cement, fly ash etc) but these have marginal impact on EBITDA at best due to low profitability of domestic circuits.

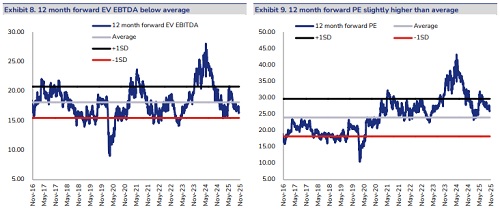

* Maintain REDUCE with higher TP of INR520 (vs. INR500 earlier): We value CCRI’s core business using DCF methodology and arrive at a Target price of INR520 (vs 500 earlier) led by higher EBITDA estimates for FY26 and lower risk-free rate of 6.5% (in line with India’s G-sec yield). Thus, we maintain REDUCE rating.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361