Add Star Cement Ltd For Target Rs.211 by Centrum Broking Ltd

Weak results owing to lower realizations and higher cost

STRCEM reported weak Q3 numbers due to higher costs and lower realizations. STRCEM’srecently commissioned 3.3mn mt kiln at Lumshong is still facing stabilization issues. Consequently, overall production is still lower and costs higher. While demand and pricing environment in North East remains robust, the company’s profitability and growth outside NE remains weak. We are building in 13%/18% Revenue/EBITDA CAGR for STRCEM over FY24-FY27E and value it at 9x FY27E EV/EBITDA to arrive at our target price of Rs211 (unchanged). We maintain our ADD rating.

Q3FY25 result highlights

Both revenue and volume grew 10% YoY, in line with our estimates, reaching Rs7.2bn and 1.07mn MT, respectively. Realization was up 1% QoQ but below our expectation. Operating cost per mt at Rs5,759 increased by 11% QoQ due to one-time maintenance shutdown cost and purchase of clinker from outside at higher price, which in total stood at Rs400mn. EBITDA at Rs1.04bn was down 30% YoY and 20% below our estimate. EBITDA/mt came in at Rs977 against our expectation of Rs1,223.

Capex on track; limestone mine in Rajasthan to provide regional diversification

The company’s ongoing capex plan includes 2mn mt GU in Silchar (FY26) and 2mn mt Jorhat GU (FY27). FY25/FY26 capex is pegged at Rs7bn/Rs6bn. The company’s total capacity post this capex will increase to 11.7mn mt from current 7.7mn mt. It has acquired limestone mines in Rajashthan, Nimbol (65-70mn mt) and the geological survey is in process with further expansion details to be provided in the coming quarters.

Complete acquisition ruled out

UltraTech has recently acquired a 8% stake in the company from the Chamaria family, a promoter shareholder. In the Q3FY25 concall, the management stated that the remaining promoters have no plans for dilution and reaffirmed STRCEM’s long-term vision

Valuation and outlook

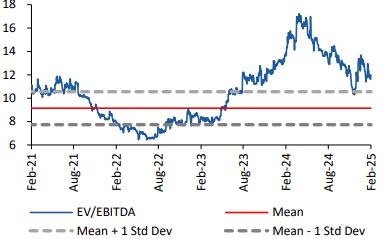

STRCEM stock is currently trading at ~15x/11x FY25/FY26 EV/EBITDA, which we believe is on the higher side given the size of the company and geographic concentration risk. We also believe that ramp-up of additional capacity will be challenging given the small size of the industry (capex of 4mn mt is 31% of total demand in NE). We value STRCEM at 9x FY27E EV/EBITDA to arrive at our target price of Rs211. We have ADD rating on the stock.

Valuation

We are building in 13%/18% CAGR in Revenue/EBITDA for STRCEM over FY24-FY27E. We value it at 9x FY27E EV/EBITDA to arrive at our target price of Rs211. We maintain ADD rating.

1-year forward EV/MT

EV/EBITDA mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331