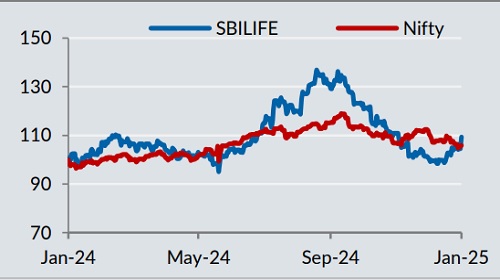

Buy SBI Life Insurance Company Ltd For Target Rs. 1920 By Yes Securities Ltd

Our view – Agency channel expected to drive growth going forward

APE growth – Growth improved in 3Q, with management guiding for robust agency channel growth:

New business APE grew 28.8%/13.2% QoQ/YoY. For 3Q, Banca channel grew 9.1% YoY whereas the Agency channel jumped 23.2% YoY. For FY25, individual APE growth is expected to be 14% whereas overall APE growth is expected to be 11%. Overall APE growth is slower than individual APE growth due to slowdown in the group fund business. The overall growth guidance is 15-17% in the medium term. With the kind of base the company has, 10% growth going forward from the Banca channel is satisfactory, as per management. The agency channel is expected to grow at 30% plus in the medium term. Management is confident of this growth since the company is not dependent on large agents, which have to be pursued via high commission payouts.

Stock performance

VNB margin – Calculated VNB margin has inched up sequentially, while management guided for stable to positive margin:

Calculated VNB margin for 3QFY25 rose 4bps QoQ but fell -46bps YoY to 26.9%. Management stated that, while it is a bit early to comment on the impact of surrender rule changes, the impact is expected to be minimal. Protection has seen higher double-digit growth sequentially in 3Q and the good growth is expected to continue in 4Q as well. There is significant focus on pure protection and the share of pure protection has risen to 37% in 3Q, with the remaining 63% being ROP (Return of Premium). There is not much change in ULIP margin but going forward, protection rider will be launched for attachment with ULIP. VNB growth will be slightly less than APE growth for FY25 as a whole and is likely to be single digit or 10%. There is potential for sequential margin expansion in 4Q due to improved product mix due to the new Non-Par product launched. From a medium-term perspective, the company will try to maintain VNB margin in a 27-29% range.

We maintain ‘BUY’ rating on SBIL with a revised price target of Rs 1920:

We value SBIL at 2.4x FY26 P/EV for an FY25/26/27E RoEV profile of 18.7%/18.6/18.5%.

Other Highlights (See “Our View” above for elaboration and insight)

* VNB growth: VNB growth was at 29.0%/11.3% QoQ/YoY where the QoQ growth was driven by growth in APE

* Expense control: Expense ratio de-grew -7/-91bps QoQ/YoY to 9.7%, where the opex ratio grew 1bp YoY but commission ratio de-grew -8bps YoY

* Persistency: 37th month ratio was flat YoY but grew 16bps QoQ to 72.4% whereas 61st month ratio grew 137/521 bps QoQ/YoY to 63.3%

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632