Buy Tata Power Ltd for the Target Rs. 476 by Motilal Oswal Financial Services Ltd

Focus on execution in FY26

* TPWR’s 4QFY25 EBITDA came in 7% above our estimate at INR32.5b, while adjusted PAT was in line with our est. at INR9.7b.

* Healthy 4Q EBITDA was backed by: 1) robust improvement in the Orissa distribution business, 2) strong performance in the Mundra, coal and shipping businesses, 3) higher contribution from both traditional and renewable generation. The cell and module business has continued to rampup well, with utilization now at elevated levels for both products. However, new RE capacity installation in 4Q stood at 166 MW, which was lower than the expectation of ~0.6GW.

* Key highlights for the quarter include: 1) Capex of INR162b was incurred in FY25, incl. INR41b in 4Q. For FY26, the capex target is INR250b (~60% for RE expansion and ~30% for Transmission & Distribution broadly, but might change); 2) TPWR has guided for 2.5-2.7GW of RE installation in FY26, which we believe could be ambitious given land acquisition/transmission issues plaguing the sector; 3) Progress on bidding opportunities for DISCOM privatization across India, including in UP, can be a key catalyst for the stock; 4) In cell and module, management expects production to exceed 3,700MW for both cells and modules in the coming year.

* The board recommended a final dividend of INR2.25/share for FY25.

* We reiterate our BUY rating on the stock with a TP of INR476.

EBITDA above estimate; adj. PAT in line

Results overview:

* TPWR reported consolidated EBITDA of INR32.5b in 4QFY25, 7% above our estimate of INR30.3b (+39% YoY), as all core businesses, incl. generation, T&D and RE, delivered strong performances.

* 4Q revenue stood at INR171b (+7% YoY), while reported PAT was in line with our est. at INR10.4b (+16.5% YoY).

* Adjusted PAT stood at INR9.7b (+14.5% YoY), which was in line with our est. of INR10.1b.

* For FY25, consol. revenue increased 6% YoY to INR654b, while EBITDA stood at INR139b. Reported PAT was INR39.7b (up 7% YoY).

Operational highlights:

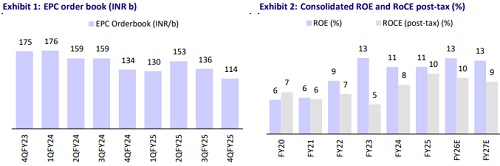

* Solar utility scale EPC and group captive order book stood at INR113.8b as of 4Q end.

* In 4Q, TPWR installed 354MWp of rooftop solar, and its third-party solar rooftop order book stood at INR10b as of 4Q end.

* The 4.3GW module plant is operating at over 90% utilization. All four cell lines (1GW each) also ramped up in 4QFY25. In FY25, ~3,300MW of modules were supplied. In 4QFY25, 913MW of modules and 650MW of cells were supplied.

* Commissioned 1,026MW of RE capacity in FY25, including 166MW in 4QFY25.

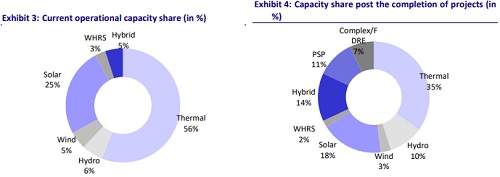

* As of 4Q, TPWR had a clean and green operational capacity of 6.9GW (44% of total installed capacity), with an additional 9.9GW under construction.

Highlights of 4QFY25 performance

* Capex of INR162b was incurred in FY25, incl. INR41b done in 4QFY25. For FY26, the capex target is INR250b (~60% for RE expansion and ~30% for Transmission & Distribution broadly, but might change).

* On track to commission 2.5-2.7GW of RE capacity in FY26. The RE pipeline stands at 5.5GW, expected to be commissioned over the next 6-24 months.

* TP Solar’s cell and module plants are now fully operational. Mgt. expects production to exceed 3,700MW for both cells and modules in the coming year.

* The 600MW Dagachhu hydro project in Bhutan has started, with completion expected by Nov’29.

* The board recommended a final dividend of INR2.25/share for FY25.

Valuation and view

* The valuation of TPWR is segmented across various business units, leading to a target price of INR476/share.

* Regulated business is valued using a 2.5x multiple on regulated equity.

* Coal segment is valued based on equity with a 1.5x multiple of FY24 book value.

* Renewables segment is valued at a 14x multiple of the projected FY27 EBITDA.

* Pumped storage segment is valued at 1x PB, while other segments are valued at 1.5x PB. Cash and investments add INR49/share.

* The sum of these contributions results in a total TP of INR476/share, reflecting the comprehensive valuation of TPWR’s diverse business segments.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412