Neutral KEC International Ltd For Target Rs.900 by Motilal Oswal Financial Services Ltd

Weak quarter

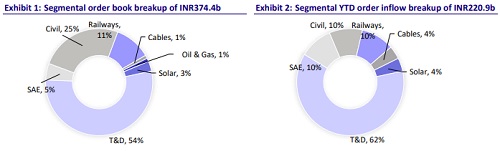

KEC International (KEC)’s 3QFY25 result was weak, with a miss on the revenue and PAT fronts. Revenue growth was hit by slower execution of water projects, labor shortages, and extended monsoons in Southern India. Margins and order inflows surprised during the quarter. YTD order inflows have spiked 72% YoY to INR221b, taking the order book to INR374b, up 24% YoY, particularly driven by T&D. Delayed payments from water projects led to a build-up in working capital and net debt, which will ease in the coming quarters. We expect growth over FY26/27 to be largely driven by the T&D segment, while the non-T&D segments will grow at a slower pace. We cut our estimates for FY25/FY26/FY27 mainly to factor in higher debt and interest expenses. We reiterate our Neutral rating on the stock with a TP of INR900 (based on 20x Mar’27 estimates).

Result below expectations

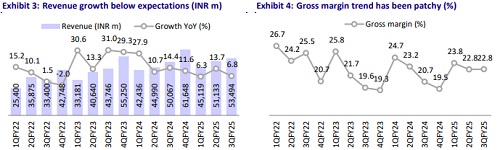

KEC reported weak numbers for 3QFY25, with a miss vs. our estimates at the revenue and PAT levels. Revenue growth stood at 7% YoY to INR53.5b vs. our estimate of INR57.9b. EBITDA grew 22% YoY to INR3.7b, while the margin at 7% improved 90bp YoY/70bp QoQ in line with management’s guidance of a sequential improvement. Interest expenses continued to remain high due to higher debt and working capital. These adversely impacted PAT, which came in at INR1.3b vs. our estimate of INR1.5b. Order inflows surged 124% YoY to INR86b, taking the closing order book (OB) to INR374b (+24% YoY). T&D/nonT&D mix stood at 59%/41%. OB + L1 position stood at INR410b. For 9MFY25, revenue/EBITDA/PAT grew 9%/147%/55% YoY.

Execution hurt by labor shortages and delayed payments

KEC’s 3QFY25 revenue growth was entirely driven by the T&D segment, which reported revenue of INR23.8b (+20% YoY), aided by a strong order book execution. The civil segment’s execution was hit by labor shortages and execution slowdown in Water projects owing to a buildup in receivables. While the payments from state governments have started flowing in, the company will be cautious while bidding for upcoming JJM projects, closely observing the cash flow trajectory first. Railways revenue declined 30% YoY, as the company focuses on the physical completion of the 15-20 legacy projects in the next 1-2 quarters. Cable division growth stood at 6% YoY and would improve further on the commissioning of the conductor facility from 4QFY25.

T&D witnessing robust traction across geographies

The company sees a robust T&D opportunity pipeline across India, the Middle East, the Americas, and the CIS regions, driven by the thrust on energy transition. The NEP provides long-term visibility on domestic T&D projects, with the company reporting a growth of 103% in overall T&D order inflows for 9MFY25. KEC has already bagged ~INR6-7b of HVDC orders from PGCIL, NTPC, etc. In the Middle East, the company has a positive outlook for Saudi Arabia and Abu Dhabi, where it benefits from a localized presence and faces limited competition. Saudi Arabia has a healthy pipeline of transmission projects, in which the company intends to participate. For the coming few quarters, the company sees a domestic T&D pipeline of ~INR500b.

Margin improvement can be gradual

In 3QFY25, the company reported a three-year high margin of 7%, with the 9MFY25 margin at 6.4%. While KEC has been reporting a sequential uptick, we believe margin improvement would be limited to 8-8.5% in FY26, despite the T&D margin having reached double digits. The low-margin legacy railways orders will be executed over the next 1-2 quarters, which combined with operating de-leverage in the Civil segment, will ultimately have a bearing on overall margins.

Non-T&D execution may remain lower than T&D

Execution of non-T&D segments may be slower than the T&D segment, with the company taking a conscious decision to adopt a selective approach towards railway opportunities, where competitive intensity has surged, and water projects where it is facing payment delays. In contrast, the domestic oil & gas tendering pipeline has seen a slowdown. On the Civil side, though management is confident of ~15% growth in FY26, it is facing labor shortages, which might weigh on execution. Accordingly, we believe T&D segment execution will be much faster going forward.

Working capital to experience moderation from FY26

Management is confident of achieving NWC of ~110 days by Mar’25, from 134 days currently. This will be backed by the realization of dues from water projects, which stood at INR5b as of 3QFY25 out of which it has already received ~INR1.6b in Jan’25. Similarly, the company has received INR4.5b from Afghanistan to date, with another ~INR1-1.5b expected in 4QFY25. Overall, its collections are improving, and the company targets a debt reduction of INR5-6b by 4QFY25, taking the overall debt level to INR45-50b.

Financial outlook

We reduce our revenue, margin, and earnings estimates for FY25/FY26/FY27, factoring in the 9MFY25 performance. Accordingly, we expect a revenue/EBITDA/PAT CAGR of 13%/25%/49% over FY24-27. This will be driven by: 1) order inflow growth of 27% over the same period, led by a strong prospect pipeline; 2) a gradual recovery in EBITDA margin to 7.0%/8.2%/8.2% by FY25/26/27; and 3) a gradual reduction in NWC, which has moved up during FY25. With the expected improvement in execution and margins, we expect the RoE and RoCE to improve to 17.9% and 16.1% by FY27, respectively.

Valuation and recommendation

KEC is currently trading at 23x/19x on FY26E/27E earnings. We value the company at 20x, rolling forward to Mar’27E. Our estimates bake in a revenue CAGR of ~13% and EBITDA margins of 8.2%/8.2% for FY26E/27E. We reiterate our Neutral rating with a TP of INR900.

Key risks and concerns

A slowdown in order inflows, higher commodity prices, an increase in receivables and working capital, and heightened competition are some of the risks that could potentially impact our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412