Buy Kirloskar Oil Engines Ltd For Target Rs.1,200 by Motilal Oswal Financial Services Ltd

Tough quarter

Kirloskar Oil Engines (KOEL)’s 3QFY25 result was weaker than our expectation due to demand slowdown in B2B and lower volumes from the B2C segment because of facility transition. KOEL, being a key player in the low-to-mid-kVa power genset market, was hurt by demand volatility and competition in 3Q, leading to pressure on volumes and prices. We expect the demand and pricing environment to remain a bit volatile during 4QFY25 too. We anticipate the genset market to start maturing from 1QFY26. We also expect the B2C segment to start ramping up from 4QFY25, which can lead to better absorption of costs and higher margins. The company intends to increase its share of higher-margin segments such as HHP, distribution, and exports but is currently disrupted due to weak demand. We revise our estimates downward to factor in the 9MFY25 weakness of both B2B and B2C and bake in lower margins. The stock is trading at 21x/17x FY26/27E earnings. We value it at 25x Mar’27E earnings for the core business and add the value of subsidiaries to arrive at our TP of INR1,200. Reiterate BUY.

Weak performance due to demand slowdown

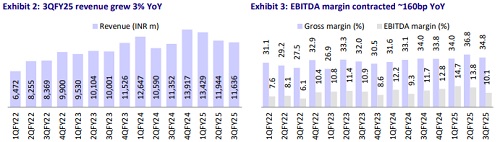

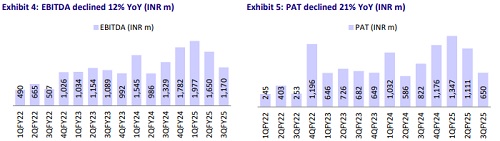

KOEL reported a weak quarter and was adversely impacted by a demand slowdown in powergen and increased costs for the B2C division. Revenue came in at INR11.6b, growing by 3% YoY as the company faced muted demand in the B2B segment (+3% YoY) owing to the CPCB 4+ transition, while B2C declined 3% YoY due to the continued impact of the consolidation of five of its plants into a single unit in Ahmedabad. EBITDA at INR1.2b declined 12% YoY, due to weak revenue and operating deleverage. Accordingly, EBITDA margin came in at 10.1%, a contraction of ~160bp YoY. PAT at INR650m declined 21% YoY, owing to weak operating performance and a higher effective tax (26.7% vs. 25.9% in 3QFY24). For 9MFY25, revenue/EBITDA/PAT grew 7%/24%/27% YoY.

Segmental performance weak in Powergen and B2C

B2B Powergen revenue stood at INR4.2b in 3QFY25 vs. INR4.8b in 2QFY25 and INR4.26b in 3QFY24 (our expectation at INR4.1b). This suggests that a 2% YoY dip in revenue is led by a sharp volume decline, which has even offset the impact of better pricing. As per management, volumes were down by nearly 40-45% YoY, and this could have offset the 35-40% price hike due to CPCB 4+ transition. While for Cummins, the similar comparable portfolio of low-kVa to mid-kVa has grown 24% YoY. So, we believe that KOEL might have ceded some market share to other players during the quarter. B2B industrial revenue has grown by 15.5% YoY, which is slightly lower than our estimates. B2B distribution revenue has grown 15.6% to INR2.1b. Exports were also down 17% YoY due to weak demand from its key markets and a lack of large-sized order inflows during 3QFY25.

Profitability hit by pricing pressure and higher costs for the B2C division

B2B’s EBIT margin for 3QFY25 stood at 8.9% vs. 12.4% in 2QFY25 and 10.8% in 3QFY24. This indicates pricing and cost pressures in the B2B segment. B2C losses have widened during the quarter with a --9.3% EBIT margin due to initial ramp-up issues from the shift of facilities at one location. With the normalization of volumes in B2C, KOEL expects margins in the B2C segment to revert to previous levels.

Outlook on the Powergen market

The Powergen market demand was hit by emission norm change and inventory of the earlier CPCB 2-related products. With the inventory of CPCB 2 largely being over, demand for CPCB 4+ products is expected to revive. Industry volumes are gradually improving sequentially from 28,000 units in 2QFY25 to 32,000 units in 3QFY25, and there are expectations that industry volumes will be around 36,000-38,000 units in 4QFY25 vs. more than 40,000 units in 4QFY24. Pricing is dynamic in the industry currently and varies from node to node. KOEL is strategically not participating in demand from commoditized segments such as telecom and is focusing on increasing the share of HHP in the overall portfolio.

Outlook on industrial, distribution, and exports in the B2B segment

The industrial business reported a healthy growth of 16% YoY, aided by strong demand from construction, railways, mining, oil & gas, defense, etc. The company expects the momentum to continue, especially from defense with its close cooperation with the armed forces. The distribution segment clocked 15% growth, with improving penetration of its service network leading to continued traction. We see the momentum to sustain with the transition to CPCB 4+. Exports declined 17% YoY on a high base of 3QFY24, and the company has identified this segment as not having performed as envisaged in its 2X3Y strategy. It will focus on each geography separately on its merits and is confident of a pickup in the Middle East.

Arka Fincap’s AUM surpasses INR67b

Arka’s revenue grew 43% YoY to INR2.1b, while AUM stood at INR67.4b. Management continues to closely monitor the granularity of the loan book, spread of the risk, and return profile. Arka intends to grow its loan book by increasing its exposure to small-ticket loans against property, which are fully secured. Management does not contemplate hiving off the entity, and Arka will continue to be housed under the consolidated KOEL business for the foreseeable future.

Financial outlook

We reduce our estimates by 12%/17%/21% for FY25/26/27 to factor in lower revenue across segments as well as lower margins due to price volatility in B2B. We expect a revenue CAGR of 12% over FY24-27, driven by 11%/15%/15%/12%/10% CAGR in powergen/industrial/distribution/exports/B2C. Over FY24-27E, we bake in 240bp improvement in margins to build in better product mix and operating leverage benefits. We expect a PAT CAGR of 21% over the same period.

Valuation and recommendation

The stock is currently trading at 26x/21x/17x FY25/26/27E earnings. Adjusted with subsidiary valuation, KOEL is trading at 22x/18x/14x FY25/26/27E EPS, which is still at a significant discount to the market leader. We reiterate our BUY on KOEL as we expect it to benefit from improved sales from higher HP segments, exports, and improving the trajectory of the B2C segment.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

.jpg)