Neutral Axis Bank Ltd for the Target Rs. 1,300 by Motilal Oswal Financial Services Ltd

PPoP in line; PAT miss amid one-time provisioning

Asset quality outlook turning better

* Axis Bank (AXSB) reported 2QFY26 net profit of INR50.9b (26% YoY decline, 8% miss) amid higher provisions.

* NII grew 1.4% QoQ (up 2% YoY) to INR137.4b (4% beat). NIMs contracted 7bp QoQ to 3.73%, aided by 4bp growth from interest reversals.

* Provisioning expenses stood at INR35.5b (18% higher than MOFSLe). The bank made a one-time standard asset provisioning of INR12.31b following an RBI inspection related to two discontinued crop loan variants.

* Loan book grew 11.7% YoY (up 5.4% QoQ). Deposits grew 10.7% YoY (up 3.6% QoQ), and CD ratio increased to 92.8% (vs. 91.2% in 1QFY26). CASA mix stood stable at 40%.

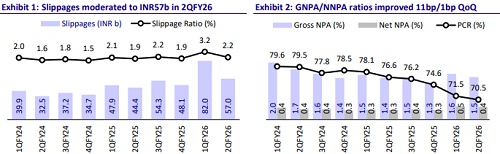

* Fresh slippages stood at INR56.96b (vs INR82b in 1QFY26), reflecting a technical impact of INR15.12b (44% QoQ decline). Net slippages on account of technical impact remained muted at INR2.8b. Adjusted for this technical impact, gross slippages stood at INR41.8b. GNPA/NNPA ratios improved 11bp/1bp QoQ to 1.46%/0.44%. PCR moderated 103bp QoQ to 70.5%.

* We fine-tune our earnings estimates and project FY27 RoA/RoE at 1.6%/14.4%. Reiterate Neutral with a TP of INR1,300 (1.6x FY27E ABV).

Business growth gains traction; NIM contracts by modest 7bp QoQ

* AXSB reported 2QFY26 PAT of INR50.9b (down 26% YoY/12% QoQ, 8% miss). NII grew 1.4% QoQ (up 2% YoY) to INR137.4b (4% beat). NIMs contracted 7bp QoQ to 3.73%.

* Other income declined 1.4% YoY/9% QoQ to INR66.3b (inline). Treasury gains stood at INR4.98b vs INR14.2b in 1QFY26. Total revenue grew 1% YoY to INR203.7b.

* Opex grew 5% YoY to INR99.6b (5% higher than MOFSLe), primarily driven by PSLC-related costs (INR9.48b), of which INR4.74b was recognized in 2Q. PPoP declined 3% YoY to INR104.1b (in line), while C/I ratio increased to 48.9%.

* Loan book grew 11.7% YoY/5.4% QoQ, with retail loans growing 2% QoQ, corporate book growing 10.7% QoQ, and SME loans rising 19% YoY/8.8% QoQ. Management expects advances to grow ~300bp faster than the industry over the medium term.

* Deposits grew 10.7% YoY (up 3.6% QoQ), resulting in an increase in C/D ratio to 92.8%. CASA mix stood at 40%.

* Fresh slippages stood at INR56.96b due to a technical impact. Adjusted for the technical impact, gross slippages stood at INR41.84b. GNPA/NNPA ratios improved 11bp/1bp QoQ to 1.46%/0.44%. PCR moderated 103bp QoQ to 70.5%.

* Delinquency trends in PL, credit cards, and MFI segments are stabilizing, with the bank resuming its card distribution network. Restructured loans stood at 0.10%. Credit cost stood at 0.73%.

* CAR/CET-1 stood at 16.55%/14.43%. Average LCR stood at 119%. RWA levels have increased sequentially, reflecting ~5% higher risk intensity due to higher operating risk and a shift toward SME exposure

Highlights from the management commentary

* Higher provisions during this quarter were primarily due to: 1) erosion in security value for 1-2 accounts, 2) aging-related provisions, and 3) higher standard provisions as advised by the RBI.

* The bank had offered two farmer loan products between 2015 and 2019, earlier classified under PSL but now declassified. RBI has directed the bank to make a static provision of INR12.31b, representing 5% of the total exposure. This provision is expected to reverse once the book runs down by Mar’28. To offset the impact, the bank has made PSLC purchases.

* As retail growth strengthens and risk profile improves, the bank expects to benefit from lower risk weights and further expansion in the retail book.

* The bank has maintained a CD ratio of around 92% (±2%) and guides to remain within this band.

Valuation and view

AXSB reported in-line PPoP, though net earnings were impacted by a higher onetime standard provision, as advised by the RBI. Margins contracted by modest 7bp QoQ, with management expecting NIMs to bottom out in 3Q. Asset quality improved sequentially as GNPA/NNPA ratios improved and slippages moderated QoQ, driven by a sequential decline in both core and technical slippages. Business growth has gained traction, with deposits expected to grow at a healthy rate, while the bank aims to outperform systemic credit growth by 300bp CAGR over the medium term. AXSB has maintained its through-cycle margin guidance of ~3.8%, even as it remains watchful of further repo rate cuts in the coming months. We finetune our earnings estimates and project FY27 RoA/RoE at 1.6%/14.4%. Reiterate Neutral with a revised TP of INR1,300 (1.6x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412