Neutral Bajaj Auto Ltd For Target Rs.8,770 by Motilal Oswal Financial Services Ltd

In-line result; favorable FX supports margins

Exports revive, but long-term outlook remains uncertain

* BJAUT delivered an in-line performance in 3QFY25, with volume growth of ~2%. Favorable FX and a higher spares mix helped BJAUT sustain margins at 20%+ despite a rising EV mix.

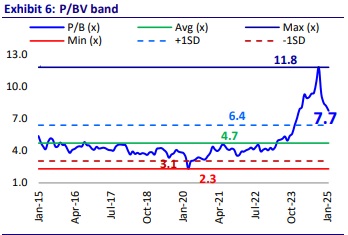

* We have marginally lowered our FY25/FY26 earnings estimates by 2% each. The key concern is that BJAUT has lost share in domestic 125cc+ segment on YTD basis. While exports seem to have revived in the near term, the longerterm outlook remains uncertain given the adverse macro globally. Hence, despite a correction in the stock price recently, BJAUT at ~25.5x FY26E/22.2x FY27E EPS appears fairly-valued. Therefore, we maintain a Neutral rating with a TP of INR8,770, based on 24x Dec’26E consolidated EPS

Margins maintained at 20%+ despite increase in EV mix

* 3QFY25 standalone revenue/EBITDA/PAT grew ~6%/6%/3% YoY to INR128.1b/INR25.8b/INR21.2b (est. INR130.3b/INR25.8b/INR21.7b). 9MFY25 revenue/EBITDA/adj. PAT grew 14%/17%/14% YoY.

* Revenue growth was led by 2% YoY growth in volumes and ~4% YoY growth in ASP at INR104.6k (est. INR106.4k).

* The green energy portfolio contributes ~45% of revenue (vs. 30% YoY).

* Gross margin was flat QoQ at 28.7%, (-20bp YoY, est. 28.4%). Raw material basket remained flat QoQ. Net impact of pricing was also minimal in 3Q.

* EBITDA margin stood at 20.2% (+10bp YoY/flat QoQ, est. 19.8%) despite the ramp-up of EVs due to favorable currency and improved spares (+21% YoY).

* Despite lower other income, adj. PAT came in line with our estimate.

* Cash balance stood at INR150b. BJAUT has invested INR15b in its finance subsidiary BACL. It has also invested INR4.5b in capex, two-thirds of which was invested in EVs.

Highlights from the management commentary

* Domestic 2Ws: Management expects the industry to post 6-8% growth in the near term. Given its focus on 125cc+ segment, BJAUT targets to outperform industry growth.

* Exports: Management expects exports to grow 20%+ for the next couple of quarters. The fastest-growing markets for BJAUT are Latin America (+30% YoY) and ASEAN. Even Africa has recovered, with Nigeria now clocking close to 30k units per month. However, BJAUT has refrained from giving a longterm outlook for exports given the current uncertainty in global markets.

* BJAUT expects the L5 segment to grow at 5-7%, driven by rising EV penetration and BJAUT targets to outperform industry growth with new launches.

* For its EV portfolio, BJAUT has posted EBIDTA in 3Q vs. just break-even in 2Q.

* Management has indicated that input cost is likely to see headwinds in 4Q, which is likely to be partially offset by favorable currency movement.

Valuation and view

* We have marginally lowered our FY25/FY26 earnings estimates by 2% each. BJAUT has lost market share in the domestic motorcycle segment by 150bp to 17%. The key concern is that it has lost share in 125cc+ segment as well on YTD basis.

* While exports seem to have revived in the near term, the longer-term outlook remains uncertain given the adverse macro globally. Further, the ramp-up of its CNG bike Freedom has been slower than expected. Hence, despite a correction in the stock price recently, BJAUT at ~25.5x FY26E/22.2x FY27E EPS appears fairly valued. Therefore, we maintain a Neutral rating with a TP of INR8,770, based on 24x Dec’26E consolidated EPS

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412