Buy IIFL Finance Ltd for the Target Rs. 450 by Motilal Oswal Financial Services Ltd

Strong growth in gold loans; overall credit costs moderate

Calc. NIM contracts ~10bp QoQ; GNPA improves ~20bp sequentially

* IIFL Finance’s (IIFL) 4QFY25 NII was down 20% YoY, but it rose ~6% QoQ to ~INR13.1b (~6% beat). Other income stood at ~INR810m (PQ: INR1.1b).

* Net total income declined ~10% YoY to ~INR14b. Opex dipped ~4% YoY to INR7.4b (in line), with the cost-to-income ratio declining to ~53% (PQ: 56% and PY: 49%). PPoP stood at INR6.6b and declined ~17% YoY. ? Credit costs were lower than estimated and stood at ~2.7% (PQ: ~4.2% and PY: ~1.9%). The decline in credit costs was primarily because of lower credit costs in the MFI business.

* Consol. PAT (post-NCI) declined ~44% YoY to INR2.1b in 4QFY25, and it dipped ~79% YoY to INR3.8b in FY25.

Consol. AUM up ~10% QoQ; strong growth in Gold loan AUM

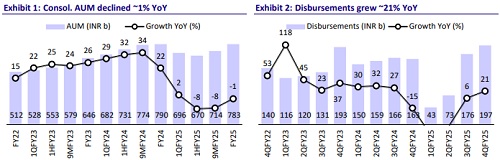

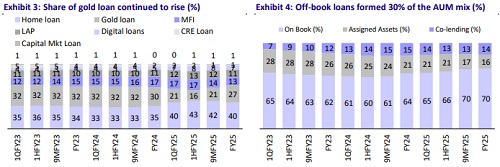

* Consol. AUM declined 1% YoY but grew ~10% QoQ to INR783b. On-book loans grew ~8% YoY. Off-book formed ~30% of the AUM mix, with colending forming ~14% of the AUM mix.

* Gold loan AUM stood at ~INR210b and rose ~40% QoQ. Sequential growth in Consol AUM was driven by gold loans (+40%), home loans (+4%), and MSME loans (+2%). Microfinance declined ~5% QoQ. Home loans rose ~15% YoY, and MSME loans grew ~18% YoY.

* The company has witnessed strong momentum in gold loan disbursements and expects the same to sustain through FY26. Management guided for gold loan growth of ~25-30% in FY26.

* In the previous quarter, gold loan growth came with a trade-off in yields, but in 4QFY25, the company reported an improvement in gold loan yields (up ~25bp QoQ) and expects some more yield improvement going forward.

* We estimate gold loans and consolidated AUM to grow ~25%/~18% YoY in FY26, resulting in a consol. AUM CAGR of ~18% over FY25-27E.

MFI credit costs moderate; no disruption visible in TN as yet

* Overall credit costs moderate in 4Q, primarily driven by a sharp reduction in credit costs within the MFI segment. Management attributed the decline in MFI credit costs to 1) selling a portion of its stressed MFI portfolio to an ARC, resulting in write-backs of ~INR500-600m; 2) reduction in PCR for Stage 2 and Stage 3 assets. Stage 3 PCR declined from ~88% to 71%, while Stage 2 PCR dropped from ~28% to 19% during the quarter; and 3) release of management overlay of INR1.25b, further easing the credit cost burden. These factors led to a reduction of ~INR2.4-2.5b in MFI credit costs in 4QFY25. Management guided MFI credit costs of ~5% in FY26.

* Additionally, the IIFL Samasta management highlighted that the company is not seeing any disruptions in Tamil Nadu from the recent TN Bill and that collection efficiencies in the state continue to remain at normal levels.

NIM dips ~10bp QoQ; calc. yields rise ~35bp QoQ

* Consol. yields/CoB rose ~35bp/30bp QoQ to ~13.3%/~9.7%.

* Calculated NIM dipped ~10bp QoQ.

Asset quality improves; PCR declines ~5pp QoQ

* GS3 (consol.) declined ~20bp QoQ to ~2.23%, while NS3 rose ~5bp QoQ to ~1.05%. PCR declined ~5pp QoQ to ~54%.

* Management shared that there was some spillover of stress from the unsecured segment in micro-LAP business but highlighted that, excluding the micro-LAP portfolio, asset quality within the housing business improved during the quarter.

* Management guided consolidated credit costs of ~2.5-2.7% (as a % of avg. loan book) in FY26 (vs. ~3.1% in FY25).

Highlights from the management commentary

* IIFL intends to grow faster in the secured portfolio, while growth in the unsecured portfolio will largely be driven through bank partnerships. The company intends to grow at a slower pace in the unsecured portfolio.

* The MFI and unsecured MSME portfolios are expected to witness elevated credit costs in the current year. However, the company plans to gradually pivot the MSME product mix towards a higher proportion of secured lending. As a result, it expects credit costs to normalize to historical levels by FY27.

* Management expects DA and co-lending to pick up in FY26. It targets to increase the off-book (co-lending and assignments) to ~40% by Mar'26.

Valuation and view

* IIFL delivered a healthy performance during the quarter, driven by strong sequential growth in both gold loans and overall AUM. The rebound in gold loan disbursements reflects the company’s renewed focus on regaining market share and recapturing previously lost business in this segment. On the asset quality front, credit costs moderated on a sequential basis, primarily driven by a decline in MFI credit costs.

* We cut our FY26 and FY27 EPS estimates by ~8%/18% to factor in the lower loan growth and NIM compression. The stock trades at 1x FY27E P/BV and ~8x P/E for a PAT CAGR of ~136% over FY25-FY27E. We estimate RoA/RoE of 2.8%/14% in FY27. We have a BUY rating on the stock with a TP of INR450 (based on SoTP valuation; refer to the table below).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412