Hold Mahindra & Mahindra Financial Services Ltd For Target Rs.285 by Prabhudas Liladhar Capital Ltd

Disbursements tepid; asset quality a monitorable

Quick Pointers:

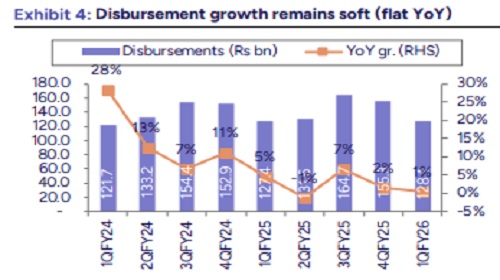

* Flat disbursement growth in Q1; seeing weakness in PV and CV/ CE ? GS3 ratio saw a jump on account of seasonality; expect it to remain rangebound

Q1 disbursement growth was flat YoY with a weakness in the CV/ PV/ SME segment; AUM grew 15% YoY to Rs 1,220 bn. Expect NIM to improve in subsequent quarters aided by a boost in fee income/Used Vehicle mix and lower CoF. Expect opex costs to be elevated as the company invests in business transformation. Asset quality saw a seasonal weakness in the quarter; we continue to be watchful of collection efficiency trends. We value the standalone business of MMFS at 1.3x FY27E P/ABV. Our SOTP ascribes a valuation of Rs 269 for the standalone business and Rs 16 for subsidiaries, with a 25% Holding Co. discount, to arrive at a TP of Rs 285. Low visibility on growth and weak asset quality trends weigh on profitability. Assume coverage with a HOLD rating.

* Q1 disbursements lacklustre; expect 15% growth in FY26: Q1 saw a flattish trend in disbursements (Rs 128 bn) on account of a slowdown in the M&HCV/ entry-level PV segment. Commentary also highlighted a temporary recalibration in SME disbursements (-19% YoY) on account of organisational/ structural changes. Tractor disbursements however, saw a decent pick-up in the quarter (+21% YoY) and company expects the trend to continue. Consequently, AUM grew 15% YoY/ 2% QoQ to Rs 1,220 bn. The share of M&M assets as a part of AUM was maintained at 44% (in the range of 40-45%). While disbursement growth continues to remain challenging due to an industry-wide slowdown in the auto sector, company expects an uptick in momentum with a positive monsoon/ recovery in rural demand. We remain conservative and build an AUM growth of 15% in FY26E.

* Spreads to range between 6.5%- 6.7%: While CoF remained stable YoY at 6.3%, reported spread improved to 6.7% (vs. 6.5% in Q4FY25) driven by an increase in yield (+10 bps QoQ) and fee income (+10 bps QoQ). Company expects to maintain spread in the range of 6.5%- 6.7% in FY26, supported by a rising share of high-yielding segments (Used Vehicle and tractor) in the mix. It is also focusing on increasing fee income and has made multiple efforts on that front- co-branded credit card partnership with RBL Bank, Fast tag tie-up with IDFC bank, insurance distribution/ NPCI approval for TPAP license. Management commentary highlighted a slight reduction in incremental CoF and we expect NIM to improve in subsequent quarters aided by a lower cost of borrowing. Opex continues to be elevated, with C/I ratio at 40.8% in 1Q as the company continues to make investments in collections.

* Watchful of asset quality trends: Gross Stage 3/Net Stage 3 ratio stood at 3.85%/ 1.91% vs. 3.69%/ 1.84% in Q4FY25. Commentary highlighted a seasonal weakness in the quarter and expects asset quality ratios to remain rangebound. We continue to be watchful of collection efficiency trends (95% in Q1). Company raised capital of ~Rs 30 bn via a rights issue, resulting in a boost in CAR/ Tier 1 ratio (20.6%/ 17.9% respectively).

Above views are of the author and not of the website kindly read disclaimer