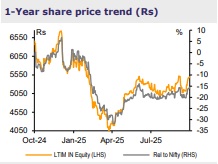

Add LTIMindtree Ltd For Target Rs. 6,200 By Emkay Global Financial Services Ltd

Margin beat; deal momentum to bolster growth

LTIM reported better than expected operating performance in Q2. Revenue grew 2.3% QoQ to USD1,180mn (2.4% CC), a tad better than our expectations. Revenue growth was broad-based across verticals, led by Consumer, Healthcare, Life Sciences and Public services, and Manufacturing. EBITM expanded by 160bps QoQ to 15.9%, beating expectations, on the back of savings from the Fit4Future program (80bps) and balance from currency movement. Deal wins remained robust, with large deals signed across all five verticals resulting in a TCV of USD1.59bn (book-to-bill: ~1.3x) and marking the fourth consecutive quarter with order intake exceeding USD1.5bn. The management expects reaching near double-digit revenue growth in USD terms by Q4 on the back of broad-based growth, seasonal pass-through, deal intake, and pipeline negating the impact of seasonal furloughs and AI productivity recalibrations. The mgmt maintains a positive outlook on EBITM expansion going forward. We raise FY26-28E EPS by ~4-5%, given the Q2 performance. We retain ADD on LTIM while raising our TP by ~19% to Rs6,200, at 28x (earlier 24x) Sep-27E EPS.

Results Summary

Revenue increased 2.3% QoQ (2.4% CC) to USD1.18bn, in line with our estimates. EBITM expanded by 1600bps QoQ to 15.9%, above our expectations of 15%. This improvement was primarily driven by the Fit4Future cost optimization program and non-recurrence of visa cost (80bps) and forex impact (80bps). Top-5-client revenue declined 5.2% QoQ, while the top 6-10 clients saw growth of 7.5% QoQ. Growth was broad-based across geographies – North America (2.1% QoQ), Europe (2.4%), and RoW (3.7%) – in USD terms. Growth was broad-based across verticals – Consumer (9.1% QoQ), HLS (10.2%), Manufacturing and Resources (1.7%), BFSI (0.2%), and Tech, Media and Communications (0.1%). TTM attrition was down by 20bps QoQ to 14.2%. Total headcount was up 3.0% QoQ to 86,447. Utilization (excl trainees) was flat QoQ at 88.1%. The company has declared a dividend of Rs22/sh. What we liked: Broad-based growth, margin beat, healthy deal intake. What we did not like: Weakness in top-5 clients.

Earnings Call KTAs

1) In the BFSI vertical, growth remained muted this quarter due to recalibration of large engagements – primarily driven by AI-led productivity gains. Despite such short-term softness, the management maintains a positive outlook for 2H, underpinned by strong deal wins and a robust pipeline. 2) The Healthcare, Life Sciences, and Public Services vertical saw broad-based growth, supported by healthy demand from healthcare providers, pharmaceutical firms, and public sector clients, showcasing diversified sector strength. 3) Growth was flat due to recalibration in top accounts, especially in HiTech. 4) The Technology, Media, and Communications vertical is currently transitioning from a ‘pre-productivity era’ – before a major AI adoption into a ‘post-productivity era’ when clients are beginning to realize and reinvest the efficiency gains delivered by AI integration. 5) The company does not perceive any structural risks related to revenue concentration among its top-5 clients; rather, it considers the current revenue transition phase to be temporary and primarily associated with accelerating AI productivity, and not a decline in client demand. 6) An early ramp-up is seen in the PAN 2.0 deal, which should scale up through Q3; the major media deal signed in Sep-25 (announced in Oct-25) has a longer, multi-vendor transition and will ramp up over a couple of quarters. 7) The company aims to maintain or expand margin levels with a combination of AI-led productivity, pyramid correction, span of control, and ongoing cost optimization. 8) Non-controlling interest saw an uptick due to a shift from equity-method accounting to a full line-by-line consolidation for an Aramcopartnered entity, reflecting recent partnership changes; this entity will be fully consolidated going forward. 9) Amid a shift driven by Gen AI, the company is aligning its compensation strategy with AI readiness (skill transformation being central to the compensation strategy), introducing phased wage hikes, effective January and April, covering 50% of employees in each round. 10) Gururaj Deshpande, with more than 30 years of large-scale IT delivery experience, has joined as the company’s Chief Delivery Officer. He is set to play a pivotal role in enhancing client delivery and embedding AI across delivery frameworks.

Update on AI / Gen AI

1) The management is proactively infusing AI across all verticals, with over 40-50 accounts adopting AI in Q2. 2) It has deployed over 1,500 digital agents across delivery and operations. 3) The management is of the view that AI integration impacts renewals, pricing, and scope, while also creating new opportunities and strengthening client relationships.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354