Add Home First Finance company Ltd For Target Rs. 1,650 By InCred Equities

Caution over uncertainty

* HFFC posted an in-line 2QFY26 PAT of ~Rs1.3?bn led by healthy AUM growth, 20bp qoq rise in NIM and contained opex, while credit costs inched up.

* AUM rose to ~142bn, up ~26% yoy and ~5% qoq, and disbursement moderated to ~13bn due to cautious lending to US tariff-affected sectors.

* We appreciate the connector-led model & conservative lending approach. The recent correction sweetens the deal. Maintain ADD rating with a TP of Rs1,650.

In-line PAT; NIM expands by 20bp qoq to 5.4%

Home First Finance Company (HFFC) reported an in-line 2QFY26 PAT of ~Rs1.3bn, up ~43% yoy and ~11% qoq. The growth was driven by healthy AUM growth of 5% qoq, 20 bp qoq improvement in NIM to 5.4% & contained opex, while credit costs rose by 8bp qoq. The cost-to-income ratio improved to 31.8% (vs. 34% in 1QFY26 and 36.5% in 2QFY25).

AUM growth awaits more clarity from uncertain trends

The pace of assets under management (AUM) growth was healthy at ~26% yoy & ~5% qoq, although slower than the 30%+ yoy run rate amid industrywide heating in stress assets. Disbursements were a tad lower than expected at ~Rs13bn, up ~10% yoy & ~4% qoq, due to a cautious stance at select locations like Coimbatore & Tirupur having a direct exposure to the sectors hit by US tariffs. The average loan ticket size remained at ~Rs1.18m (flat qoq) and its portfolio still tilting towards >Rs1.5m loans, as management feels customers are moving towards large-ticket loans due to rising real estate prices. HFFC is seeing tailwinds in 2HFY26F driven by easing inflation, supportive government measures, a good monsoon season, and an improving macroeconomic environment.

Stressed assets up largely led by rising delinquency in South India

Equated monthly instalment (EMI) bounce rates moved up to 17.4% in Oct 2025, partially impacted by the number of working days and the same is guided to be pulled back. The 1+DPD bucket rose to 5.5% (10bp qoq) and 30+ DPD to 3.7% (20bp yoy), driven by delinquencies at select locations in Tamil Nadu & Andhra Pradesh; management expects normalization in three-to-four months. However, there was some improvement in collections in Surat, which saw rising stress in recent quarters. Calculated credit costs were high at ~44bp, above the guided 30-40bp range, although FY26F guidance stays at 40bp.

Outlook and valuation

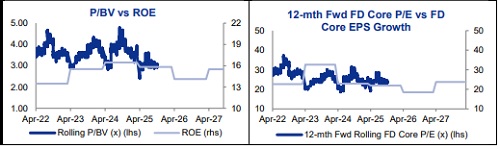

HFFC’s connector model, strong tech infrastructure, and prudent geographic focus, coupled with a modest ~17% non-housing exposure, position it on a lower-risk footing amid an industry-wide uptick in asset quality stress. The recent capital raising will subdue return ratios in the near term; however, we believe the same will normalize by mid-FY27F. We believe a 15% correction in the last around four months makes the risk-reward ratio attractive, and maintain our ADD rating on HFFC with a stable target price of Rs1,650, valuing it at 3.6x FY27F BV. Downside risks: A sharp fall in NIM and asset quality stress.

Above views are of the author and not of the website kindly read disclaimer