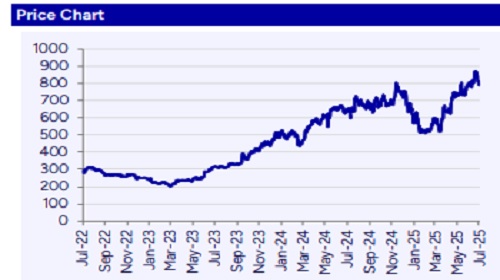

Buy Nippon Life India Asset Management Ltd For Target Rs.860 by Prabhudas Liladhar Capital Ltd

Net flow market share remains higher than stock

Quick Pointers:

* Steady quarter with slight beat in core income due to better yields

* Market share in net equity flows is intact leading to market share gains.

NAM saw a stable quarter as QAAuM and core income were largely in-line. Despite strong equity QAAuM growth of 9.1% QoQ and fall in equity share by 37bps QoQ, blended yields were higher to PLe by 0.9bp since (1) company is still benefitting from commission rationalization and (2) ETF yields improved by 2bps QoQ due to sizable growth in higher yielding AuM. NAM continues to gain market share in equity MAAuM as share in net equity flows (ex-NFO) is healthy at 11.4% in Q1FY26 (10.6% in FY25) which is higher than stock MAAuM market share of 7.1%. Over FY25-27E we expect core PAT CAGR of 15.4%. As equity markets have done well in Q1FY26 and net flows have improved and normalized in Jun’25 from Apr/May’25, we increase multiple on FY27E core EPS to 35x from 31x and raise TP to Rs860 from Rs700. Retain ‘BUY’.

* Steady quarter with core numbers in-line: QAAuM was in-line at Rs6,127bn (+10% QoQ); while equity (incl. bal) at Rs2,771bn grew by 9.1% QoQ. Revenue grew by 7.1% QoQ and was higher at Rs6.07bn (PLe Rs 5.93bn) led by higher revenue yields at 39.6bps (PLe 38.7bps). Opex grew by 8% QoQ and was more at 2.3bn (PLe Rs2.2bn) as staff cost ex-ESOP was a 6.5% miss at 1.17bn; other opex was stable at 857mn (PLe Rs855mn). ESOP cost as expected was Rs110mn. Hence, core income (+6.5% QoQ) was largely in-line at 3.8bn (PLe Rs3.7bn) resulting in operating yields of 24.7bps (PLe 24.3bps). Other income was ahead at 1.5bn (PLe Rs1.1bn) due to MTM gains. Tax rate was 24.5% (PLe 24%). Hence, core PAT yields came in at 18.6bps (PLe 18.5bps). PAT came in at Rs4bn (PLe Rs3.66bn) due to higher MTM gains.

* Equity performance (in 3-yr bucket) and flows remain healthy: Equity share slightly fell QoQ to 45.2% (45.6% in Q4FY25) and debt fell by 16bps while share of liquid/ETF rose by 4/78bps. Despite rise in share of lower yielding AuM and strong equity growth QoQ, blended yields were higher by 0.9bp since (1) company is still benefitting from commission rationalization and (2) ETF yields have gone up QoQ from 15bps to 17bps due as products with higher expenses have grown sizably. Performance in 3/5yr buckets remains superior and market share in net equity (incl. balanced) flows remained strong in Q1FY26 at 11.4% (vs 10.6% in FY25). As net flow equity market share remains higher than stock MAAuM market share, NAM continues to gain market share in equity (incl. balanced); it enhanced by 12bps QoQ and 18bps YoY to 7.1%.

* Fall in SIP folios QoQ in-line with industry: Share in SIP flows slightly declined from 10.16% in Q4FY25 to 10.07% in Q1FY26 and SIP folios declined QoQ to 9.9mn from 10.5mn due to one-time cleanup of inactive accounts in-line with industry. However, NAM is getting reasonable flows across categories; 75% of SIP by value has a ticket size

Above views are of the author and not of the website kindly read disclaimer