Buy Piramal Finance Ltd for the Target Rs. 1,460 by Motilal Oswal Financial Services Ltd

Predictability returns, profitability builds - Upgrade to BUY

Legacy book wind-down nears end; retail engine providing growth visibility

The earnings volatility seen during the transition period is now comfortably behind, with the legacy wholesale portfolio largely run down and a retaildominated book driving consistency in performance. Improved NIMs, sustained cost efficiencies, and stable asset quality underpin a visible improvement in the RoA trajectory. The company’s retail transformation, supported by sharper underwriting, AI-driven productivity gains, and calibrated risk-taking, is now translating into steady growth and profitability. With the balance sheet cleanup nearing completion and growth visibility improving across core segments, we see a compelling risk-reward at current valuations. We upgrade Piramal Finance (PIEL) to BUY with a revised TP of INR 1,460, as the company consolidates its position as a stable, retail-focused lender.

* PIEL reported 2QFY26 net profit of ~INR3.3b (PQ: ~INR2.8b). NII in 2QFY26 rose ~31% YoY to ~INR10.2b. PPOP grew ~37% YoY and stood at ~INR4.3b (PY: INR3.2b). Opex to AUM for the company’s retail business declined to ~3.9% (PQ: 4.2%).

* The company recorded an exceptional expense of INR810m in 2QFY26, of which 1) INR600m was related to amalgamation costs, and 2) as part of the sale agreement, the company has provided INR210m towards compensation for tax matters pertaining to earlier years for Piramal Imaging.

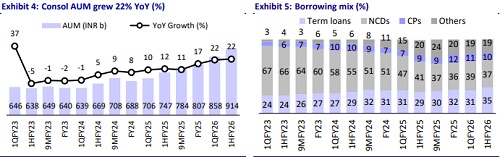

* Consol. NIMs expanded ~20bp QoQ to 6.1% (PQ: 5.9%). Growth to Legacy AUM mix improved to 94%:6% in Sep’25 from 34%:66% as of Mar’22.

* Total AUM grew 22% YoY and 6.6% QoQ to INR914b. Wholesale 2.0 AUM grew ~43% YoY to INR113b, while Wholesale 1.0 AUM declined ~55% YoY/14% QoQ to INR54b. The company reiterated that it would look to run down its legacy wholesale book to ~INR30b by end-FY26.

* PIEL is now more confident in its retail-focused strategy, with legacy challenges largely behind it. We believe that the phase of earnings volatility is now comfortably behind, and that there will be no negative surprises or volatile quarters going forward. With the legacy wholesale book expected to be largely addressed/run down by end-FY26, the portfolio will increasingly shift toward a stable, retail-dominated mix. Consequently, we now expect PIEL to exhibit a more predictable and consistent earnings trajectory.

* The company is prioritizing RoA enhancement through multiple structural levers such as NIM expansion (with a better product mix and a decline in CoB), better operating efficiency, and improvement in the fee income profile.

* AI-driven efficiencies have helped the company lower its long-term opex-toAUM guidance by ~25bp to 3.25-3.5%. The company has provided a positive outlook, guiding for significant growth in PAT and AUM till FY30. It guided for a scale-up in AUM to ~INR1.5t+ by FY28 and INR2t+ by FY30 (AUM CAGR of ~20-25% over FY25-30). On profits, it guided for PAT of ~INR13b-15b in FY26, ~INR45b by FY28, and ~INR65b by FY30.

* We estimate a total AUM CAGR of ~23% over FY25-FY28 and RoA/RoE of 2.7%/12.5% by FY28E. We upgrade our rating on the stock to BUY with a revised TP of INR1,460 (based on Sep’27E SOTP).

Highlights from the management commentary

* Management shared that the company remains selective in wholesale lending, focusing on plain-vanilla operating loans (target yields ~14%) while avoiding structured, high-risk deals.

* The company expects internal accruals and capital releases from the legacy portfolio to adequately fund growth through FY27; any capital raise decision will be evaluated thereafter.

* The company indicated that it continues to actively engage with credit rating agencies, and noted that the ongoing improvement in profitability and risk profile could pave the way for a potential credit rating upgrade.

Strong retail loan growth of ~36% YoY; retail mix stable QoQ

* Retail AUM grew ~36% YoY to INR747b with its share in the loan book rising to ~82% (PQ: 80%).

* Retail disbursements grew ~36% YoY to INR110b. Disbursement growth was strong sequentially across all major product segments. Disbursement momentum accelerated sequentially in UBL and digital loans while salaried PL maintained earlier strong momentum.

* Management indicated that unsecured business loans (UBL) and used car finance remain segments requiring closer monitoring. While asset quality in these portfolios has remained stable, there has been no visible improvement during the quarter. In contrast, the company highlighted a sequential improvement in the performance of its MFI and digital loan portfolios.

Asset quality stable; credit costs (after adjusting for ECL re-balance) flat QoQ

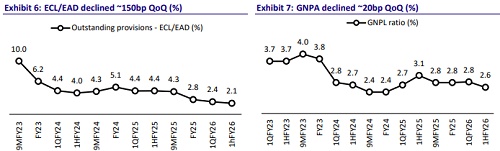

* GS3 improved ~25bp QoQ to ~2.6%, while NS3 declined ~20bp QoQ to 1.8%. Stage 3 PCR was stable QoQ at ~29.4%.

* 90+ dpd remains steady at 0.8% for overall retail AUM. Growth business (Retail and Wholesale 2.0) gross credit costs rose ~30bp QoQ to 1.8% (PQ: ~1.5%). The sequential increase is because 1QFY26 had a net positive impact of ~36bp on credit costs due to ECL rebalancing. Total ECL/EAD declined ~30bp QoQ to ~2.1% of the AUM.

* Management shared that credit risk in the unsecured MSME and business loans segment, which peaked in Oct/Nov’24, has not come down from those levels but has also not deteriorated further. The company shared that it expects the micro-LAP segment to remain under stress for a couple of quarters before improving.

* Capital adequacy (CRAR) rose to ~20.7% (vs ~19.3% at Jun’25).

Valuation and view

PIEL reported a healthy operational performance during the quarter, led by strong growth in its retail loans and continued scale down of the legacy wholesale book, which now accounts for <6% of total AUM. Asset quality remained broadly stable across key product segments, leading to stable credit costs. With rising retail traction and a better funding mix, NIM expanded further, reinforcing the shift toward a more stable and profitable lending model.

* Our earnings estimate for FY26 and FY27 factors in gains from the AIF exposures, deferred consideration of USD120m from the sale of Piramal Imaging, and zero tax outgo in the foreseeable future. Due to the uncertainty and unpredictability surrounding the monetization of the stake in Shriram Life and General Insurance, we have not factored it into our estimates yet. However, the eventual monetization is expected to provide one-off gains, which could help offset credit costs associated with the disposal of the residual stressed legacy wholesale AUM (of ~INR54b).

* We estimate a total AUM CAGR of ~23% and a ~26% CAGR in Retail AUM over FY25-FY28. We upgrade PIEL to BUY as we see a compelling risk-reward with the business entering a structurally stronger phase of growth and profitability. The company has largely completed its transition into a retail-focused franchise with sharper underwriting, enhanced productivity, and healthy risk-adjusted credit costs. We upgrade our rating on the stock to BUY with a revised TP of INR1,460 (based on Sep’27E SOTP).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412