Buy Life Insurance Corporation Ltd For Target Rs.1,085 by Motilal Oswal Financial Services Ltd

Weak growth in APE and VNB; VNB margins improve sequentially

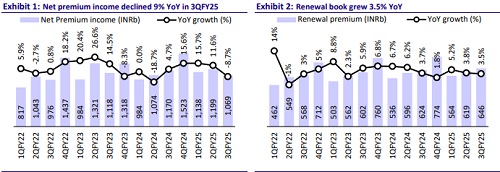

* In 3QFY25, LIC reported net premium income of INR1.1t, down 9% YoY. For 9MFY25, net premium income grew 6% YoY to INR3.4t. Renewal premium grew 3% YoY to INR646b.

* New business APE declined 24% YoY to INR99.5b. For 9MFY25, it grew 6% YoY to INR379.8b.

* VNB for 3QFY25 declined 27% YoY to INR19.3b. However, for 9MFY25, it grew 9% YoY to INR64.8b. VNB margins grew sequentially to 19.4% from 17.9% in 2QFY25 (20% in 3QFY24).

* LIC reported 17% YoY growth in shareholder PAT to INR110.6b. For 9MFY25, PAT grew 8% YoY to INR291.4b.

* New products in the par segment will drive volumes, while management expects the momentum in the non-par segment to continue.

* We have cut our net premium, APE and VNB margin estimates by 4% each for FY25, factoring in 3QFY25 performance. With the increase in the share of the non-par segment, we expect VNB margin to see improvement. Reiterate BUY with a TP of INR1,085 (premised on 0.7x Sep’26E EV).

Rising share of non-par in APE mix

* LIC’s renewal premium grew 3% YoY to INR646b, while the first-year/single premiums declined 14%/24% YoY to INR73b/INR351b.

* For 9MFY25, Individual Business APE increased by 4.7% to INR246b and Group Business APE grew 8.8% to INR133.6b.

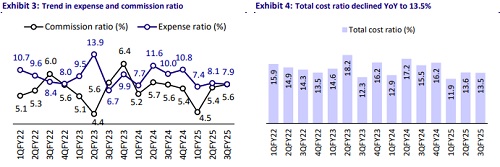

* VNB margins improved 150bp sequentially due to 1) change in commission payouts, 2) product mix shift toward Non-par, 3) revisions in the premium rate for certain products with lower margins, 4) revision of the minimum ticket size of low-persistency products.

* Commission expense declined 8% YoY to INR596.6b. However, in order to align with business growth, management guides for commission payouts to increase going further.

* Income from investments in policyholders’ account remained flat YoY at INR943.4b, while it grew 50% YoY to INR16b in shareholders’ account.

* On the product front, LIC launched 38 new products (24 individual, 8 group, 5 individual riders and 1 group rider) after the IRDAI (insurance products) regulation in Oct’24. LIC’s continued focus led to an increase in the share of Non-Par in individual APE to 27.3% from 14% in 9MFY24. With the launch of new products, management expects the growth in the Par segment to recover.

* On the distribution front, LIC has a dominant portion of agency force (~1.4m) in the industry with higher vintage of > 5 years at 53.98%. New business premium from Banca channel grew 31.2% YoY, and from alternate channel, it grew 30.6% YoY.

* The 13th/37th/61st month persistency stood at 68.6%/60.9%/59.7% in 3QFY25.

* AUM stood at INR54.8t, up 10% YoY. The solvency ratio improved to 202% vs. 193% in 3QFY24 and 198% in 2QFY25.

Valuation and view

LIC maintains its industry-leading position and is focusing on ramping up its overall growth through wider product offerings, a shift in the product mix toward non-par, a stronger agency channel, and digitization. LIC has done an alignment of distributor incentives to absorb the impact of surrender charges. With the introduction of a new hedging mechanism, the company is confident of curbing the uncertainties around VNB and expects the product-level margins to remain intact. We have cut our net premium, APE and VNB margin estimates by 4% each for FY25, factoring in 3QFY25 performance. With the increase in the share of the non-par segment, we expect VNB margin to improve. Reiterate BUY with a TP of INR1,085 (premised on 0.7x Sep’26E EV).

.

.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412