Buy Canara Bank Ltd for the Target Rs. 115 by Motilal Oswal Financial Services Ltd

NII in line; PAT beat led by lower provisions and healthy other income

RoA outlook steady; NIM improves QoQ

* Canara Bank (CBK) reported a 4QFY25 standalone PAT of INR50b (+33.1% YoY, 20% higher than MOFSLe), fueled by healthy other income and lowerthan-expected provisions.

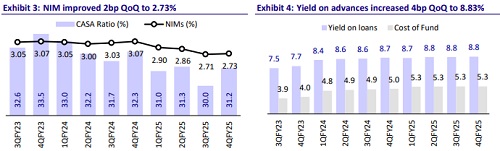

* NII declined 1.4% YoY/rose 3.2% QoQ to INR94.4b (in line). NIM improved 2bp QoQ to 2.73% during 4QFY25.

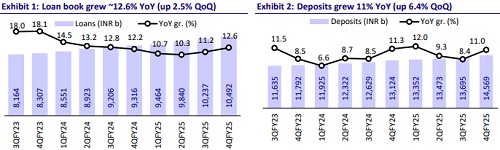

* The loan book rose 12.6% YoY/2.5% QoQ to INR10.5t, while deposits surged 11% YoY/6.4% QoQ to INR14.6t. CASA ratio improved to ~31.2% in 4QFY25.

* On the asset quality front, total slippages stood at INR27b (vs. INR24.6b in 3QFY25). Healthy recovery and write-offs led to 40bp/19bp QoQ improvements in GNPA/ NNPA ratio to 2.94%/0.70%. PCR stood at 76.7%.

* We broadly maintain our projections and estimate CBK to deliver an FY27E RoA/RoE of 1.0%/18%. Reiterate BUY with a TP of INR115 (premised on 0.9x FY’27E ABV).

Business growth guidance maintained; CASA improves 117bp QoQ

* CBK reported a 4QFY25 standalone PAT of INR50b (+33.1% YoY; 20% beat), led by higher-than-expected other income and lower provisions. For FY25, earnings grew 17% YoY to INR170b. We expect FY26E earnings at INR170b.

* NII dipped 1.4% YoY to INR94.4b (inline). NIM improved 2bp QoQ to 2.73%. Other income grew 9.5% QoQ to INR63.5b (21.7% YoY, 11.2% beat), amid reversals in SR provisions and healthy recoveries. Recovery from NPAs was INR24.7b vs. INR20b in 3Q. Thus, total revenue rose 6.7% YoY (4.3% beat).

* Operating expenses grew 1.3% YoY to INR75.1b (+5.6% QoQ, in line). The C/I ratio thus remained largely stable at 47.6%. Provisions stood at INR18.3b (-26% YoY/-23.6% QoQ; 15.4% lower). PPoP grew 12.1% YoY/5.7% QoQ to INR 82.8b (~8% beat).

* The loan book grew 12.6% YoY/2.5% QoQ, led by the retail segment, which was up 7.3% QoQ. Within this, housing grew 3% QoQ. Deposits surged 11% YoY (6.4% QoQ) due to a healthy seasonal flow in CA deposits. Hence, the CASA ratio improved 117bp QoQ to ~31.2%; the CD ratio stood at 72%.

* GNPA/NNPA ratios improved 40bp/19bp QoQ to 2.94%/0.7%. PCR stood at 76.7%. Total slippages were elevated at INR27b (vs. INR24.6b in 3QFY25) amid higher slippages in the MSME segment. Credit costs were 0.99% vs. the FY25 guidance of 1.1%. Further, the slippage ratio is expected to remain benign at 0.9% for FY26.

* The total SMA book moderated to 0.96% in 4QFY25 from 1.14% in 3QFY25 due to a reduction in the SMA-2 book.

Highlights from the management commentary

* The bank carried out a provision reversal exercise, which resulted in a 150bp improvement in the PCR, bringing it in line with industry peers. Out of the INR17b in SR, INR11b was reversed during the Mar’25 quarter.

* The majority of slippages were observed in the MSME portfolio, and most of these were due to technical reasons rather than fundamental credit deterioration.

* Guidance for FY26: business growth at 10.5% YoY, advances growth at 10-11%, deposits growth at 9-10%, and CASA ratio at 32%.

* From the Dec’24 quarter, the bank’s NIM improved 3bp. Yields on retail gold stood at 9%+ and have been aiding the overall yield.

Valuation and view

CBK reported a healthy quarter with earnings beat driven by inline NII, healthy other income, controlled opex, and lower than expected provisions. The bank has reported an improvement in the NIMs, primarily driven by better yields from advances coupled with the steady cost of funds. Loan growth was steady and largely driven by growth in the retail segment, while deposits surged owing to a seasonal flow in the CA deposits. This resulted in a CASA ratio improvement for the bank. CBK has largely maintained its business growth guidance for FY26E. Barring some QoQ increase in slippages, asset quality stood quite stable, which led to benign credit costs in 4Q. Management expects credit costs to remain benign at 0.9% for FY26. SMA continues to decline during the quarter, with no major signs of stress in the book. We broadly retain our projections and estimate CBK to deliver an FY27E RoA/ RoE of 1.0%/18%. Reiterate BUY with a TP of INR115 (based on 0.9x FY’27E ABV)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd ( 1 ).jpg)