Banking Sector Update : Credit market share: Are PSBs making a comeback? By Motilal Oswal Financial Services Ltd

Gap between retail and system growth has reduced to its lowest in past 10 years India’s banking landscape over the past two decades have witnessed Private Banks steadily gaining credit market share. This was led by aggressive network expansion, strong underwriting and a distinct thrust on retail lending with superior customer service by Private Banks. PSBs on the other hand faced issues centered around asset quality, weak capitalization levels, merger linked challenges and slower adoption of digital banking which hampered their business productivity. However, recent balance sheet repair and improving profitability levels with most PSBs crossing 1% RoA mark, has supported PSB’s capitalization levels and enabled them to deliver an improved growth trajectory. FY25 thus stood as the first year in past fifteen years when PSBs grew at a faster pace than Private Banks. In this note, we have covered this market share journey between Private and PSU Banks and present our thoughts on the outlook going forward.

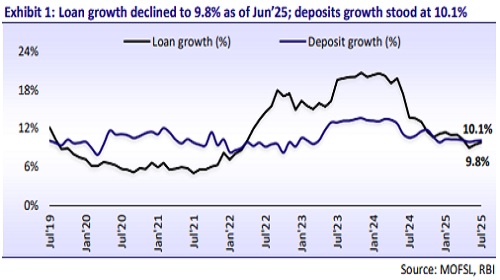

* Credit growth moderated to 9.8% YoY in Jul’25, down from a 15.6% CAGR in FY22-24, driven by tight liquidity, regulatory curbs, and weak corporate demand across both retail and wholesale segments.

* Retail growth slowed across secured and unsecured loans, with mortgage and card growth decelerating to 9%/8.5% YoY. We expect recovery in 2HFY26, supported by festive demand and easing rates.

* Unsecured retail stress is close to bottoming out. Stabilizing delinquencies and risk-based pricing should support a gradual recovery from 2HFY26. We estimate MFI stress also to subside over 2HFY26 enabling modest sector growth against a sharp 14% YoY decline in FY25.

* PSBs overtook Private Banks in FY25, with them delivering 12% YoY growth vs. 10% for private banks. Elevated CD ratios for private banks may keep this gap tight in FY26-27 as well. PSBs thus reversed market share loss in FY25, gaining ~40bp, aided by HDFCB’s slowdown. While not structural, we expect only a modest ~140-160bp decline in PSBs share over FY25-28 vs a sharper decline in preceding three year blocks.

* PSBs’ growth outlook remains steady rather than steep. Despite improved fundamentals, they continue to lag in branch expansion, tech, and staffing. We expect a 10-13% loan CAGR for PSBs over FY25-28.

* Top picks: ICICIBC, HDFCB and SBIN.

Credit growth shows moderation across segments; expect recovery in 2H

After a strong run over FY22-24, when system loans posted a 15.6% CAGR, credit growth has since moderated to 9.8% YoY, according to the latest RBI print. The slowdown has been broad-based, affecting both retail and wholesale segments. This moderation reflects a combination of factors, such as tighter liquidity in prior quarters, regulatory curbs on unsecured retail, and muted loan demand from the corporate sector.

* Retail growth has slowed down, led by a moderation across both secured and unsecured segments. We note that growth for systemic mortgage and card businesses has moderated to 9% and 8.5%, respectively vs 20% and 33% a year ago.

* We expect credit demand to pick up in 2HFY26, supported by festive demand, improving liquidity, benefits from reduced interest rates, and a pick-up in consumption following lower tax rates. We, thus, estimate system growth to sustain at ~11% over FY26.

Unsecured retail growth nearing bottom; AQ normalization to aid recovery

* Unsecured retail segments like personal loans and credit card posted a 22% and 25% CAGR, respectively, over FY21-24. However, Credit card growth considerably slowed down to just 8.5% YoY as of May’25, due to heightened stress and moderating demand. Personal loan growth across key banks in our coverage has moderated from 16-43% range in FY24 to tepid 1-8% currently. Likewise, MFI industry has de-grown by 14% YoY in FY25 vs growth of 25% YoY in FY24 with most lenders reporting further decline in 1QFY26.

* Bank commentaries suggest that incremental delinquencies have plateaued, and are hopeful of moderation in credit cost over 2HFY26. We estimate top private banks to start showing improved traction in unsecured loans over the coming quarters. Risk-based pricing is now well embedded into overall product underwriting, and gradual improvement in margins, credit cost trajectory will further support profitability.

Growth divergence between Private and PSU bank narrows

The credit growth gap between Private banks and PSBs has narrowed significantly in recent years. While private banks consistently outpaced the system through much of the past decade, FY23-25 marked a clear shift as PSBs regained balance sheet health, strengthened their capitalization levels, and reported a strong turnaround in sector profitability. Over FY22-24, private banks posted an ~17% CAGR, adjusted for the HDFCB merger, though growth declined to ~10% YoY in FY25. In comparison, PSBs posted healthy credit growth of 12% in FY25. This compares to the average ~1.7%/7.7 growth differential between Private and PSBs that persisted over the FY23-25/ FY20-22.

* Given the elevated CD ratios across select large private banks, we estimate the growth differential between PSBs and Private banks to remain narrow over FY26-27.

* Our estimates currently factor in 12-16% CAGR for large Private banks over FY25-27E vs 10-13% CAGR for PSBs.

PSBs’ market share shows stability after years of consistent losses

PSBs’ credit market share has structurally declined from ~81% in FY2000 to 57% by FY2025. We note that during FY14-24, PSBs lost ~20% credit market share, implying an average loss of 200bp each year. This was driven by a weak balance sheet, regulatory constraints (including PCA), and the inability to match the distribution and underwriting agility of private banks. However, over the past few years, PSBs have managed to arrest their market share erosion, cumulatively losing only ~200bp over the past three years (adjusted for HDFCB-HDFC merger). With HDFCB’s loan growth slowing significantly (5% in FY25), PSBs gained credit market share by ~40bp in FY25, for the first time in past one decade. While this trend is temporary, we estimate controlled ~140-160bp decline in PSBs’ credit market share over FY25-28.

Is the current growth trajectory for PSBs sustainable?

* PSBs posted 12% credit growth in FY25, outpacing private peers as well as system growth—a marked turnaround led by strong internal accruals (RoEs at 15-18%), CET-1 ratios of 10-14%, and improved underwriting (GNPAs <4% with PCR ranging between 75-94%). However, the long-term sustainability of this growth remains unclear, as PSBs have not invested in business expansion to the same extent as private banks.

* We note that during FY21-25, PSBs collectively added just ~267 branches vs. ~11,750 branches for private banks, while they already lag in digital adoption. While some PSBs, such as SBI and BoB, are ramping up tech spends, broader transformation continues to trail private peers. Similarly, we note that PSBs’ share in total employee headcount has declined significantly to 42% from 72% in 2010 with Private Banks continuing to add employees and strengthening their distribution strength.

* We, thus, expect PSBs to continue reporting moderate growth in the medium term and factor in 10-13% loan growth over FY25-28 across our six coverage PSU banks. While PSBs are now structurally sound, their growth runway appears steady rather than steep, reflecting stability more than scale-led acceleration.

Maintain preference for ICICI, HDFCB and SBI

* We maintain our view that NIMs will remain under pressure through 1H and partially into 3QFY26, driven by continued loan repricing. However, a gradual reduction in funding costs will enable margin recovery from 2H onwards, translating into healthy earnings growth over FY27E.

* Banks are increasingly focusing on building granular and stable deposit franchises to cushion margin pressures and support balance sheet resilience. Strong liability profiles are becoming a key differentiator in the current environment.

* We estimate banking sector earnings to recover from 2HFY26 with growth improving to ~19% over FY27E, marking an end to the five year earnings deceleration cycle. We estimate credit growth to sustain at ~11% for FY26E and 12.5% for FY27E.

* Top ideas: ICICIBC, HDFCB, and SBIN. These banks stand out due to their strong balance sheets, healthy PCR, and robust contingency buffers, capitalization levels which will enable them to better withstand the cyclical pressures.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Automobiles Sector Update : Demand revival remains elusive By Motilal Oswal Financial Servic...