Telecom Sector Update : Home broadband (HBB) – the biggest growth driver for Bharti and RJio by Motilal Oswal Financial Services Ltd

Home broadband (HBB) – the biggest growth driver for Bharti and RJio

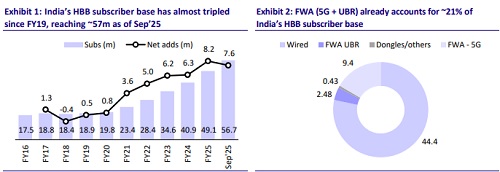

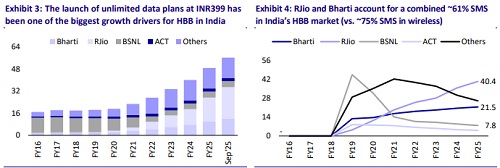

Driven by the launch of affordable home broadband (HBB) services (unlimited internet starting at INR399) by RJio in Sep’19, India’s HBB subscriber base has almost tripled to over 56m as of Sep’25 and is set to soon surpass the country’s DTH subscriber base. This exponential growth has also been fueled by the increased adoption of hybrid working models (post-COVID-19), rising traction of OTT streaming, and a pick-up in connected TVs/bundled connectivity services. Notably, Bharti and RJio together account for ~62% of India’s HBB subscriber market share (SMS) (vs. ~75% in wireless SMS). However, the top two telcos have together accounted for ~86% of incremental HBB net adds since Sep’19, a trend that has only accelerated with the launch of fixed wireless access (FWA) offerings (currently offered exclusively by RJio and Bharti). We believe HBB will be the biggest growth driver for telcos over FY25-28E, given a significant headroom for subscriber growth (modest penetration at ~3-4%) and strong potential for ARPU improvement (one of the lowest prices globally for unlimited data at USD5/month). We expect India’s HBB market size to potentially double by CY28 to ~INR650b. Despite the impending entry of Starlink, we believe the market is likely to evolve into a duopoly between Bharti and RJio. We ascribe an enterprise valuation of ~INR1.57t and INR790b, respectively, for RJio’s (~12% of our overall JPL EV) and Bharti’s (~6% of our India EV) HBB segment.

India’s HBB market tripled since the launch of JioFiber in Sep’19

* RJio commercially launched its fiber broadband offering, JioFiber, in Sep’19, almost three years after the rollout of its wireless services. At launch, the company had set a target of connecting 100m homes.

* The initial uptake of HBB services was slower than the company’s expectations. However, similar to the wireless segment, RJio disrupted the industry by offering unlimited data across all its plans (vs. the earlier model of fixed monthly data allowances), starting at a lucrative price point of INR399 per month.

* Similarly, Bharti strengthened its HBB play by offering unlimited data plans starting at INR499 and partnering with local cable operators for last-mile connectivity, enabling it to expand its presence to over 1,000 cities (vs. <100 before Sep’19).

* Driven by affordable unlimited data plans, the COVID-led adoption of remote working and e-learning, and the rise of OTT streaming, India’s HBB market— which had remained largely stagnant at ~18m subscribers—witnessed a sharp acceleration in growth over the next few years.

* Further, with the rollout of 5G, RJio and Bharti introduced FWA offerings, which helped overcome challenges associated with the fiber rollout, thereby expanding the TAM for HBB services.

* India’s HBB market has almost tripled since the launch of JioFiber in Sep’19, reaching ~57m subscribers. With increasing content bundling alongside internet services, the HBB market is now on track to soon surpass the DTH subscriber base in India.

Bharti and RJio capture ~86% of incremental HBB net adds since Sep’19

* From ~18m HBB subscribers prior to JioFiber’s launch, RJio alone has grown to ~23m subscribers, accounting for 40%+ of the HBB SMS.

* Similar to the trend seen in the wireless segment, Bharti also emerged as the winner from RJio-led disruption in the HBB space. Bharti’s HBB subscriber base has expanded ~5x since Sep’19, with its SMS rising to 21%+ (vs. ~12% before the launch of JioFiber).

* Bharti and RJio together account for ~61% of the HBB SMS (still below their combined ~75% SMS in the wireless segment). However, since Sep’19, the two have contributed ~86% of incremental HBB net adds since Sep’19 and almost 100% of the net adds in the past 12 months.

* With HBB net additions accelerating to 1m/month for RJio and ~1m/quarter for Bharti, we believe India’s HBB market is heading towards a duopoly. Even the impending Starlink launch is unlikely to significantly alter this scenario.

Significant headroom for growth as HBB penetration in India remains low

* Rolling out fiber has long been a key bottleneck in accelerating HBB penetration in India, primarily due to challenges such as delays in securing right-of-way permissions, prohibitive rollout costs, and frequent cable cuts.

* However, with pan-India 5G availability and the subsequent launch of FWA services, Bharti and RJio are now able to seamlessly deliver high-speed home internet, collectively connecting ~4m homes each quarter now.

* Despite a 3x growth in India’s HBB subscriber base since Sep’19, the country remains among the most under-penetrated markets globally, with HBB penetration at ~3-4% (vs. ~48-49% for leaders such as France and South Korea), and even trailing regional peers such as Thailand (~15%), Malaysia (~14%), and Indonesia (~5%).

* Given the rising affluence, shifting preference for connected TVs/OTTs, and the growing popularity of converged offerings that bundle content with internet services, we believe India’s HBB base still has significant headroom for growth (to ~100m homes potentially over the medium term).

Focus could shift to monetization once the land-grab phase tapers off

* Currently, the top telcos’ focus has been on increasing the HBB subscriber base, with their affordable unlimited HBB offerings starting at INR399-499/month.

* India’s HBB tariffs are among the lowest globally, with unlimited broadband data plans starting at USD5/month. We believe there is considerable scope for tariff hikes once the current land-grab phase tapers off.

* While there have been three rounds of smartphone tariff hikes (in Dec’19, Dec’21, and Jun’24) and a significant increase in minimum recharge packs, HBB plan prices have not increased since the launch of JioFiber in Sep’19.

* The cost differential between wireless and HBB services has reduced significantly (from 4.4x earlier to 1.55x currently) and could decline further following the anticipated potential wireless tariff hike (we expect ~15% from Dec’25).

* With the cost differential between wireless and HBB narrowing, we believe there is a genuine risk of downtrading (potentially 8-10% of household connectivity spends), as non-working members of the family may shift to lower/minimum recharge packs, relying on the HBB connection to meet their data requirements.

* We believe telcos may consider raising HBB plan prices in the upcoming tariff hikes or pursue monetization/premiumization opportunities by bundling content and value-added services (gaming, cloud PC, home security, etc).

HBB to be the biggest growth driver for Bharti and RJio over FY25-28

* Driven by the ramp-up of FWA offerings (AirFiber), we expect RJio’s HBB subscriber base to more than double to ~50m by FY28 (vs. ~23m currently), with HBB subs accounting for ~9% of its total base (vs. <5% currently).

* Given the higher ARPU contribution from HBB subs, we expect HBB to account for ~14% of RJio’s overall revenue by FY28 (vs. ~7-8% as of 1HFY26).

* Similarly, for Bharti, we expect HBB or WiFi subs to double by FY28 to ~20m (vs. ~10m in FY25).

* We expect Bharti’s Homes segment revenue/EBITDA to reach ~INR125b/INR68b by FY28, clocking a CAGR of 28%/32% over FY25-28, substantially outpacing the growth in its Mobility segment (13%/16%).

Valuation and view

* Given its strong growth trajectory and significant headroom for ARPU expansion, we believe the HBB segment could potentially command a higher valuation (vs. the Mobility segment).

* However, we ascribe the same multiple as the Mobility segment to both Bharti’s and RJio’s HBB segment. We believe there could be upsides to our multiples if the current high growth momentum continues beyond FY28.

* We value RJio’s HBB segment at a DCF-implied multiple of ~12x FY28 EV/EBITDA for our valuation of INR1.57t (or USD18b), contributing ~12% to JPL’s overall EV.

* Similarly, we value Bharti’s Homes segment at a DCF-implied multiple of ~12x FY28 EV/EBITDA to arrive at our EV of ~INR790b (or INR136/share), accounting for ~6% of our India EV for Bharti.

* We continue to prefer Bharti (BUY, TP INR2,285) and RJio (RIL, BUY, TP INR1,700) in the telecom space.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Life Insurance Sector Update : Ending the year on a `healthy` note ! By Motilal Oswal Finan...