Banking Sector Update : Ground zero: Channel check – Boots, branches, and beyond by Motilal Oswal Financial Services Ltd

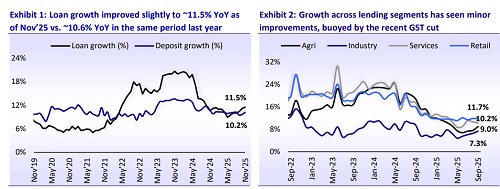

Asset quality outlook turning favorable; growth rebounding gradually We interacted with various direct loan selling agents (DSAs), covering the corporate and retail segments, to gain insights into the credit demand outlook and emerging asset quality trends. Following are the key takeaways:

* PSU banks have emerged as the dominant force in MSME lending, gaining market share over the past 6 to 9 months on the back of materially faster turnaround times (2–4 days), CGTMSE-backed lending, and repo-linked pricing. This has significantly narrowed the cost gap compared to private banks.

* Unsecured business lending is undergoing a reset, with growth moderating to ~10-20% from 30-40% in prior years. Despite a sharp correction in pricing (~12-12.5%), demand has not revived meaningfully.

* Collection intensity has increased in unsecured MSME, with higher recovery costs and more tactical borrower behavior.

* Housing and real estate momentum remains intact, led by a pickup in disbursements and strong activity among large developers. Stress among small developers is visible but remains contained and non-systemic.

* PSU banks have regained relevance in home loans, supported by lower pricing, improved turnaround times, and normalized DSA commissions (0.8–1.2%), aiding traction in Tier-2/3 cities, while private banks continue to dominate high-credit-score and premium borrower segments.

* Credit card growth remains subdued, with issuances continuing to be selective. Early stress indicators are stabilizing, though delinquency levels remain elevated compared to historical norms. Large private banks dominate incremental sourcing, with focus shifting to spend quality, activation, and pre-approved or secured card offerings.

* Top picks – HDFC, ICICI, SBI, and AU Bank.

MSME & BL: PSU dominance strengthens; private banks remain selective

* Channel feedback indicates that PSU banks have become more aggressive in MSME lending, materially altering market dynamics over the past 6 to 9 months. SBI, PNB, Union Bank, and BoI are now sanctioning MSME and working-capital loans with significantly improved TAT of 2-4 days, with SBI often completing approvals within 48 hours, including WC limits. This is enabling PSU banks to capture greater market share in this segment.

* Banks are employing CGTMSE-backed structures, where loans up to INR500m (with expectations of a higher threshold over time) can be sanctioned without collateral.

* A strong central push to scale MSME credit is accelerating PSU bank execution.

* Repo-linked pricing has sharply narrowed the rate differential vs private banks.

Private banks: Hybrid structures over pure unsecured

* Most private banks and NBFCs now prefer hybrid MSME structures (partial CGTMSE + collateral), limiting unsecured exposure.

* ICICI and HDFC remain the most competitive among private banks, aided by low funding costs and superior underwriting depth, while Kotak continues to remain selective, prioritizing quality over growth

Unsecured business loan: Growth on slow pace, stress pocket widens

* Unsecured business lending is undergoing a reset, with lenders adopting a cautious stance. While rates have corrected meaningfully from ~15-16% to ~12-12.5%, this has still not translated into a demand revival.

* Agri-linked commodity businesses, particularly in MP and select central India markets, have been under stress for the past 4–6 months, with ~80% of stress attributed to overleveraging.

* FMCG distributors are facing working capital strain, with payment cycles stretching from 10 days to ~40 days, squeezing cash flows despite GST changes

* Growth in unsecured MSME is now running at 10-20%, sharply lower than the 30-40% growth seen in prior years. ? DSAs highlighted that collection costs have risen disproportionately, with recovery agents earning up to 10%, while borrower behavior has turned more tactical. Lenders are responding by tightening income recognition and extending tenors, though this only partially mitigates risk.

Housing and real estate: Momentum sustained by large developers

* While growth has decelerated from its highs, momentum has seen some pickup, which is visible in improved disbursement run rates.

* The small ticket segment’s growth remains subdued, with affordable housing being the laggard. ? Small developers show early stress, though this remains contained and not systemic. Large developers are actively pursuing redevelopment projects, driving steady growth in construction finance.

PSBs showing improved traction in Home Loans

* PSBs have turned aggressive in the HL segment, offering lower rates and faster turnaround time. ? DSA commissions for HL have normalized post-festive season, remaining uniform across private and PSU banks (0.8-1.2%).

* PSUs are regaining relevance, especially in Tier-2/3 cities, even as private banks continue to focus on high credit score, premium customers.

* Bureau data supports this trend, showing stable asset quality in housing portfolios across lender types, reinforcing lender confidence

Personal Loan: Early stabilization visible; growth remains quality-led

* Stress cycle easing, not fully behind: Interactions with various DSAs indicate that early-stage delinquencies have started to stabilize, though lenders remain cautious on mid-ticket unsecured exposures, where leverage had built up during the last cycle.

* Pricing correction largely done: Personal loan rates have moderated from the mid-teens to low-teens, while affordability has improved. However, lenders are not chasing volumes aggressively, reflecting a preference for risk-adjusted growth over yield.

* Selective re-opening of credit: Incremental disbursements are largely skewed towards existing-to-bank customers, salaried profiles, and higher-quality repeat borrowers, with tighter filters for self-employed and multi-lender customers.

* Private banks lead, NBFCs stay guarded: Private banks are driving most of the incremental growth on the back of stronger liability franchises, while NBFCs remain selective, prioritizing portfolio clean-up and collections over fresh scaleup.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Life Insurance Sector Update : Ending the year on a `healthy` note ! By Motilal Oswal Finan...