Buy Oil India Ltd for the Target Rs. 495 by Motilal Oswal Financial Services Ltd

NRL expansion a key catalyst in FY26

* Oil India’s (OINL) 4QFY25 revenue came in 7% above our estimate at INR55.2b (flat YoY), as both oil and gas sales stood above our est. Oil realization was USD74.9/bbl (vs our estimate of USD75.9/bbl). EBITDA came in line with our estimate at INR19.8b as other expenses came in above our estimate. However, reported PAT was 16% above our estimate at INR15.9b, due to higher-thanexpected other income and lower-than-expected finance cost, DDA, and tax rate.

* The core story still broadly remains intact – Numaligarh Refinery Limited (NRL)’s expanded capacity is on track for commissioning by Dec’25. Further, the ~1.5mmscmd DNPL capacity expansion by Oct’25 is expected to support production volume growth in the near term. The company continues to focus on exploration and aims to achieve 10-12mmtoe p.a. production by 2030.

* We forecast Brent to average USD65/bbl in FY26/FY27 but believe downside risks remain to both oil and gas realizations. Every USD1/bbl decline in Brent prices leads to a ~2% decline in FY26E/FY27E PAT for OINL SA. While valuations look reasonable at 1.3x FY27E PB for OINL SA, production volume growth remains crucial for re-rating. Our FY26/FY27 EPS estimates are 7%/13% below consensus for OINL SA.

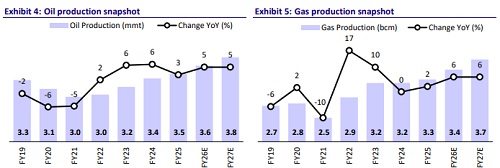

* We arrive at our TP of INR495 as we model a 5%/6% production volume growth CAGR for oil and gas production over FY25-27. We value the standalone business at 6x FY27E P/E, existing NRL stake at 3.0x FY24 P/B, and include the value of equity invested to date in NRL capacity expansion. Reiterate BUY.

Other key takeaways from the conference call

* The 9mmtpa Paradip-Numaligarh Crude Pipeline and the 2.5mmscmd Duliajan - Numaligarh Gas Pipeline are expected to be commissioned in Oct’25.

* OINL is expected to incur INR150-160b of capex in FY26 (including the NRL capex of INR91.3b).

* The Mozambique project is expected to restart in Jul’25. OINL has a 10% stake in the project.

* In FY26, ~20-25% of gas is expected to be NW gas. ~1mmscmd of gas that was previously flared is now getting piped.

* OINL dug 60+ wells in FY25. The company plans to dig 75+ wells in FY26.

EBITDA in line; PAT beat driven by lower DDA and taxes

* Revenue came in 7% above our estimate at INR55.2b (flat YoY), as both oil and gas sales stood above our estimate.

* Oil sales came in at 0.85mmt (our estimate of 0.83mmt). Gas sales stood at 0.67bcm (our estimate of 0.65bcm).

* Oil and gas production stood flat YoY at 844mmt/806bcm in 4Q.

* Oil realization was USD74.9/bbl (our estimate of USD75.9/bbl).

* EBITDA came in line with our estimate at INR19.8b (-15% YoY), as other expenses came in above our estimate.

* However, reported PAT was 16% above our estimate at INR15.9b due to higher-than-expected other income and lower-than-expected finance cost, DDA, and tax rate.

* Numaligarh refinery’s 4Q performance:

* PAT stood at INR6.2b (vs. PAT of INR6.4b during 4QFY24), as GRM stood at USD9.3/bbl.

* Crude throughput stood at 809.7tmt (similar YoY) and distillate yield stood at 88% (vs. 89% in 4QFY24).

* In FY25, net sales and EBITDA were similar YoY, while APAT declined 14% YoY.

* The Board has recommended a final dividend of INR1.5/share (FV: INR10/ share, interim dividend in FY25: INR10/sh).

Valuation and view

* Production growth guidance remained robust, with drilling activity and development wells in old areas contributing to this growth. OINL is also implementing new technologies to raise production. Capacity expansion for NRL (from 3mmt to 9mmt) is anticipated to be completed by Dec’25, which will drive further growth.

* While valuations look reasonable at 1.3x FY27E PB for OINL SA, production volume growth remains crucial for re-rating. We value the stock at 6x FY27E standalone adj. EPS and add investments to arrive at our TP of INR495. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)