Neutral Alkyl Amines Chemicals Ltd for the Target Rs. 1,640 by Motilal Oswal Financial Services Ltd

Volume-led growth to persist; pricing pressure sustains

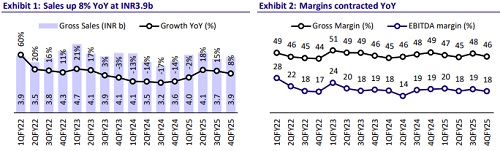

* Alkyl Amines Chemicals (AACL)’s 4QFY25 revenue increased 8% YoY to INR3.9b. The growth was mainly volume-driven, though the company continues to face pricing pressure. Gross margin dipped 330bp YoY to 45.9%, while EBITDAM stood at 17.6%. PAT came in at INR460m vs. our estimate of INR522m. Exports contributed 25% of the total revenue in FY25.

* AACL reported 13% YoY volume growth in FY25 (15% in 4QFY25), but top-line growth was muted due to continued pricing pressure (-4% YoY in FY25). Pharma demand stayed stable, while agrochem demand remained volatile amid industry-wide capacity expansions. Average capacity utilization currently stands at 65-70% for the company.

* Despite an oversupplied market and declining product prices, AACL maintained stable EBITDA margins at 18.5% in FY25, aided by falling raw material costs. Specialty chemicals faced margin stress due to Chinese dumping, but overall profitability remained intact. Prices have been subdued in the amines segment with excess supply in the domestic market.

* The company plans to invest INR1.5b in FY26, including INR1.0-1.2b at the Dahej site, with mechanical completion of the project expected by Dec’25/Jan’26. All projects are on track, with a focus on future volume growth and new product development. There are some other products, which are in the pipeline for which FID will be taken in due course of time.

* Given the lower-than-estimated 4QFY25, we cut our revenue/EBITDA/PAT estimates by 5%/11%/11% for FY26 and by 7%/13%/13% for FY27. We expect a revenue/EBITDA/EPS CAGR of 11%/13%/14% during FY25-27. We reiterate our Neutral rating on AACL with a TP of INR1,640, based on 35x FY27E EPS.

Operating performance below est.; margin contracts

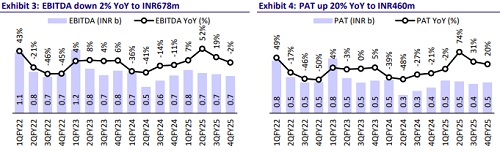

* AACL’s 4QFY25 revenue was INR3.9b (1% below our est., +8% YoY). Gross margin dipped 330bp YoY to 45.9%, with EBITDAM at 17.6% (-170bp YoY).

* EBITDA came in at INR678m (est. of INR820m, -2% YoY). PAT stood at INR460m (est. of INR522m, +20% YoY).

* For FY25, revenue stood at INR15.7b (+9% YoY), EBITDA came in at INR2.9b (+16% YoY), and PAT was at INR1.9b (+25% YoY). EBITDAM was at 18.6% (+110bp YoY).

* The Board declared a final dividend of INR10 per equity share for FY25

Valuation and view

* AACL boosted its aliphatic amines capacity by ~30% in FY24. The total capacity stands at ~200ktpa (including derivatives and specialty chemicals). Additionally, AACL is venturing into new specialty products that are likely to improve its margins amid robust demand (near-term headwinds persist) for amine derivatives and specialties.

* Over FY25-27, we estimate a ~11% revenue CAGR and a 14% EPS CAGR. The key risk to our outlook is high competition (domestic and imports, mainly from China), leading to limited pricing power. The commodity nature of some products could also make AACL susceptible to raw material price fluctuations. Upside risks could come from the implementation of ADD.

* The stock is trading at ~37x FY27E EPS of INR46.9 and ~23x FY27E EV/EBITDA. We reiterate our Neutral rating on AACL with a TP of INR1,640, based on 35x FY27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412