Neutral BSE Ltd for the Target Rs. 2,300 by Motilal Oswal Financial Services Ltd

Shift in expiry to dent market share

Expect 350-400bp hit on premium market share

* We had upgraded BSE to BUY from Neutral in our thematic report titled “Indian Capital Market: A golden era!” published in Dec’24. We followed up in Jan’25 with BSE as one of our top ideas for 2025. Since our upgrade in Dec’24, the stock has delivered a stellar return of 48%.

* BSE has announced the shift in the expiry of weekly contracts of Sensex from Tuesday to Thursday starting 01 Sep’25. We note that this shift will lead to a loss in market share for BSE in terms of premium turnover, which stood at 22.6% in May’25.

* Currently, each of the days accounts for 18-22% share in the week’s total premium volume. BSE has a market share of 8% on Wed/Thu and 21%/24%/38% on Fri/Mon/Tue. Overlaying the current trends on the day-wise share in volumes for the week, we expect a market share loss of 350-400bp for BSE.

* We reduce our premium average daily turnover (ADTO) estimates for FY26/FY27 to INR137b/INR157b from INR155b/INR190b earlier. This is translating into a reduction of 9%/12% in our FY26/27 earnings estimates.

* With the recent rally, the stock trades at FY27E P/E of 53x, significantly higher than its historic average as well as that of its global peers. We downgrade our rating on BSE to Neutral with a revised TP of INR2,300 (45x FY27E P/E).

Shift of Sensex expiry to Thursday will lead to market share loss

* Weekly expiry days have seen significant shifts over the past couple of years. It started with BSE launching its weekly contracts for Sensex and Bankex on Friday in May’23. This was followed by NSE shifting its Bank Nifty expiry to Wednesday in Sep’23 and BSE shifting Bankex expiry to Monday in Oct’23. After the new F&O regulations, BSE shifted the Sensex expiry to Tuesday in Jan’25. NSE then expressed interest in shifting Nifty expiry to Monday.

* However, the regulator then released a consultation paper and followed it up with a final regulation on allowing weekly expiries only on Tuesdays and Thursdays. Also, the regulations now mandate exchanges to seek regulatory approval before changing expiry dates of contracts.

* BSE, under the new regulations, has shifted the expiry of Sensex to Thursday from Tuesday. We note that after the implementation of new F&O regulations (effective Mar’25), in weeks where markets were open on all five days, the share of each day was in the 18-22% range.

* BSE had an average market share of 8% on Wednesday and Thursday (days influenced by Nifty’s expiry). On Friday/Monday/Tuesday, the premium turnover market share was 21%/24%/38%. Assuming the recent trends and overlaying them on day-wise share in volumes for the industry, we believe that BSE’s market share can be in the range of 18-19% (from 22.6% in May’25).

* The impact of these measures will be visible from Sep’25 when the new contracts kick in.

Performance was strong during previous regulatory changes

* SEBI has brought in significant changes in F&O regulations since Nov’24, which included 1) restricting weekly expiry to only one index per exchange and 2) increasing the lot size of the index derivatives by 2-3x. These measures were expected to have a significant impact on volumes for stock exchanges, including BSE.

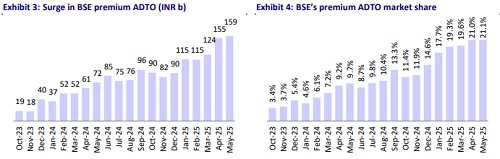

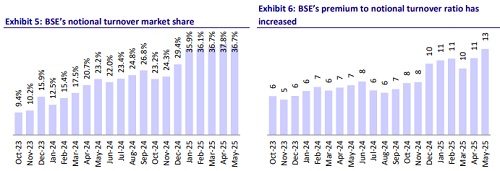

* However, as the regulations were implemented, BSE’s volumes only got stronger. In terms of premium turnover, ADTO, which was at INR90b, in Oct’24 saw a sustained uptrend and reached INR159b in May’25. The key drivers of this surge were: 1) increased volumes on non-expiry days for Sensex, which led to increase in premium to notional turnover from 0.08% in Oct’24 to 0.13% in May’25, and 2) the addition of 100+ colocation racks toward the end of Mar’25.

* This was also reflected in a strong financial performance in 4QFY25, which was one of the weakest quarters for capital market players in recent times, with revenue/PAT surging by 75%/366% YoY. Consequently, the earnings estimates have been upgraded, which led to further re-rating of the stock.

Valuation and view: Reduce estimates to factor in the impact of shift in expiry

* We reduce our premium ADTO estimates for FY26/FY27 to INR137b/INR157b from INR155b/INR190b earlier. This translates into a reduction of 9%/12% in our FY26/27 earnings estimates.

* For every INR10b cut in our premium ADTO assumptions, earnings would be cut by ~6%.

* The stock trades at FY27E P/E of 53x, more than 2x the average of listed exchanges globally. Given the high-growth potential of Indian markets due to under penetration, a premium is deserved.

* We downgrade our rating to Neutral with a one-year TP of INR2,300 (45x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412