Buy Kajaria Ceramics Ltd for the Target Rs. 950 by Motilal Oswal Financial Services Ltd

Weak earnings; demand outlook cautiously optimistic

Eyeing demand recovery in real estate and exports in FY26

* Kajaria Ceramics’ (KJC) 4QFY25 EBITDA was below our estimate due to lowerthan-estimated realization and higher-than-estimated other expenses. EBITDA (including discontinued operation) declined ~28% YoY to INR1.7b (~28% miss) and OPM contracted 3.8pp YoY to ~10% (est. ~13%). PAT (incl. discontinued operations) declined ~39% YoY to INR943m (33% miss).

* Management highlighted that demand was soft in both domestic and exports in 4QFY25. Margin contraction was due to another muted quarter for the Bathware division and a write-off in UK operations (INR70m). It refrained from giving any guidance for FY26 and indicated that it would wait for one more quarter to see a recovery in demand. Further, it is exploring certain measures, including cost optimization, brand strengthening, and reach enhancement, to become more competitive and improve margins.

* We cut our EPS estimates by ~11%/10% for FY26/FY27 to factor in persistently weak domestic demand and increased competition from Morbi players due to weak exports (down ~20% YoY in FY25). This also led to margin pressure. We value KJC at 35x FY27E EPS to arrive at our revised TP of INR950 (earlier INR1,020). Maintain BUY.

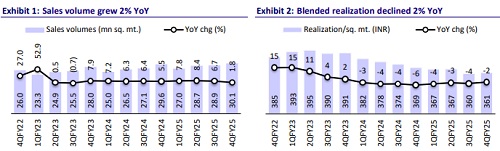

Volume up 2% YoY; tiles realization declined ~2% YoY

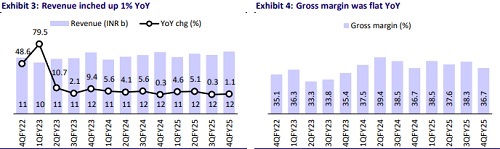

* Consol. revenue/EBITDA/PAT (excluding discontinued operation) stood at INR12.2b/INR1.4b/INR733m (+1%/-20%/-30% YoY). Tile volume inched up ~2% YoY to 30.1msm, while realization declined ~2% YoY to INR361/sqm. Sanitaryware/adhesives revenue increased ~8%/51% YoY.

* Gross margin remained flat YoY at ~37%. Employee costs increased 14% YoY (11.7% of revenue vs. 10.4% in 4QFY24). Other expenses rose 15% YoY (13.6% of revenue vs. 12.0% in 4QFY24). OPM contracted 3.0pp YoY to ~11%.

* In FY25 (excluding discontinued operation), revenue grew ~4% YoY, while EBITDA/PAT declined ~11%/22% YoY. OPM contracted 2.3pp YoY to ~14%. Tile sales volume grew ~6% YoY, while realization declined ~4%. OCF dipped ~16% YoY to INR5.0b. Capex stood at INR2.2b vs. INR3.0b in FY24.

Highlights from the management commentary

* Plywood business was set up in 2017, and with the implementation of GST, it was anticipated that there would be a shift from unorganized to organized players. However, this did not work and KJC decided to close this business.

* Nepal plant with 5.1msm capacity was commissioned in Sep’24. It operated at ~50% utilization in 4QFY25.

* The company is exiting its loss-making ventures, including UK retail business, though it will continue to export. However, it remains confident about its investment in the UAE, which it views as a strategic, long-term opportunity.

View and valuation

* KJC’s reported performance was below our estimates, affected by muted domestic demand and weak exports, which led to higher competitive intensity and margin pressure. However, new project launches in the real estate sector should drive demand revival. Management is hopeful for a pick-up in export demand, supported by lower freight costs (currently at lowest). It is undertaking several cost-saving measures and strengthening its distribution network to gain market share.

* We estimate KJC to post a CAGR of 8%/11%/12% in revenue/EBITDA/PAT over FY25-27. We estimate an ~8% CAGR in tile volume over FY25-27. We factor in lower margins of 13.7%/14.3% for FY26/27E (vs. last 10-year average of ~16%) considering that higher competitive intensity could put pressure on realization. Valuation at 34x/29x FY26/27E EPS appears reasonable; and we believe demand recovery would be the key trigger for stock price performance. We maintain our BUY rating with a revised TP of INR950 (earlier INR1,020), based on 35x FY27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412