Weekly Derivatives Insights 14 July 2025 - Axis Securities

The Week That Was:

* Nifty futures closed at 25,223.4 on Friday, down 1.2% (316.7 points), with a 14.5% rise in open interest, indicating Long Unwinding.

* Bank Nifty futures settled at 56,917.6, down 0.7% (-376.2 points), with a 3.3% rise in open interest, indicating Short Build-up.

* India VIX decreased by 4.0%, from 12.31% to 11.82%, suggesting a slight reduction in market volatility.

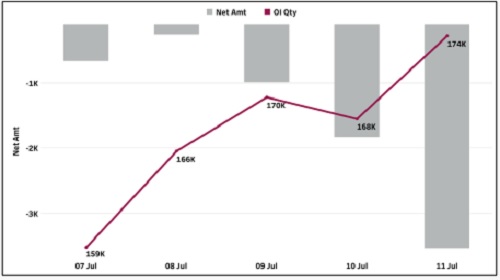

* FII Index futures Long-Short Ratio dropped from 0.40 to 0.25, indicating an increase in bearish bets with more shorts added and long positions unwound.

* Total outstanding open interest in Nifty and Bank Nifty futures were 1.77 cr units (prev: 1.58 cr) and 0.238 cr units (prev: 0.23 cr), respectively.

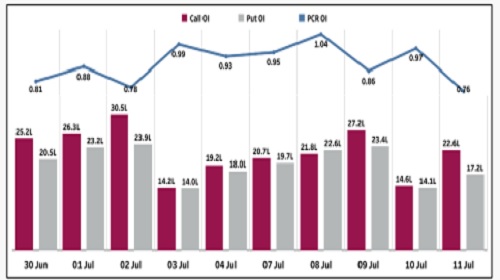

Nifty Open Interest Put-Call Ratio

* Nifty PCR dropped by 0.17 this week, as call option positions outpaced puts—hinting at a tilt toward bearish sentiment.

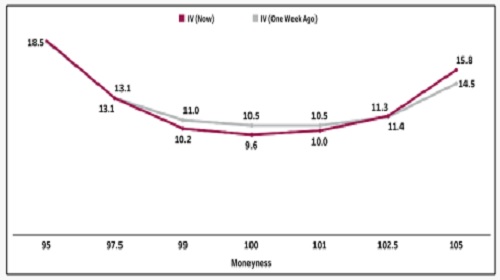

Volatility Analysis

* The implied volatility curve for the upcoming weekly expiration mostly shifted lower this past week for near-ATM strikes, but for OTM calls, it was noticeably higher. This means that market participants are expecting a rebound should the market struggle at the start of the week.

* Additionally, implied volatility for 2.5% OTM calls rose slightly while that for similar-distance puts fell a little, in a sign that the positioning is for the index to find buyers in a normal market, assuming no event-driven volatility spike.

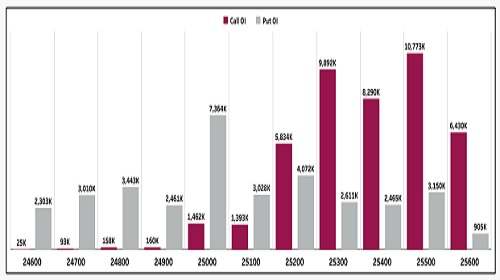

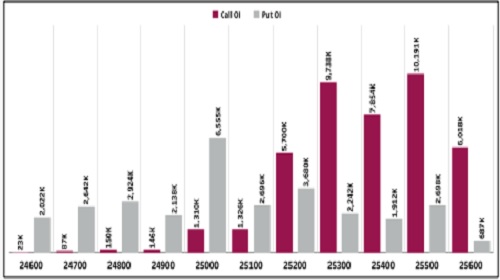

Nifty Open Interest Concentration (Weekly)

* The strike-concentration for the upcoming expiry on July 17 shows that the Nifty has strong supports at 25,000, 24,800 and 24,500, while resistance can be seen near 25,300, 25,500 and 25,800.

* Speaking of open interest changes, the 25,500-strike call and 24,000 strike put saw the maximum addition, alongside the 25,000-strike put and the 25,300-strike call.

* Based on the data, we project the Nifty to trade between 24,800 and 25,500 in the week ahead.

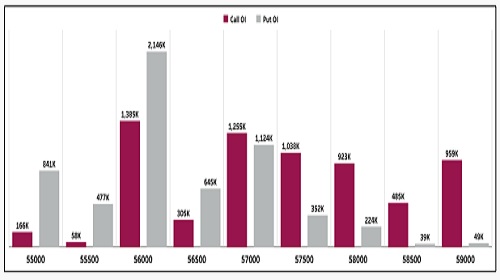

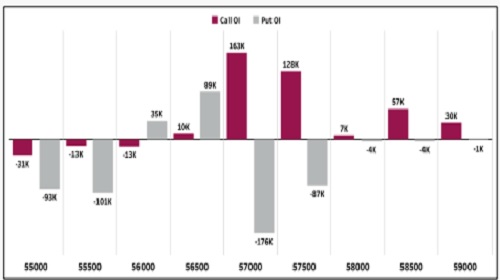

Bank Nifty Open Interest Concentration (Monthly)

* The strike concentration for the July expiration shows that the Bank Nifty has strong supports at 56,000, 55,000, and 55,500, while resistance rests at 57,000, 58,000, and 57,500.

* Speaking of open interest changes, the 57,200-strike Call saw the maximum addition, while the 56,500- strike Put saw the largest addition.

* Based on the data, we project the Bank Nifty to trade between 55,500 and 58,000 in the coming week, with 56,000 acting as a pivotal level.

Nifty Change in Open Interest (Weekly)

* Using the monthly expiration cycle, notable addition in calls was seen at the following strikes - 25,500 (9.3 Lc), 25,600 (8.2 Lc), and 25,700 (6.7 Lc), respectively. There was unwinding observed at 26,500 & 26,000 strikes.

* Coming to puts, the 25,000 (8.1 Lc), 24,900 (2.9 Lc), and 24,800 strikes (2.8 Lc) saw considerable addition in open interest. Unwinding was witnessed at the 24,500 & 25,800 strike

Bank Nifty Change in Open Interest (Monthly)

* For the Bank Nifty - based again on the monthly expiration cycle - notable addition in calls was seen at the following strikes - 57,200 (1.7 Lc), 57,000 (1.6 Lc), and 57,500 (1.3 Lc), respectively. Significant unwinding was observed at the 56,000 & 55,500 strikes.

* Coming to puts, the 56,500 (0.9 Lc), 56,900 (0.4 Lc), and 56,000 strikes (0.3 Lc) saw considerable addition in open interest. There was notable unwinding observed at 57,000 & 55,500 strikes.

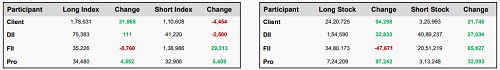

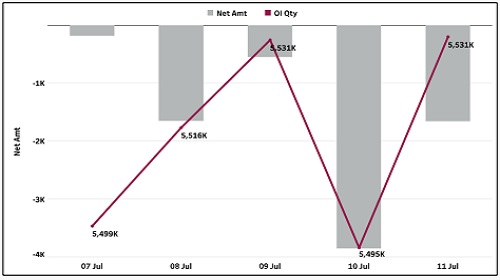

Weekly Participant-wise Open Interest (contracts)

Index Futures

* FII total open interest in Index Futures stood at 33,146 cr, an increase of 3,554 cr from last week.

* Foreigners had 1,74,212 index futures contracts open, up a net of 20,553 contracts from the previous week. Nifty Futures saw an addition of 15,194 contracts, while Bank Nifty saw an addition of 5,833 contracts.

* In Nifty options, they finished the week with 11,88,708 contracts, which was an addition of 1,40,224 contracts. Bank Nifty positions decreased by 24,831 contracts to 1,77,970 contracts.

Stock Futures

* Coming to Stock Futures, open interest was 3,85,658 cr, reflecting a weekly decline of 3,909 cr.

* The total number of stock futures contracts stood at 55,31,392 an increase of 38,156 contracts over the previous week.

* For Stock Options, open interest was at 7,80,573 contracts, a reduction of 64,150 contracts on the week.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633