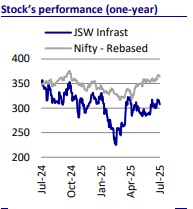

Buy JSW Infrastructure Ltd for the Target Rs. 370 by Motilal Oswal Financial Services Ltd

Achieves record volumes; sets stage for integrated logistics leadership

In this note, we present the key takeaways from JSW Infrastructure Ltd’s (JSWINFRA) FY25 Annual Report.

Strong FY25 performance propels JSWINFRA toward port and logistics growth milestones

* In FY25, JSWINFRA handled 117MMT of cargo (up 9% YoY), supported by higher volumes at terminals in Mangalore, Ennore, and Paradip, along with the commencement of interim operations at JNPA and Tuticorin. Third-party cargo volumes surged 34% YoY to 57MMT, increasing their share in the overall cargo mix to 49% from 40% in FY24.

* In FY25, the company strategically entered the logistics sector through the acquisition of a 70.37% stake in Navkar Corporation Ltd (NAVKAR) and the Gati Shakti Multi-Modal Cargo Terminal at Arakkonam, laying the groundwork for a pan-India logistics network to deliver integrated, end-to-end supply chain solutions.

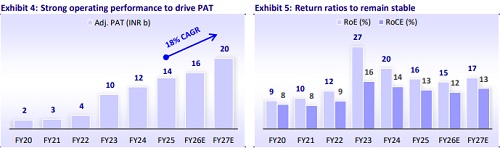

* Revenue grew 19% YoY to INR 44.8b, EBITDA rose 15% to INR 22.6b, and APAT increased 22% to INR 14.5b. The company maintained strong financial health, with a net debt-to-EBITDA ratio of ~1x and a net debt-to-equity ratio of 0.2x.

* JSWINFRA ended FY25 with strong growth in cargo and profitability and is advancing toward its goal of 400 MTPA port capacity by FY30. Driven by the NAVKAR acquisition, its logistics arm is targeting 50% revenue growth in FY26 and aims to reach INR80b revenue by FY30. Backed by a solid balance sheet, JSWINFRA is well-positioned to achieve 13-15% volume CAGR over the next few years. We estimate a volume/revenue/EBITDA/APAT CAGR of 13%/22%/23%/18% over FY25-27. Reiterate BUY with a TP of INR370 (premised on 23x FY27 EV/EBITDA).

Future growth strategy for ports and logistics businesses

* JSWINFRA has outlined an ambitious roadmap to expand its port capacity to 400 MTPA by FY30, up from 177 MTPA in FY25. The expansion will be driven by a mix of greenfield projects, brownfield expansions, and connectivity infrastructure, backed by a planned capex of INR300b for ports and an additional INR90b for logistics.

* In the logistics segment, JSWINFRA is targeting INR80b in revenue by FY30, with an expected EBITDA margin of ~25%, driven by its asset-light, integrated platform under JSW Ports & Logistics.

Ports expansion strategy in place to raise capacity to 400 MTPA by FY30

* JSWINFRA made significant progress across its brownfield and greenfield expansion initiatives during FY25. At the Goa Terminal, capacity was increased from 8.5 MTPA to 11 MTPA, with additional regulatory approvals pending to raise it to 15 MTPA.

* A major expansion of 36 MTPA was launched at Jaigarh (15 MTPA) and Dharamtar (21 MTPA) to support the growing needs of JSW Steel’s Dolvi facility, with a combined capex of INR23.6b.

* A 2 MTPA LPG terminal is under construction at Jaigarh with a capex of INR9b, while the Mangalore Container Terminal is being expanded from 4.2 to 6 MTPA. Interim operations commenced at new berths in Tuticorin (7 MTPA) and JNPA (4.5 MTPA liquid cargo), contributing 1.1 MMT to FY25 volumes.

* In terms of greenfield developments, the company signed a concession agreement for a 30 MTPA port at Keni in Karnataka and is advancing the development of a 30 MTPA port at Jatadhar in Odisha.

* It also received a Letter of Intent for developing Murbe Port in Maharashtra.

* For port connectivity, JSWINFRA continued construction of a 302-km slurry pipeline in Odisha, completing 210 km of welding and 180 km of pipe-lowering activities. To support its expansion plans, the company also procured a state-ofthe-art dredger from IHC Dredging in the Netherlands.

Foray into logistics business via NAVKAR acquisition

* In FY25, JSWINFRA made a strategic foray into the logistics sector, marking a significant step in its evolution from a pure-play port operator to an integrated ports and logistics platform. The company acquired a 70.37% stake in NAVKAR for an enterprise value of INR17b, gaining access to key logistics assets, including container freight stations (CFS), inland container depots (ICD), and Category I and II container train operator licenses.

* This acquisition provided JSWINFRA with a 283-acre land bank in high-volume trade hubs like Panvel and Morbi, strengthening its hinterland connectivity and multimodal capabilities.

* Additionally, the company acquired the Gati Shakti Multi-Modal Cargo Terminal (GCT) at Arakkonam, near Chennai, under an asset-light model to enhance lastmile infrastructure in southern India.

Focus on ESG initiatives

* JSWINFRA adopted the Miyawaki method to plant 1,600 native trees at Ennore, creating a dense green zone. At Ennore Bulk Terminal, cranes now operate on electric power, reducing emissions. Dharamtar Port achieved a 34% cut in freshwater usage through improved water management.

* The JSW Udaan Scholarship supported 308 students in FY25. Ambulance services aided 1,077 patients in Paradip and Jaigarh. Under Project Humraahi, 900 truckers in Jaigarh received eye check-ups, audiometry services, and healthcare referrals.

* As of Mar’25, JSWINFRA’s Board comprised 10 directors, including two women directors. CSR spend for FY25 stood at INR168m, and a dividend of INR0.80 per share was recommended for FY25.

Valuation and view

* JSWINFRA ended FY25 on a strong note, delivering robust growth in cargo volumes, revenue, and profitability, while making steady progress toward its long-term goal of achieving 400 MTPA port capacity by FY30. The recent acquisition of NAVKAR has significantly strengthened its logistics segment, which is targeting INR80b in revenue by FY30. With a strong balance sheet and a favorable macro environment, JSWINFRA is well-positioned to benefit from India's infrastructure push and increasing third-party cargo demand, despite global headwinds.

* We expect JSWINFRA to strengthen its market dominance, leading to a 13% volume CAGR over FY25-27. This, along with a sharp rise in logistics revenues, is expected to drive a 22% CAGR in revenue and a 23% CAGR in EBITDA over the same period. We reiterate our BUY rating with a TP of INR370 (based on 23x FY27 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412