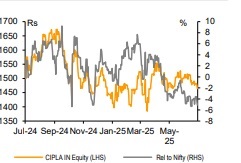

Buy Cipla Ltd For Target Rs.1,600 by Emkay Global Financial Services Ltd

Cipla’s 1QFY26 revenue was below our estimates, primarily on account of a sharp miss in domestic sales. The EBITDA beat (vs consensus; in line with our estimate, albeit with margin ahead of estimate) was gross margin-led. We caution against meaningfully extrapolating the 1Q margin beat given that Cipla’s margin, even in a normalized domestic growth scenario, tends to be a tale of two halves. Margin trends over the last 3 years include the favorable impact of gRevlimid and do not serve as a guide; however, 2HFY26 is likely to stay true to the traditional script (2H margins lower vs 1H) owing to the expected significant decline in gRevlimid contribution 3Q onward. The management maintaining its full year EBITDA margin guidance (23.5-24.5%) reflects this dynamic. 1Q domestic weakness (~3% YoY growth in branded Rx), which was attributed to adverse seasonality and an organizational realignment, reinforces our view that near-term domestic growth is likely to undershoot street expectations (refer to our FY25 ARA note). We raise FY26E/27E EPS by 4%/2% (note that we are still building in an uptick in domestic growth from 2Q + double-digit domestic growth in FY27E). We roll forward to Jun-27E EPS and revise up our TP by ~7% to Rs1,600 (vs Rs1,500 earlier); retain REDUCE.

US sales marginally ahead, partly aided by new launches

US sales at USD226mn were marginally ahead of our estimate. Base business sales were higher, partly aided by the launch of gAbraxane and Nilotinib during the quarter. Per the management, gRevlimid sales were largely flat QoQ (~USD45mn, per our estimate). Cipla’s market share in Albuterol and Lanreotide stood at 19.5% and 21%, respectively, at the end of the quarter. Cipla has entered into an agreement with Tanvex BioPharma for its first biosimilar launch in the US in 2QFY26. Tanvex-Cipla’s Nypozi will be the 5th player in the Filgrastim biosimilar market.

Domestic miss due to weaker branded as well as trade generic growth

Overall domestic sales growth at 6% YoY was meaningfully below our expectations. Growth in the core branded prescription business (~3%, per our estimate) and the trade generic business (~5% YoY) was below our estimates, while consumer health growth (~24% YoY) was ahead of expectations.

KTAs from the earnings call

1) Lanreotide sales are now in line with the average quarterly sales for FY25. 2) Expects 2-3 peptide launches in the US in FY26; targets USD1bn in US sales in FY27. 3) Cipla will in-license more biosimilar assets in the near term; plans launching its own assets starting CY29-30. 4) The company is prepared for a reinspection of its Indore facility which is expected any time between now and Feb-26. 5) Cipla created a new domestic respiratory division for the launch of new products (incl triple combination inhalers) in 1Q; some key inhaler brands were impacted by pricing adjustments over the last 12-15 months.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)