Buy LIC Housing Finance Ltd For Target Rs. 685 By Yes Securities Ltd

Growth and Margins remain key monitorables

NPL resolutions drive positive credit cost; disbursements in-line, margin stable

LIC HF delivered a 15% beat on our PAT estimate on account of provision write-back underpinned by sustained IHL NPL resolutions and a large Corporate NPL recovery (a fully provided ~Rs5bn account was sold to ARC for cash consideration of Rs2.5bn). NIM was stable with marginal decline in both computed portfolio yield and cost of funds. Overall disbursements stood at Rs155bn (down 6% qoq/up 2% yoy), comprising of IHL Rs122.5bn (down 6% qoq/5% yoy), NHI-LAP Rs21bn (up 10% qoq/21% yoy), and wholesale (DF + HFC) ~Rs10bn (down 30% qoq/up 162% yoy). IHL originations were impacted in the quarter by Rs7-8bn due to issues in Hyderabad and Bangalore (these markets contribute ~35% of the book). Portfolio run-off rate was under control at 13.8% in IHL, and the lumpsum prepayment rate for 9M FY25 stood at 9.3% (10.4% in FY24). Loan portfolio growth slightly improved to 6.4% yoy with IHL growth at 7% yoy.

Management expects some growth recovery, resilience in margins and further improvement in asset quality

LIC HF expects IHL disbursements to recover significantly from Q4 FY25 with business returning to normalcy in Hyderabad and likely clearance of the substantial sanction backlog (~Rs6bn) in Bangalore. The co. has launched the Affordable HL product (200- 250 bps higher pricing than prime HL) in select centers and the business would be scaled-up in a calibrated way. There is renewed emphasis on project finance, but the management intends to be prudent in credit selection and pricing. Co. doesn’t expect any material uptick in BT Out in a rate easing environment with a view that comfortable liquidity conditions would benefit Bank Loan, CP and Bond pricing, which will allow timely/competitive reduction of PLR. In Q4 FY25, NIM is likely to remain stable supported by the 10 bps PLR hike effective from January. In the long run, the scalingup of Affordable HL product would be margin accretive. Stage-3 improvement is expected to continue with sustained recoveries in retail loans and likely conclusion of 4-to-5 large NPL resolutions. Credit cost is estimated to be moderate even in FY26.

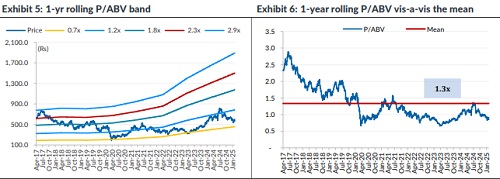

Re-rating contingent on better disbursement performance

We have marginally lowered loan book growth expectations through FY25-27 as the management intends to prioritize margin/profitability over unwarranted growth. We estimate 9-10% loan growth and 12.5-13% RoE delivery over FY25-27. LIC HF’s valuation is undemanding at 0.7x FY27 P/BV, and we see a possibility of some re-rating with better disbursement performance coming through. Upgrade the stock to BUY with 12m PT of Rs685.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632