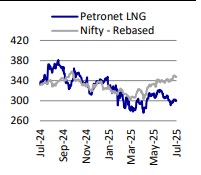

Buy Petronet LNG Ltd for the Target Rs.410 by Motilal Oswal Financial Services Ltd

Tide is turning, slowly

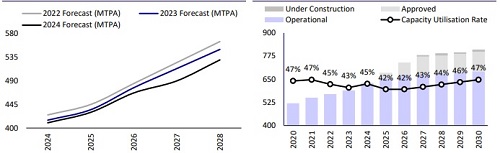

* We upgrade PLNG to Buy with a DCF-based TP of INR410/sh. According to our DCF analysis (WACC: 11.2%), at CMP, PLNG is pricing in an unrealistic scenario of a 20% decline in tariff at both the Dahej and Kochi terminals in FY28 with no tariff hike thereafter, and 0% terminal growth. Additionally, the street narrative that competing terminals are taking away market share has: 1) not played out so far as utilization at competitor terminals continues to languish at 14-43%, and 2) overlooked PLNG’s strong scale, historical capex, and connectivity advantages. While concerns around a potential tariff cut in FY28 linger, we highlight that a sharp cut in tariff at Dahej in FY28 can lead to industry-wide pressure, as competing terminals were built at ~2x the capital cost (Dahej capex/mmtpa = ~INR5b vs ~INR9- 11b for competitors). This would further increase the relative attractiveness of the Dahej terminal, especially as its expanded capacity comes online.

* At 9.7x FY27 P/E and 4% dividend yield, we believe valuations are at absolute rockbottom levels. We move to a DCF-based TP (earlier 10x FY27 PE) and assume a 10% tariff cut in Dahej and Kochi in FY28, 4% escalation thereafter, 2% terminal growth, and 11.2% WACC, leading to a TP of INR410/share. While we build in full capex for the petchem venture, we value it at only 0.5x equity.

Capacity expansion can drive a re-rating; upside from soft LNG prices in FY27

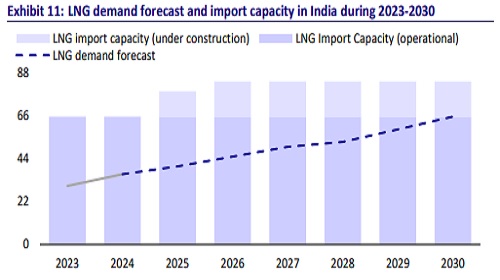

The 5mmtpa new capacity (+18% on the current base) at Dahej is set to commence operations in Dec’25, driving a 3.3% volume CAGR over FY25-28. We are building in a PAT CAGR of 9% during FY25-27E, driven by volume growth and the scheduled 5% tariff hike for both the Dahej and Kochi terminals. Additionally, the completion of the Kochi-Mangalore-Bangalore pipeline (KMBPL), slated for Dec’25, is expected to improve medium- to long-term visibility and support utilization at the Kochi terminal. Volumes in the coming years are likely to benefit from lower spot LNG prices starting in FY27, along with an already soft crude price outlook.

Either a tariff cut or higher competitive pressure, not both

Our model assumes a 10% tariff cut at Dahej and Kochi in FY28, followed by a 4% annual increase thereafter, which we consider realistic. A sharp cut in tariff at Dahej can lead to industry-wide pressure as competing terminals were built at ~2x the cost (Dahej capex/mmtpa = ~INR5b vs ~INR9-11b for competitors). This would further increase the relative attractiveness of the Dahej terminal, especially as its expanded capacity comes online. In addition, the current market price implies that investor expectations are currently baking in both these competing scenarios (price cut + volume loss), which we believe are unlikely to play out simultaneously.

Competition-related narrative floundering; ignores

Dahej’s competitive moat and oversimplifies the business Rising competition has been a key concern for PLNG in recent years. However, we highlight: 1) the anticipated terminal from Swan Energy did not materialize, 2) other terminals have struggled to ramp up utilization (14-43%) despite being operational for several years, and 3) specifically, GAIL’s Dabhol terminal, even after the construction of a breakwater, is unlikely to maintain utilization significantly above 50% on an annual basis. Dahej, meanwhile, has continued to operate at near 100% utilization, supported by its strong moat: 1) connectivity via five key pipelines, providing access to demand centers, and 2) a scale advantage (17.5mmtpa vs average terminal size of 5mmtpa), which allows for lower-priced gas contracts and enables better arbitrage opportunities.

Valuations imply the stock is at a point of maximum pessimism PLNG trades at 9.6x FY27 EPS, compared to its historical one-year forward P/E of 10.4x. Under a variety of bearish scenarios, our DCF-based valuation implies -4% to 21% upside from the current price. Our DCF-based TP (WACC: 11.2%, TG = 2%) assumes a 10% tariff cut in FY28, followed by a 4% increase for both the terminals. While we have incorporated the full capital expenditure for the petchem plant, we value it conservatively at 0.5 times FY29E P/B and discount this back to FY27. In our bear-case DCF scenario (same WACC and TG as the base case), we assume no tariff hike after the 10% cut in FY28, resulting in a valuation of INR363/sh. In an extreme bear-case DCF scenario, we assume 0% terminal growth and no tariff hike following a 20% cut in FY28, implying a valuation of INR288/sh.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412