Neutral Petronet LNG Ltd for the Target Rs. 315 by Motilal Oswal Financial Services Ltd

Dahej expansion key catalyst ahead

* Petronet LNG’s (PLNG) 4QFY25 EBITDA came in 21% above our estimates, as the ‘use-or-pay’ (UoP) provision of INR2.3b was reversed during the quarter. EBITDA, adjusted for UoP provision reversal, stood in line with our estimate at INR12.8b. Total volumes came in 8% below our estimate, primarily due to lower third-party cargos. Dahej utilization was 9% below estimates, while Kochi utilization stood 6% above est. During the quarter, PLNG received INR3.6b w.r.t CY21 UoP dues. Additionally, some customers brought LNG quantities up to 31st Mar’25, for which revenue was recognized at the prevailing regasification rate. We note that while spot LNG prices were high, averaging USD14/mmbtu in 4Q (similar QoQ), the current spot LNG price is ~USD11.5/mmbtu.

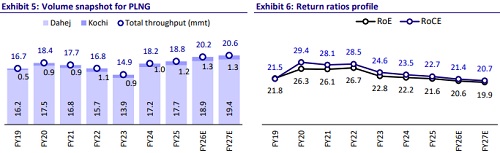

* Following are the key takeaways of the earnings call: 1) The Dahej terminal expansion from 17.5mmt to 22.5mmt is expected to be completed in the next 3-4 months (Jun’25 earlier), after which it will be available for use; 2) INR45b-50b capex will be incurred in FY26, out of which INR25b/3b will be incurred on Dahej petchem plant/Gopalpur LNG terminal; 3) In 1QFY26, some refiners, which had shifted to Naphtha, have returned to NG, as spot LNG prices have corrected; and 4) Major fertilizer plant shutdowns led to lower volumes in 4Q.

* Going forward, the key catalysts will be: 1) the commissioning of the expanded Dahej capacity, and 2) pipeline connectivity for the Kochi terminal. While the PDH-PP project and Gopalpur FSRU can support the future volume trajectory, we believe that the economics of these projects are yet to be established and that they are longer-dated projects. As such, we maintain our Neutral rating with a TP of INR315.

Weak operational performance; EBITDA beat driven by UoP reversal

* 4Q revenue came in 9% below our estimate, as total volumes were 8% below our estimate.

* We note that spot LNG prices were high in 4Q, averaging USD14/mmbtu (similar QoQ).

* However, EBITDA was 21% above our estimates at INR15.1b (+37% YoY), as the UoP provision amounting to INR2.3b was reversed. EBITDA, adjusted for the UoP provision reversal, stood in line with our estimate.

* During the quarter, PLNG received INR3.6b w.r.t CY21 UoP dues. Additionally, some customers brought LNG quantities up to 31st Mar’25, for which revenue was recognized at the prevailing regasification rate. The company has not waived off any UoP dues during the quarter.

* Reported PAT also stood 26% above our est. at INR10.7b (+45% YoY), with other income and tax coming in above our estimate.

* Operational performance:

* Total volumes came in 8% below our estimates, primarily due to lower thirdparty cargos.

* Dahej utilization was 9% below estimates, while Kochi utilization stood 6% above our estimate.

* In FY25, net sales were flat YoY at INR510b, while EBITDA/PAT were up 6%/11% YoY at INR55b/INR39b. In FY25, PLNG waived off UoP charges of INR1.8b (nil in 4Q).

* As of Mar'25, provisions on UoP dues stood at INR4.7b.

* UoP dues of INR14.2b (net provision INR9.5b) were included in trade receivables as of Mar'25. The company has obtained bank guarantees from customers to recover UoP charges. While some customers have not given balance confirmations for these dues, management is confident of recovering such charges.

* The board recommended a final dividend of INR3/sh (FV: INR10/sh).

Valuation and view

* PLNG’s volume utilization improved slightly in FY25, even as spot LNG prices remained elevated in 2HFY25. While we remain positive about volume growth, we believe the ongoing uncertainty around UoP provisioning and rising competition will prevent a further re-rating.

* We value PLNG at 10x FY27E EPS to arrive at a TP of INR315. We reiterate our Neutral rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412