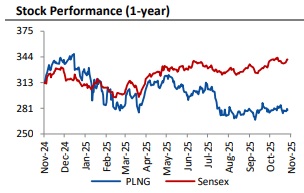

Buy Petronet LNG Ltd for the Target Rs. 348 by Systematix Institutional Equities

We attended the Dahej Plant visit organized by Petronet LNG and interacted with the top management of Petronet LNG. Key takeaways are:

Synergies from LNG terminal to cut capex and opex in upcoming petrochemicals: PLNG is investing Rs207 bn in setting up 750KTA of PDH, 500KTA of PP, Ethane and Propane handing capacity of 1.2mtpa each. The company’s existing cold-energy would help eliminate the refrigeration and cooling tower requirement which would reduce capex by nearly Rs3.5-4 bn. Further, it would help cut power cost of Rs1.2 bn (19MW savings). Despite higher cash balance, PLNG has finalized rupee-denominated debt at an attractive RoI (D:E - 70:30) and expect financial closure to happen soon. The company keeps optimism for the reversal of petchem margins as they expect demand to exceed supply by over 5mtpa in India

3rd Jetty to have propane, ethane unloading facilities: The company is investing Rs20 bn on the 2.5km stretched 3rd jetty which is likely to be commissioned by Mar’27. With the increment capex of just Rs1-1.5bn, this will be equipped with propane and Ethane unloading arms. PLNG is eyeing to sale 0.3mtpa of propane (captive consumption of 0.9mtpa) and 1.2mtpa of ethane which would add to its growth

Dahej expansion is on track: The management reiterated its 16% IRR margin for all projects and guided for timely commission of all the ongoing projects. The company highlighted to complete the Dahej expansion from 17.5mtpa to 22.5mtpa by Mar’26 with just one-tenth of a greenfield capex. Total evacuation capacity if 35mtpa and as Dahej is connected to all five major pipelines, competitiveness would remain strong as other LNG terminals are facing connectivity issues. Further, tariff negotiations with offtakers are still going on for RasGas volume beyond 2028, and they are not in hurry to close it.

Our view: Recently, Indian companies like GAIL and IOC have entered into a LT contract of ~7mtpa which is likely to be delivered from FY27. Further, last stretch of Mangalore-Bangalore pipeline is expected to commission by end-FY26 which would augment the volume at Kochi. Also the company is looking for bunkering option over there. Overall, based on the competition we may not see a sharp cut in tariff and may be boosted by higher tie-ups at Dahej. The stock is trading very reasonable at 9.5x on FY27 with RoE/RoCE of 18%/17%. We raise our PER multiple to 12x from earlier 11x on the back of better visibility on projects. Therefore, we raise our TP to Rs 348 from earlier Rs 319 on unchanged earnings estimates. We upgrade the stock to BUY from earlier HOLD.

Above views are of the author and not of the website kindly read disclaimer