Hold Petronet LNG Ltd for the Target Rs. 290 By Prabhudas Liladhar Capital Ltd

Muted Quarter

Quick Pointers:

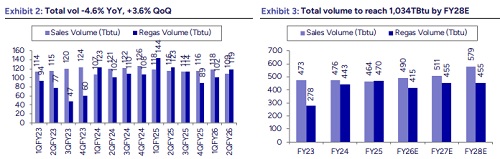

* Dahej regas volume stood at 211TBtu vs 225TBtu in Q2FY25 and 207TBtu in Q1FY26

* Expansion to 22.5mmtpa at Dahej remains on track by CY25 end

Despite slight sequential improvement in total volumes, standalone EBITDA came in 31.5% lower than our estimates at Rs11.2bn (Ple: Rs16.3bn, BBGe Rs12.3bn, -6.9% YoY & -3.7% QoQ). The decline was largely due to impairment charge of Rs1.6bn which included the waiver of Use or Pay (UoP) dues of Rs0.29bn and Rs1.1bn increase in other expenses due to lease accounting impact. As a result, PAT came in at Rs8.1bn, -4.9% YoY and -5.3% QoQ (Rs8.5bn in Q2FY25 and Q1FY26 respectively). In H1FY26, EBITDA and PAT declined - 17.6%/-16.7% YoY to Rs22.8bn and Rs16.6bn. Capex in H1FY26 stood at Rs5.3bn out of the total planned Rs50bn for FY26. A significant portion of the remaining spend in H2FY26 is expected to be ROCE dilutive in the near term. Management remains confident of recovering the UoP dues; however, we remain cautious on the possibility of any further waiver of such dues. Maintain “Hold” with a target price of Rs290 based on 9x FY27/FY28E EPS.

* Lower volumes at Dahej: Long-term regas volume at Dahej declined to 95Tbtu in Q2FY26 vs 96TBtu in Q2FY25 and 105TBtu in Q1FY26. Third party volume stood at 116TBtu vs 123TBtu in Q2FY25, however it improved by +13.7% QoQ from 102TBtu in Q1FY26. Total volumes at Dahej declined -6.2% YoY and improved by +1.9% QoQ to 211Tbtu.

* Kochi utilization improved: Kochi’s long term regas volume stood at 14TBtu, flat vs Q2FY25 and 13TBtu in Q1FY26. Utilization stood at 27%, improving from 22% and 21% in Q2FY25 and Q1FY26 respectively, as BPCL’s June’25 cargo was booked in this quarter. Kochi-Bangalore pipeline completion is expected to be connected to the National Grid soon and co. expects volumes from the terminal to improve going forward.

* UoP provisioning – As of Q2FY26, out of the total Use or Pay (UoP) dues of Rs 13.9bn, co. made a provision of Rs7.4bn. It incurred an impairment charge of Rs1.6bn in Q2FY26, which included the waiver of Use or Pay (UoP) dues of Rs290mn. ~98% of the business is with promoters and hence it does not expect any issues in recovering its dues. Bank guarantees are in place. Company expects to recover Rs6.9bn in H2FY26, with settlements taking place in Q4FY26.

* Gopalpur LNG Terminal: Due to escalation in cost of FSRUs, the company has settled on land-based terminal at Gopalpur. The LNG terminal is 35km away from existing Srikakulam-Angul pipeline and once connected, can access the national gas grid. With emerging demand centers, Gopalpur is expected to emerge as the next Dahej LNG terminal in terms of growth.

* Conference Call Highlights: 1) Other expenses increased due to lease accounting impact for chartered vessels handling Qatar Gas volumes. The company incurred FX loss of Rs840mn (~Rs3.25/USD impact on USD300mn lease liability). 2) FY26 volume outlook – mgmnt did not provide firm volume guidance, 3) Kochi Terminal: Utilization improved as BPCL’s June’25 cargo was booked this quarter. Further volume increase expected once Kochi–Bangalore pipeline connects to the national grid and on account of increase in BPCL cargoes. 4) Dahej Terminal: Term contract volumes fell, but 3rd party volumes rose due to cargo scheduling adjustments. 5) Petchem Project: All major long-lead packages are awarded, with few in pipeline, project remains on schedule. YTD capex stood at Rs6.0 bn. Gopalpur Terminal – Co. has acquired the land and is awaiting environmental clearance (EC), construction to begin post-approval, completion targeted within 3 years, subject to EC. Dahej Expansion - Mechanical work near completion and the project is expected to be completed soon. YTD capex stood at Rs4.5bn. 6) FY25-26 capex guidance stood at Rs50bn (mainly for Petchem, Gopalpur, Third Jetty); Rs5.3 bn spent in H1FY26, balance to be spent in H2FY26. 7) UoP Recoveries- Co. has 98% of business with promoters and hence does not expect any issues in recovering its dues. Bank guarantees are in place. PLL expects to recover Rs694cr in 2HFY26, with settlements taking place in Q4FY26, 8) Tariffs- No disclosure on Dahej/Kochi tariffs due to confidentiality. 9) On Competition – Co. expects growth in demand will support upcoming LNG capacities.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271