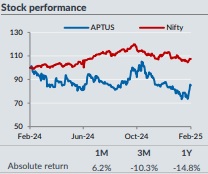

Buy Aptus Value Housing Finance Ltd For Target Rs. 436 By Yes Securities Ltd

A steady quarter

Stable disbursements, spread and asset quality

Aptus delivered an in-line performance on growth, NII and PAT in Q3 FY25. Disbursements were similar to the preceding quarter at Rs9.3bn, translating into AUM growth of 5.7% qoq/27% yoy. While the growth in HL remained in sync with AUM, SBL witnessed a growth acceleration. Portfolio spread was sequentially stable at 8.7% with largely unchanged portfolio yield and funding cost. There was a slight improvement in Opex/Asset ratio with controlled manpower cost (productivity-led growth). Asset quality was steady with stable 1+/30+/90+ dpd buckets, underpinned by marginal uptick in collection efficiency notwithstanding higher holidays/festivals and floods in certain parts of TN (33% AUM) in Nov. Technical write-off were slightly higher in the quarter at ~Rs70mn, and the recoveries from written-off loans were higher too at ~Rs50mn. Owing to higher write-offs (no change in policy of technically writing off NPLs older than 24 months), the annualized credit cost was elevated at 50 bps. The sustenance of brisk portfolio growth and steady operating metrics continues to drive persistent RoE improvement for Aptus.

Management continues to expect strong growth and pull-back in asset quality

Aptus expects disbursements momentum to increase with significant scaling-up of new branches (67 branches added in past 18 months), addition of 35-40 new branches every year, improvement in growth of TN portfolio (plaguing issues resolved and resumption of branch addition), sourcing augmentation from non-branch channels and fulfilment efficiencies from the new LOS. Management estimates disbursements/AUM to grow by 25-27%/30% p.a. in the coming three years. Managing portfolio spread around the current levels should be less of an issue for Aptus with fixed-rate loans much larger than fixed-rate borrowings and no pressure of reducing product rates ahead of the decline in funding cost (BT Out has been consistently at 2.5%). A significant portion (35-40%) of the bank borrowings is linked to Repo/EBLR. The co. doesn’t envisage any regulatory pressure on its lending rates across products, as its pricing is either in-line or lower than competition. A pull-back in 30+ dpd/NPL levels is expected in Q4 FY25, and hence the credit cost for the whole year is estimated between 30-40 bps.

Remains a preferred pick in Affordable Housing; Retain BUY with 12m PT of Rs436

We expect 26%/21% AUM/Earnings CAGR over FY25-27 with RoE reaching 19.5% in FY27. Key monitorables would be 1) acceleration in disbursements momentum, 2) further recovery in TN portfolio growth, 3) scale-up in non-South markets, 4) opex efficiencies from new LOS and 5) stability in asset quality. Structurally we remain bullish on Aptus as it has stronger moats than peers (Home First and Aavas), which is reflected in much lower BT pressure, resilient Spread performance, restrained opex and higher profitability. Aptus also differentiates with its high founder promoter holding at ~25%. Valuation stands at 14.5x P/E and 2.7x P/ABV on FY27 estimates, which we believe is attractive in the context of envisaged strong portfolio growth and RoE delivery.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632