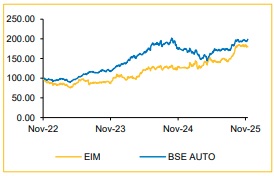

Reduce Eicher Motors Ltd For Target Rs. 7,020 By Choice Broking Ltd

Sustained growth Amid Margin Constrained

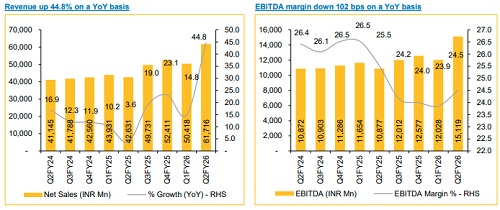

Record-breaking Quarter with Broad-based Growth: EIM delivered its strongest-ever quarterly results in Q2FY26, with consolidated revenue rising 45% YoY to INR 61,716 Mn and PAT up 24.5% to INR 13,695 Mn, supported by robust festive demand, successful product refreshes and sustained growth in both, Royal Enfield (RE) and VECV, businesses. However, impacted by higher input cost and elevated marketing spend, EBITDA margin contracted 120 bps YoY to 24.5%, We believe near-term margin pressure may impact profitability in the upcoming quarter, though strong demand and product mix should support growth momentum.

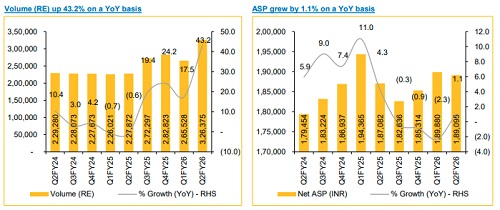

Sustained Leadership and Expanding Global Presence: Royal Enfield maintained its leadership in the mid-size motorcycle segment with ~84% market share, driven by solid demand for its 350cc portfolio and festival-led volume surge. International volumes grew 49% in H1FY26, led by strong traction in Brazil, Nepal and Bangladesh, while the newly-launched Flying Flea brand strengthened EML’s presence in global EV mobility. We expect continued product refresh cycle, GST benefits on <350cc models and capacity expansion to sustain growth momentum across markets

View and Valuation

We revise our FY26/FY27E EPS estimate upwards by 1.5%/6.1% and come up with a target price of INR 7,020, valuing the company at 27x (unchanged) on the average of FY27/28E EPS. Accordingly, we retain our ‘REDUCE’ rating, factoring in sustained margin pressure and recent rally in the stock.

Q2FY26, Revenue/EBITDA largely in line, while earnings missed our estimate

* Revenue was up 44.8% YoY (+22.4% QoQ) to INR 61,716 Mn (vs CIE est. at INR 60,733 Mn), led by 43.2% YoY growth in volume and 1.1% YoY in ASP.

* EBITDA was up 39.0% YoY and up 25.7% QoQ to INR 15,119 Mn (vs CIE est. at INR 14,819 Mn). EBITDA margin was down 102 bps YoY and up 64 bps QoQ to 24.5% (vs CIE est. at 24.4%).

* APAT was up 24.5% YoY and up 13.6% QoQ to INR 13,695 Mn (vs CIE est. at INR 14,869 Mn).

Strategic Investments and Technology-led Growth in VECV: VECV achieved its highest-ever Q2 sales at 21,901 units, with market leadership in LMD trucks (35% share) and strong export growth of 61% YoY. INR 5,440 Mn investment in a new AMT plant, as announced, reinforces its position as a global hub for Volvo Group. We believe sustained investments in automation, alternative fuel (CNG, LNG, EV) and connected vehicle platforms will support long-term profitability and strengthen EML’s diversified growth outlook.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)