Buy Bharat Electronics Ltd for the Target Rs. 500 by Choice Institutional Equities

Business Overview:

BHE, a leading Indian defence and aerospace electronics company under the MoD, specialises in advanced electronic systems for defence, aerospace and civilian applications. Its portfolio includes radars, communication systems, avionics and missile guidance. Serving key clients, such as the Indian Armed Forces, DRDO, ISRO and international defence organisations, BHE plays a vital role in defence modernisation and the “Aatmanirbhar Bharat” initiative. With an unexecuted order book of INR 716.5 Bn (3.0x FY25 revenue), the company ensures strong visibility and steady growth.

How is BHE a beneficiary of India's defence eco-system & export potential?

BHE’s platform demonstrated exceptional performance during Operation Sindoor, with extensive deployment in the India-Pakistan conflict. This success has reinforced the Indian armed forces‘ confidence in BHE’s capabilities while showcasing its ability to deliver complex, mission-critical systems. This expertise is now gaining recognition in the international market. BHE’s robust order book of over INR 716 Bn, combined with high-visibility projects, provides strong revenue growth momentum and cements BHE’s leadership in the sector. These projects include INR 300+ Bn QRSAM, INR 270 Bn in assured orders in FY26E and strategic programs, such as NGC subsystems, LCA upgrades and radar and EW systems.

In response to rising geopolitical tensions, we expect BHE to accelerate its project execution, supported by a strong (~35% contribution) MSME vendor eco-system. This is expected to drive faster revenue recognition, while its in-house design supports healthy margin expansion. Furthermore, BHE is tapping into growing export opportunities, particularly in Europe and is actively investing in emerging technologies, such as drone warfare and AI-integrated solutions. These initiatives enhance BHE’s future earnings visibility and position the company for sustained long-term growth.

What makes BHE a strong investment opportunity?

Our research indicates that, electronic components contribute approximately 30–60% of the cost of defence equipment, depending on the platform type. BHE holds a strategic position in India's defence sector, catering to all arms of the armed forces and serving as a key supplier to major defence companies.

Additionally, BHE is well-placed in the defence sector, as it is solely not dependent on order inflows from major DPSUs. Its diversified portfolio, strong R&D capabilities and increasing presence in both, defence and non-defence, sectors enhance its long-term growth potential. The company's ability to secure independent contracts from other DPSUs and expand into new technological domains, such as AI and cybersecurity, further strengthens its investment appeal.

Near-term triggers:

1) QR-SAM, MR-SAM, Kusha Project, Akash SAM, 2) We expect a significant amount of defence business to come from Europe in the near to medium term.

Valuation:

At present, we have a “BUY” rating on the stock with a Target Price of INR 500.

Key Risks:

* Supply chain risk – Dependence on specific raw materials, semiconductors and critical components can lead to delays and cost overruns due to global shortages or trade restrictions.

* Market risk – Possible changes in defence policies, probable economic downturns and likely shift in government priorities can reduce demand for defence products and services.

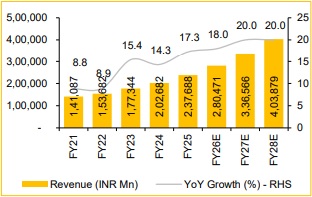

Revenue expected to expand 19.3% CAGR over FY25-28E

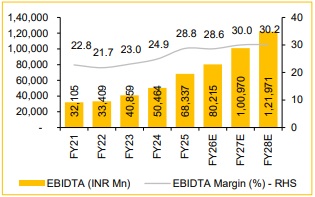

EBITDA Margin to improve led by better mix

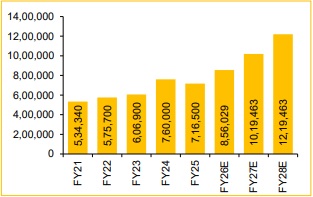

Strong order book position (INR Mn)???????

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)