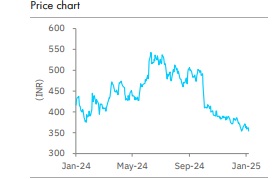

Sell Mahindra Logistics Ltd For Target Rs. 293 By Elara Capital Ltd

Rivigo losses dampen path to profitability

Mahindra Logistics’ (MAHLOG IN) weak performance in Q2 led to >25% correction in the stock price due to deferment of break-even timelines for its B2B Express Logistics business. In Q3, MAHLOG posted yet another disappointed quarter with net loss. The B2B segment (Rivigo) continued to eat into profitability of the 3PL segment due to lower volumes of 63k tonnes versus 92k tonnes target required for break-even. Although MAHLOG emphasized on ramping volumes through higher order intake but the pace of growth slowed down due to downtrading by existing customers. We remain cautious as recovery in volumes in the B2B segment may take longer (by 2-3 quarters) as against earlier break-even timeline of end-FY25. So, we maintain Sell with lower TP of INR 293 (from INR 322) on P/E of 27x FY27E.

Losses continues:

Consolidated revenues grew 14% YoY to INR 15.9bn, as estimated, led by a 15% growth in supply chain management (95% of revenue), while the mobility segment (5% of revenues) declined 7% YoY. EBITDA margin was 4.6% (up 90bps YoY), in line with estimates of 4.5%, led by normalization of other expenses (higher in Q2FY25 given hiring of seasonal work force). Higher depreciation and increased finance cost due to warehouse and vehicle additions led to higher-than-estimated loss of INR 90mn versus INR 25mn estimated.

B2B Express – Subdued performance:

Revenues from B2B Express decreased 10%/5% YoY/QoQ to INR 0.9bn, majorly on lower volumes (down by 14% YoY/5% QoQ to 62.7k tonnes) due to weak seasonal demand post October and operational challenges from labor shortages. EBITDA and net loss continued at negative INR 134mn and negative INR 248mn, on lower utilization and delayed demand recovery. MAHLOG is aiming for 95-100k tonnes volume (incremental 6-7k tonnes of volumes per month) in the medium term to achieve break-even, led by higher order intake of 3.5-4k tonnes and returning back of lost volumes from existing customers.

3PL segment – Picking pace:

Contract Logistics segment grew at 14% YoY to INR 12.6bn due to better demand in automotive and consumer durable segments. The total order intake in Q3 stood at INR 1bn and is expected to improve in Q4, led by finalization of new contracts (delayed from Q3). Margins are maintained at 10% and could improve with better line haul utilization (currently at 75%) and decrease in empty space at warehouse (22.3mn sqft under management).

Reiterate Sell with TP pared to INR 293 from INR 322:

Amid uneven demand environment and high competition in the express segment, a sharp recovery in volumes is required to improve utilization and operating performance in the near term. Delayed recovery in the Express segment is hampering profitability of the overall business. We remain cautious as regards improvement timelines of Rivigo’s performance and hence, cut FY26E/27E estimates by 22%/9% respectively to factor in reported loss in 9MFY25 (versus our estimate of profit earlier). We reiterate Sell with lower TP of INR 293 from INR 322 earlier, based on P/E of 27x (unchanged).

Please refer disclaimer at Report

SEBI Registration number is INH000000933