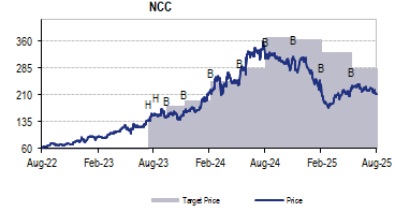

Buy NCC Ltd For Target Rs. 278 By JM Financial Services

NCC reported weak earnings in 1Q26 as adjusted PAT at INR 1.9bn (down 5% YoY) was below JMFe of INR 2.16bn impacted by lower execution in JJM projects amid delayed payments and delay in start of execution for newly won projects. Gross debt increased from INR 14.8bn in Mar-25 to INR 18.5bn in Jun-25 amid seasonality. With a robust bid pipeline of INR 2.5tn spread across verticals, NCC maintained its inflow guidance of INR 220-250bn for FY26E. Despite weak 1Q26, NCC has maintained its revenue growth guidance of 10% for FY26E along with EBITDA margins of 9-9.25%. It has received robust order inflows of INR 67bn in YTD. Standalone order backlog stands at INR 618bn (3.3x TTM revenues) as of Jun25. Given the weaker execution/margins in 1Q26, we have cut FY26/27/28 EPS by 4%/3%/ 2% factoring lower revenue/margins. We expect robust core EPS CAGR of 24% over FY25- 28E. Maintain Buy with a revised price target of INR 275 (valued at 16x FY27E core EPS).

* PAT missed JMFe due to lower execution:

NCC’s revenue/EBITDA declined by 7%/10% YoY to INR 44bn/INR 4bn (JMFe: INR 52bn/INR 4.8bn) due to lower execution in JJM projects amid delayed payments and delay in start of newly won projects. NCC has outstanding JJM order backlog of c.INR 40bn and receivables have further elevated to INR 17bn in June-25 (Mar-25: c.INR 15bn). EBITDA margins fell by 30bps YoY to 9% (JMFe: 9.2%). Interest costs fell by 1% YoY/ 13% QoQ to INR 1.51bn (JMFe: INR 1.7bn) likely due to lower average debt levels during the quarter. Gross debt increased QoQ from INR 14.8bn in Mar-25 to INR 18.5bn in June-25.

* Maintains FY26E guidance despite weak quarter:

Despite muted execution in 1Q26, NCC has retained its revenue growth guidance of 10% for FY26E, led by execution uptick in from newly secured orders in 2H26. NCC also reaffirmed its EBITDA margin guidance of 9–9.25% for FY26E and remains confident of achieving lower end of the range. NCC has to invest INR 4.3bn in smart meter projects (INR 700mn already invested) over FY26/27E. It is also looking out for JV partner for the same. In Vizag deal, NCC has outstanding loan of c.INR 3.75bn which is to be received over next 2 years (expects INR 1.2bn in FY26E). Receipt of loan and faster recovery of AP receivables will strengthen the balance sheet.

* Bid pipeline robust at INR 2.5tn; expects inflows of INR 220-250bn for FY26E:

NCC received robust inflows in 1Q25 of INR 36.6bn (YTD: INR 67bn), taking its standalone order backlog to INR 618bn (3.3x TTM revenues) as of Jun-25. With a robust bid pipeline of INR 2.5tn spread across verticals, NCC maintained its inflow guidance of INR 220- 250bn for FY26E. Additionally, it is L1 in projects worth INR 50-60bn.

* Business on strong footing: NCC has survived adverse business cycles and is showing marked improvement in operations and NWC management. Also, faster recovery of AP receivables and part receipt of Vizag deal proceeds will strengthen the balance sheet. We expect robust core EPS CAGR of 24% over FY25-28E. We have cut FY26/27/28E EPS by 4%/3%/2% factoring in lower revenue/margins. Stock is currently trading attractively at 13x/11x FY27/28E core EPS. We value NCC at 16x FY27E core EPS (ex of other income) to arrive at a revised SoTP based price target of INR 275. Maintain BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361