Add Dr. Lal Path Labs Ltd For Target Rs.3,260 by Centrum Broking Ltd

In-line quarter; Volume-led growth continues

DLPL delivered in-line results for 3QFY25. Overall revenue increased 11% YoY to Rs6bn with sample/patients volume growing 10%/4% YoY. The revenue per sample stood at Rs290 (flat YoY/+1% QoQ) as DLPL continues not to take price hike. Swasthfit revenue contribution increased to 23% in 3QFY25 (vs 20%/24% in 3QFY24/2QFY25). EBITDA increased 10% YoY to Rs1.5bn. However, EBITDA margin was largely flat YoY (down 490bp QoQ) to 25.8%. EBITDA per sample was Rs75 (down 1% YoY/15% QoQ). Adj. PAT was Rs967mn (+19% YoY). In the near term, DLPL is prioritising revenue growth over profitability with growth to be volume-led complemented by change in test mix. Also, it continues to not take price-hike over the next 3-4 quarters. DLPL plans to add 15-20 new labs in the rest of FY25E. Moreover, it plans to focus more on South region in the near-to-medium term. However, it expects uniform growth across the regions. Accordingly, we have reduced our earnings estimates for FY26E/FY27E by 4%/6% respectively factoring in a) no price hikes, b) HSD volume growth (v/s low-teens as expected earlier) and c) increase in capex and opex due to geographic penetration. Rolling forward our valuations to FY27E, we value DLPL at 1Y-forward PE multiple of 46x (v/s 52x earlier) to arrive at our revised TP of Rs3,260. Maintain ADD.

Volume growth to be driven by Swasthfit/geographical penetration

DLPL continues to increase volumes through Swasthfit packages and increasing doctor prescriptions. Additionally, it continues to add 15-20 labs by expanding in Tier 3 & 4 towns and its core markets. Also, it is expanding services to include bundled testing for NCDs beyond Tier-2 markets. Over FY20-24, DLPL’s revenue in tier-3+ towns has witnessed 17% CAGR as compared to overall revenues witnessing 14% CAGR over the same period. Moreover, the management expects patient volume growth of more than 4-5% going forward as it penetrates deeper into new geographies. However, as Swasthfit contribution increases, the patient visits reduce. Accordingly, we expect samples volume to exhibit 10% CAGR over FY24-27E.

Increase in investments to keep profitability in check

In 9MFY25, DLPL delivered gross margins of ~80% and expects it to stabilize in the future on account of rising cost of imported reagents (USD appreciation). Additionally, in 9MFY25, EBITDA margin was 28.2% (nearly flat YoY). However, it plans to spend in adding more labs, IT and digital infra, marketing expenses. These are likely to keep the margins in check over the near-term. However, once these initiatives are completed, we expect increased operating leverage leading to improvement in profitability over the medium term.

Maintain ADD

We have reduced our earnings estimates for FY26E/FY27E by 4%/6% respectively factoring in a) no price hikes, b) HSD volume growth (v/s low-teens as expected earlier) and c) increase in capex and opex due to geographic penetration. Over FY24-27E, we expect revenue/EBITDA/PAT to deliver 13%/13%/18% CAGR with EBITDA margin stabilizing at ~27%. Rolling forward our valuations to FY27E, we value DLPL at 1Y-forward PE multiple of 46x (v/s 52x earlier) to arrive at our revised TP of Rs3,260. Maintain ADD.

Valuations

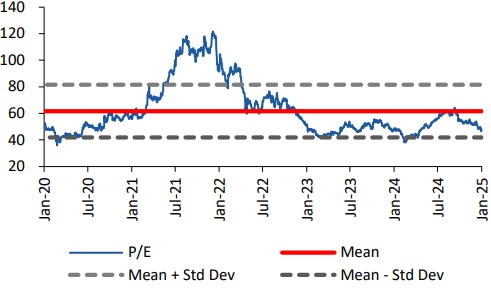

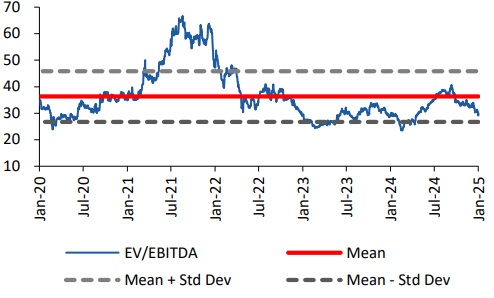

We expect revenue/EBITDA/PAT CAGR of 13%/13%/18% over FY24-27E. We value DLPL at PE multiple of 46x at FY27E EPS of Rs71 to arrive at our TP of Rs3260. Maintain ADD.

P/E mean and standard deviation

EV/EBITDA mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331