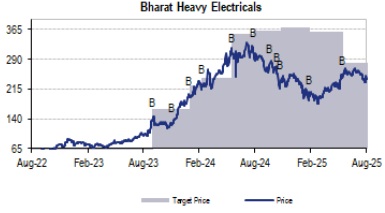

Buy Bharat Heavy Electricals Ltd For Target Rs. 278 By JM Financial Services

BHEL reported consol net revenue of INR 54.9bn (0% YoY, -20% JMFe) with an EBITDA margin of -9.8% (-3% in 1QFY25). Other expenses increased from INR 3.4bn in 1QFY25 to INR 6.8bn in 1QFY26, possible due to certain one-off provision. Company reported loss of INR 4.6bn in 1QFY26 vs. loss of INR 2.1bn in 1QFY25. Analysing the CEA’s projects monitoring reports, we expect performance of BHEL to improve from 3QFY26 given the profile of major projects under construction. The total order book stands at INR 2,044bn which is likely to increase to INR 2,250 bn by Mar’26. As execution of legacy projects are nearing completion and industry orders-mix improves, EBITDA margin is likely to improve gradually from 4.4% in FY25 to at least 11% in FY28. We continue to maintain BUY with an unchanged TP of INR 278 (30x FY27EPS).

* Financial performance: BHEL reported revenue of INR 54.9bn (0% YoY) due to subdued execution during the quarter. Other expenses increased from INR 3.4bn in 1QFY25 to INR 6.8bn in 1QFY26, possible due to certain one-off provision. Gross margin remained stable sequentially at 29% in 1QFY26. EBITDA margin contracted to -9.8% from -3.1% in 1QFY25 due to rise in other expense by INR 3.3bn. Company reported a loss of INR 4.5bn compared to loss of INR 2.1bn in 1QFY25. Power/ Industry segment reported revenue of INR 39bn/ INR 41bn (-6%/ +17% YoY) in 1QFY26. The EBIT margin for Power/ Industry segment came at -13.1%/ 19.3% vs. -1.3%/ 4.7% in 1QFY25.

* Project execution: BHEL has bagged 28 GW of the order in the new power capex cycle beginning Aug’23. The construction at 20 GW of the projects has still not started due to various reasons like lack of customer clearance, availability of land or certain regulatory approvals. The most recent under construction project is 2x800 MW NTPC Singrauli which was awarded in Mar’24. We expect performance of BHEL to improve from 3QFY26 studying the profile of major projects under construction (3x800 MW Patratu STPP commissioning expected in 1HCY26; initial civil works completed at 2x800 MW NTPC Lara and 2x800 MW NTPC Singrauli; 2x660 MW NTPC Talcher progressing slow).

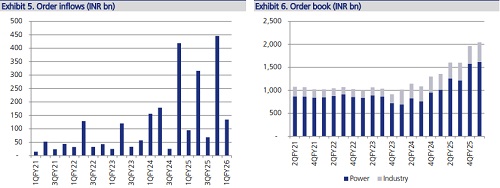

* Orders inflows: Order inflow in 1QFY26 stood at INR 134 bn (INR 76bn/ INR 58bn from Power/ Industry) vs. 95 bn in 1QFY25. Key power segment orders includes supply of 6x800MW STGs to Adani Power Ltd. Industry segment secured orders for design and execution of 6,000 MW, ±800 kV, Bhadla - Fatehpur HVDC terminals and supply of transformers. With this, the total order book stands at INR 2,044bn as of 30 Jun’25 (INR 1,617bn Power, INR 427bn Industry & Exports).

* Opportunities: Presently, 32 GW of projects are under construction, while an additional 18 GW of projects have recently been awarded and are yet to commence construction. Consequently, the ordering for remaining c. 50 GW is anticipated over the next 2-3 years. More than 10 GW of projects are in tendering stage. We expect BHEL to book orders worth INR 600-700 bn during FY26 and report total order book of at least INR 2,250 bn on Mar’26.

1QFY26 Performance

* Financial performance: BHEL reported revenue of INR 54.9bn (0% YoY) due to subdued execution during the quarter. Other expenses increased from INR 3.4bn in 1QFY25 to INR 6.8bn in 1QFY26, possible due to certain one-off provision. Gross margin remained stable sequentially at 29% in 1QFY26, but EBITDA margin contracted to -9.8% from - 3.1% in 1QFY25 due to rise in other expense by INR 3.3bn. Company reported a loss of INR 4.5bn compared to loss of INR 2.1bn in 1QFY25, driven by increased EBITDA loss.

* Segment performance: Power/ Industry segment reported revenue of INR 39bn/ INR 41bn (-6%/ +17% YoY) in 1QFY26. The weak performance of the company came from the power segment, which reported EBIT loss of INR 5.1bn vs. loss of INR 540mn in 1QFY25. In contrast, industry segment reported robust performance with EBIT of INR 3.1bn vs. INR 633mn in 1QFY25. EBIT margin for Power/ Industry segment came at -13.1%/ 19.3% vs. -1.3%/ 4.7% in 1QFY25.

* Projects commissioning: In 1QFY26, BHEL commissioned 700 MWe Unit #7 of Rawatbhata Atomic Power Plant (RAPP). It also executed 660 MW Unit #3 of North Karanpura STPP, 200 MW Unit #4 of Parbati-II HEP, and 170 MW Unit #4 of Punatsangchhu-II HEP in Bhutan. On the synchronization front, BHEL completed 660 MW Unit #5 of Sagardighi TPP (WBPDCL), 60 MW STG for NR Ispat and Power Ltd. in Chhattisgarh, and 25.6 MW STG for Assam Bio-Refinery in Numaligarh.

* Project execution: We have analyzed CEA’s projects monitoring reports. Given the profile of major projects under construction, we expect performance of BHEL to improve from 3QFY26

- BHEL has bagged 28 GW of the order in the new power capex cycle beginning Aug’23. The construction at 20 GW of the projects has still not started due to various reasons like lack of customer clearance, availability of land or certain regulatory approvals. The most recent under construction project is 2x800 MW NTPC Singrauli which was awarded in Mar’24.

- Currently the company is executing 3x800 MW Patratu STPP on fast pace which it won under intense competition and with back-ended payment terms. The commissioning of the project is expected in 1HCY26.

- The initial civil works at 2x800 MW NTPC Lara and 2x800 MW NTPC Singrauli have been completed, which is outsourced and is a low-value added activity. Subsequent to this, works on boiler structures will pick-up pace, resulting in higher revenue and better realization.

- The works at 2x660 MW NTPC Talcher is progressing at slow pace due to protests from unauthorized habitants from railway siding area affecting construction of railway siding works.

- 2x800 MW Adani Mahan is swiftly progressing. It is expected to commission in 1HCY27 i.e within 28 months of LOA, the fastest thermal power project completed in India.

* Orders inflows: Order inflow in 1QFY26 stood at INR 134 bn (INR 76bn/ INR 58bn from Power/ Industry) vs. 95 bn in 1QFY25. Key power segment orders includes supply of 6x800MW STGs to Adani Power Ltd. Industry segment secured orders for design and execution of 6,000 MW, ±800 kV, Bhadla - Fatehpur HVDC terminals and supply of transformers. With this, the total order book stands at INR 2,044bn as of 30 Jun’25 (INR 1,617bn Power, INR 427bn Industry & Exports).

* Opportunities: The government has revised its target for thermal capacity expansion from 80 GW to 100 GW by FY32 (media reports). Presently, 32 GW of projects are in the construction phase, while an additional 18 GW of projects have recently been awarded and are yet to commence construction. Consequently, the ordering for remaining c. 50 GW is anticipated over the next 2-3 years. More than 10 GW of projects are in tendering stage. We expect BHEL to book orders worth INR 600-700 bn during FY26 and report total order book of at least INR 2,250 bn on Mar’26.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)