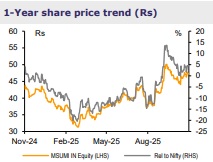

Add Motherson Sumi Wiring India Ltd for the Target Rs.50 By Emkay Global Financial Services Ltd

Healthy Q2; growth and margin outlook improving

MSUMI logged a strong Q2, with revenue up 19% YoY (11% QoQ) to Rs24.9bn, outpacing PV industry’s 4% growth on higher content/vehicle and model launches. EBITDA was also up 12% YoY to Rs2.8bn, with the EBITDAM expanding by 30bps QoQ to 10.1% despite RM pressures and start-up costs from greenfield expansions; excluding this, EBITDAM was stable YoY at 12.7% (up 90bps QoQ). MSUMI’s revenue growth is accelerating (4th consecutive quarter of growth), aided by order wins and market share gains via entry into newer models. EV’s revenue share rose to 6.7% (vs 5.4/4% in the past 2 quarters), which would aid MSUMI’s revenue, given the higher content per vehicle; the management also reiterated that the EV mix remains marginneutral due to embedded content economics. While we cut our FY26E EPS by 3% to reflect the gradual ramp-up in greenfield expansions, we raise FY27E/28E by ~5/8% and revise our TP to Rs50 (vs Rs40), at 30x Sep-27E PER (vs 28x earlier; rolled forward), on a stronger growth outlook and benefits from the EV shift (higher content per vehicle). We, thus, maintain ADD on the stock.

Profitability (excluding greenfield plants) intact YoY

Revenue grew ~19% YoY to Rs.27.6bn, above our estimate, with EBITDA at Rs2.8bn. EBITDAM declined by 60bps YoY (up 30bps QoQ) to 10.1% (Emkay est: 10.7%; consensus: 10.3%). The QoQ margin improvement was due to 170bps/20bps fall in staff cost/other expenses, though partly offset by the 150bps gross margin contraction. Excluding greenfield plants, the EBITDA margin at 12.7% was flattish YoY, though up 90bps QoQ vs 11.8% in Q1FY26. PAT rose 4% YoY to ~Rs1.65bn, driven by higher EBITDA and lower interest cost.

Earnings call KTAs

1) MSUMI's revenue growth (~19%) was ahead of the PV industry’s 4% growth, led by an increase in premiumization, volume growth and new model launches. 2) The Kharkhuda plant has successfully started production per schedule; ramp-up to continue ahead, driving future growth. 3) The recently commissioned greenfield plants together contributed ~Rs1,900mn to Q2 revenue. Utilization currently stands at ~36%, with one plant largely stabilized and the other two still scaling up, in line with OEM volume schedules. 3) Greenfield plant losses stood at ~Rs460mn in Q2 vs ~Rs308mn in Q1 (Rs700mn excl certain one-offs), aided by better absorption. The management highlighted that positive contribution will only come once utilization crosses ~70–80%, as scale efficiencies and learning-curve kick in. 4) Employee costs spiked in Q1 due to upfront hiring/training for SOP readiness. Costs have now stabilized at ~Rs4,750- 4,800mn, with additional shop-floor hiring to be done only as volumes ramp up. 5) EV penetration continues to increase within the order book, supported by ongoing OEM launch cycles. However, the management emphasized that EV growth should be viewed in the context of overall platform wins, rather than as a standalone mix story. Localization efforts continue to progress and greenfield capacity is designed to serve both EV and non-EV applications, ensuring no material dilution to RoCE. 6) Capex guidance for FY26 is ~Rs2,100mn, subject to customer nomination timelines and volume visibility.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

Ltd.jpg )