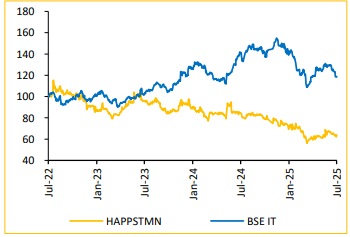

Buy Happiest Minds Technologies Ltd For Target Rs. 730 By Choice Broking Ltd

HAPPSTMN poised for strong profitable growth via strategic investments

HAPPSTMN is undergoing significant transformation through strategic initiatives, which would lead in robust & sustainable growth. These include vertical reorganization, new client acquisitions, and a focused GEN AI push. The company aims to capitalize on Cloud, Data, Cybersecurity, & AI-driven transformations within targeted sectors. BFSI & Healthcare will be key growth drivers. In BFSI, Arttha Banking platform, acquired through PureSoftware, is projected to grow 20–25% YoY in FY26, while the SaaS-based "Insurance in a Box“ is expected to gain further traction. Healthcare will see strong momentum, driven by deep capabilties in Medical Devices & BioInformatics. TME & Manufacturing are also anticipated to perform well, supported by large deal wins. HAPPSTMN is well-positioned for double-digit profitable growth in FY26 & FY27. We expect Revenue/ EBITDA/ PAT to grow at a CAGR of 13.0%/ 22.7%/ 29.0% from FY25–FY28E & upgrade our rating to BUY with a target price of INR 730, maintaining a PE multiple of 30x on FY27 & FY28E average EPS of INR 24.3.

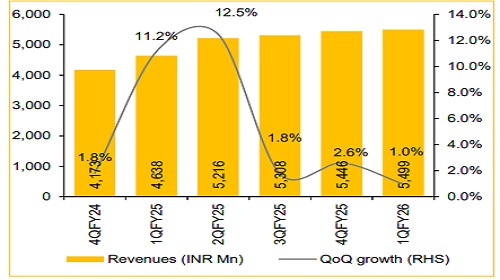

Strong operational execution in Q1FY26 amidst macro uncertainties

* Reported Revenue for Q1FY26 stood at USD 64.4Mn up 2.3% Q0Q (vs CIE est. at USD 66.3Mn). The CC growth was also 2.3% QoQ. In INR terms, revenue stood at INR 5,499Mn, up 1.0% QoQ.

* EBIT for Q1FY26 came at INR 717.0Mn, up 16.8% QoQ (vs CIE est. at INR 663Mn). EBIT margin was up 177bps QoQ to 13.0% (vs CIE est. at 11.7%).

* PAT for Q1FY26 came at INR 57.1Mn, up 68.0% QoQ (vs CIE est. at INR 47.2Mn) led by one-off provisioning done for US based client in Q4, which was absent in Q1FY26. Thus, excluding one-off, PAT in Q1FY26 was up 24.0% QoQ.

FY26 double-digit CC growth guidance intact led by transformational initiatives:

HAPPSTMN marked its 20th consecutive quarter of QoQ growth in Q1FY26 since its IPO. The company is progressing on 10 transformational initiatives, backed by strategic investments across operations, reinforcing its confidence in sustaining double-digit growth for FY26. Reorganizing business verticals, one key initiative— drove robust QoQ growth in TME (18%), Manufacturing (22%), and Retail/CPG (7%). Excluding reorganisation effects, BFSI & Healthcare posted normalized QoQ growth of 1.1% and 1.6% in reported USD terms. Among business units, IMS & GenAI (GBS) rose 3.6% and 12.0% QoQ respectively, while PDES declined 2.7%. Active clients rose by four QoQ to 285, reflecting improved conversions.

FY26 EBITDAM guidance maintained in 20-22% band:

HAPPSTMN delivered robust operational performance in Q1FY26, with EBITDAM rising 169bps QoQ to 17.1%, despite investments in GenAI & a new sales engine. Utilization improved 150bps to 78.9%, and fixed-price projects rose 160bps to 76.9%, supporting margins. Though headcount declined by 109 to 6,523, growth remained steady due to higher utilization and non-linear initiatives. While earn-outs for PureSoftware and Aureus continue, HAPPSTMN sustains a 20–22% EBITDAM band, driven by GenAI operations which has just break-even, net new sales engine contributing to strong growth & margins as well as led by geographical expansion strategy.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131