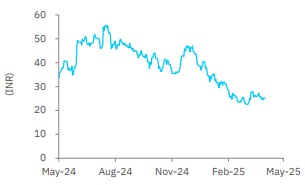

Buy Hindustan Construction Company Ltd For Target Rs. 35 By Elara Capital

Delay in order inflows impacts visibility

Hindustan Construction Company (HCC IN) FY25 standalone core Engineering & Construction segment (E&C) financial performance witnessed revenue decline of 2% but pickup in order inflows to INR 3.5bn, up 46% YoY, improvement in EBITDA margin to 19%, including claims, and a PAT at INR 849mn vs loss YoY. Orderbook at INR 118bn provides a book-to-bill visibility of 2.5x. Although bid pipeline is healthy at INR 310bn, delay in order finalization, geopolitical crises, and increased competition are risks to our call. We expect revenue growth to remain muted in the near term and EBITDA margins ex of claims to moderate to 13-14% in FY26E. We maintain Buy with a lower TP of INR 35 on 12x FY27E P/E.

FY25 focus on deleveraging, asset monetization, and pickup in the core business: Consolidated revenue of INR 56bn was down 20% YoY from INR 70bn, due to divestment of Swiss subsidiary, Steiner AG and also E&C segment (94% of FY25 revenues) was down 16% YoY led by five project completions. Orderbook remains diversified, with transportation at 53% and hydro at 29% forming the core. Claims settlement helped expand consolidated margin to ~14.2% in FY25, up from 13.6% YoY. Consolidated PAT dropped to INR 11bn from INR 25bn, dragged by fair value losses from prolific resolution (PRPPL). Gross debt reduced by INR 6bn to INR 33bn, led by INR 5-6bn through repayments, INR 1-2bn prepayment of dues, and the sale of non-core assets.

Guided for accelerated revenue growth from FY27: HCC has outlined an ambitious plans for FY26, target an orderbook expansion of INR 200bn, up 69% YoY, from INR 118bn, led by bid pipeline of INR 310bn, L1 projects worth INR 35bn, and joint venture collaboration. The project pipeline is strategically focused on large ticket sizes of INR 20-30bn hydropower and urban infrastructure projects, including largescale bids for metro corridors across Maharashtra, Delhi, Patna & Chennai metro, and pumped storage projects in Bhutan and India (areas where HCC has strong technical credentials). Although FY26 revenue is expected to be flat due to muted inflows in FY25, management targets high double digit revenue growth from FY27, led by accelerated execution on new inflows. Margin ex of claims is set to sustain at ~13-14%. On the balance sheet front, in Q1FY26, management expects INR 2.5bn from arbitration settlement under the Viwad se Vishwas Scheme (V2V2) and settlement of large claims, which are under an advanced stage. Management targets deleveraging to INR 25bn by FY26. Recent reduction in corporate guarantee on debt of PRPPL to 20% from 100% is a positive, in our view, minimizing contingent liabilities (subject to approvals).

Retain Buy with a lower TP of INR 35: We trim earnings growth estimates to factor in flat execution guidance for FY26 on the back delayed order inflows. Although deleveraging is progressing well, pickup in new orders remains crucial for revival in execution from FY27. We revise down our earnings by 59% for FY26E and by 58% for FY27E to factor in the delay. We introduce FY28 estimates. We retain Buy with lower TP of INR 35 from INR 63 based on 12x (from 13x) FY27E core business and value of subsidiaries, outstanding awards and stake in PRPPL at INR 18 per share (from INR 21 earlier).

Please refer disclaimer at Report

SEBI Registration number is INH000000933