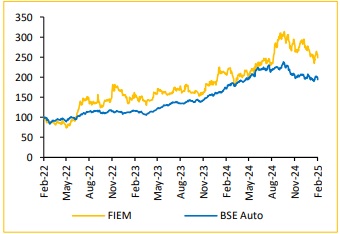

Hold Fiem Industries Ltd For the Target Rs.1,485 by Choice Broking Ltd

FIEM reported an in line performance driven by strong growth in the 2W segment

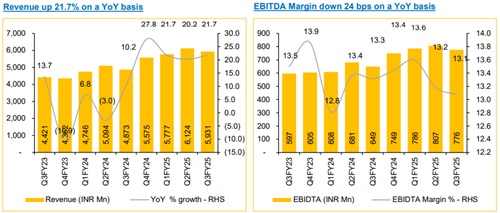

* Revenue for Q3FY25 was at INR 5,931 Mn, up 21.7% YoY and down 3.2% QoQ (vs CEBPL est. at INR 5,760 Mn).

* EBITDA for Q3FY25 was at INR 776 Mn, up 19.5% YoY and down 3.9% QoQ (vs CEBPL est. at INR 766 Mn). EBITDA margin was down 24 bps YoY and down 10 bps QoQ to 13.1% (vs CEBPL est. at 13.3%).

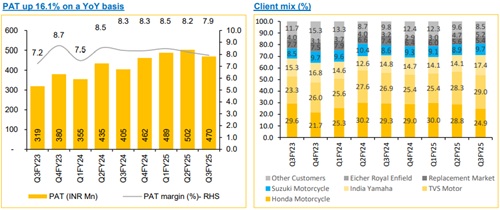

* PAT for Q3FY25 was at INR 470 Mn, up 16.1% YoY and down 6.3% QoQ (vs CEBPL est. at INR 471 Mn)

Leveraging OEM Partnerships for New Opportunities:

FIEM is a dominant player in the 2W industry and maintains strong relationships with key OEMs. The company is working with Hero on six models, with products ready for mass production and waiting for customer launches. FIEM’s supplies to Royal Enfield have increased, with a year-on-year increase of almost 100%. The company is also working with Yamaha on eight new models for domestic and export markets. We believe these relationships with OEMs provide opportunities for growth through new model developments and product launches

Expanding Horizon into the 4W segment:

While currently contributing a very small portion of the company's revenue, the four-wheeler segment represents a growth opportunity. FIEM is employing a calculated approach, initially focusing on securing its presence in various models, with immediate revenue generation not being the primary focus. The company’s facilities have been approved by Mahindra & Mahindra and production is slated to commence in Q1FY26. Fiem is pursuing multiple RFQs (Request for Quotations) that are likely to convert into confirmed orders in FY26.

View and Valuation:

We revise our FY26/27 EPS estimates downwards by 4.9%/8.8% and roll over our forecasts forward to come up with a revised target price of INR 1,485; valuing the company at 15x (previously 18x) on FY27E EPS and downgrade our rating to ‘HOLD'. We remain positive on FIEM driven by its prominent position in the E-2W lighting segment, addition of new clients and diversification with entry into the 4W segment.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131