Sell Bajaj Electricals Ltd For Target Rs.660 by Centrum Broking Ltd

Growth and margin expansion to be curtailed, Downgrade to Sell

BJE’s Q3FY25 revenue grew 5% YoY to Rs12.9bn (CentE Rs13.3bn). Consumer Products sales grew 9% YoY to Rs10.4bn led by Morphy Richards and domestic appliances. Lighting sales fell 8% YoY to Rs2.5bn owing to LED price erosion. GT channel revived with high single digit growth while alternate channel was flat YoY. Gross margin rose 200bps YoY to 31.1%, driven by price hikes. EBITDA margin was up 210bps YoY to 6.8%. PAT fell 11% YoY to Rs334mn (CentE Rs301mn). The key growth challenges faced by BJE are (1) It is more indexed towards rural markets where demand is affected due to high inflation and interest rates and (2) higher dependence on MFI and govt. channels (CSD / CPC) at 15% of sales which will continue to remain weak. BJE will increase spend on branding, GTM, manufacturing and digitalization which will weigh on margin. Thus, management expects FY27E EBITDA margin at 7% vs. earlier estimate of high single digit. We significantly cut our EPS for FY26E/27E by 40% each as we cut our EBITDA margin estimate by ~200bps each. We downgrade rating to SELL (from ADD) with a revised target price of Rs660 (Rs950 earlier) based on 35x FY27E EPS.

Consumer Products: Morphy Richards & domestic appliances posts healthy growth

Consumer Products sales grew 9% YoY to Rs10.4bn (led by festive push in Oct) and crossed Rs10bn sales mark after 2 years. Healthy double digit growth in MR (7.5-8% of 9M segment sales) and domestic appliances (water coolers and heaters) was offset by flat sales in fans and kitchen appliances. During Q3, BJE took 2-4% price hike across most categories (mixer grinders, water heaters, irons) in channels such as MFR & e-commerce. MFI (due to RBI action) and CSD/CPC is expected to remain weak for few more quarters. BJE’s premium share in the segment is at 40% while for water heater and fans it is at 20- 25%. Kitchen appliances will remain muted for 2-3 more quarters as inflationary pressure and elevated interest rates will continue to weigh on demand. EBIT margin rose 330bps YoY to 5% due to volume growth and healthy gross margin.

Lighting: LED price erosion continues to impact growth

Lighting sales fell 8% YoY to Rs2.5bn as healthy double-digit volume growth was offset by B2C LED price erosion (likely to continue for few more quarters). Professional lighting witnessed single-digit de-growth while price erosion is anticipated to extend in this category. Price erosion will likely stop once the DOB technology gets stabilized across the industry. EBIT margin fell 630bps YoY to 2.1% due to ad-spend worth Rs110mn (4.3% of lighting sales) towards ‘Built-to-Shine’ campaign. BJE will continue to invest in brand building to gain market share. Sales mix of Professional lighting: B2C is at 60%:40%. Other KTAs: (1) Q3 OCF is Rs830mn and 9M OCF is Rs2.6bn. Net cash position is Rs4.2bn. (2) FY26 capex will be Rs1bn-Rs1.5bn. (3) Q3 ad-spend at 3.3% of consolidated sales

Downgrade to SELL with a revised target price of Rs660

We expect BJE to post 11% revenue CAGR and 17% EPS CAGR over FY24-27E. BJE’s growth is likely to be curtailed due to higher dependence on rural markets and MFI/govt. channels. Operating margin expansion till FY27 will be restricted to 7% due to rising expenses towards branding and other priorities. Downgrade to SELL.

Valuations

We value BJE at 35x FY27E EPS and arrive at the target price of Rs660

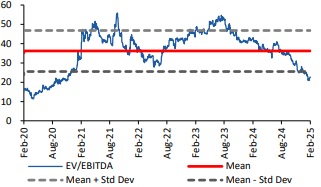

EV/EBITDA mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331

.jpg)