Reduce Dr Reddy`s Laboratories Ltd Fpr Target Rs. 1,050 By Emkay Global Financial Services Ltd

Persistent margin weakness concerning

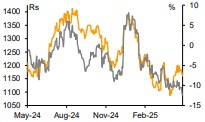

4QFY25 margin performance for Dr Reddy’s surprised negatively, with EBITDA missing street/our estimates by 10%/12%, respectively. The EBITDA miss was offset by higher other income and a lower tax rate. The sharp 250bps QoQ decline in gross margin (GM; sequential decline for the 3 rd consecutive quarter) validates the concern we have been raising since 2QFY25 that gross margin might be on a secular downward trajectory. While the GM decline in 4Q was partly attributed to one-offs, we believe that the weakness is also a function of incremental pricing pressures in the core US portfolio (particularly gSuboxone – the largest contributor ex-gRevlimid). The management’s double-digit topline growth and flattish margin guidance for FY26 notwithstanding, the street’s near-term margin expectations might need a reset, in our view. We broadly maintain our lower-than-street FY26/27 earnings estimates and introduce FY28 estimates. We retain REDUCE with an unchanged Mar-26E TP of Rs1,050.

US as well as domestic sales broadly in line with expectations

US sales at USD417mn (vs USD395mn in 3QFY25) were broadly in line with our expectations, with gRevlimid sales (~USD145mn estimated) likely to have witnessed a sequential uptick. Domestic growth at 16% YoY was in-line, even as certain therapies including cardiac, gastro, and pain witnessed a QoQ decline. Organic domestic growth, adjusted for the Sanofi vaccine deal, stood at ~6%.

Gross margin weakness persists

While the 250bps QoQ decline in overall gross margin in 4Q was partly attributed to oneoffs, this follows an 80bps/160bps QoQ decline in 2Q/3Q, respectively. Gross margin in the global generics segment declined by 200bps QoQ to 59.3% (following a 160bps/180bps QoQ decline in 2Q/3Q, respectively). We believe that the GM weakness is also a function of incremental pricing pressures in the core US portfolio (particularly gSuboxone, where the innovator has pointed to intensified pricing pressures from generics; Teva is likely to enter in CY25 and will be the fifth generic entrant).

KTAs from the earnings call

1) The company expects high double-digit growth in India in FY26, on the back of inlicensing, new launches, sustained momentum in top brands, and dedication of marketing resources to therapies (cardiac and gastro) where growth was relatively muted in FY25. 2) Dr Reddy’s remains on track to file Abatacept for the US market and expects to receive an approval for Semaglutide in Canada by the end of CY25. The company will adopt a synthetic production route for injectable Semaglutide and a semi-synthetic route for oral Semaglutide. 3) Dr Reddy’s may stop selling gRevlimid a few months before Jan-26, to avoid shelf price adjustments. 4) The company’s biosimilar portfolio (Rituximab, Bevacizumab, Denosumab and Abatacept), the acquired Nicotine Replacement Therapy business, and expansion into more markets will be the key growth drivers in Europe.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354