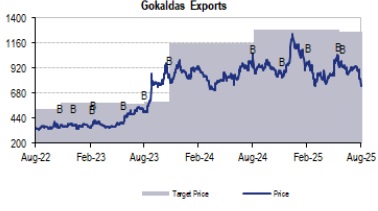

Buy Gokaldas Exports Ltd For Target Rs. 278 By JM Financial Services

Gokaldas exports reported an EBITDA of INR973mn, broadly in-line with JMfe of INR1.01bn. EBITDA was up 30% YoY supported by productivity gains and robust cost management efforts. Revenue excluding the acquired entities increased by 20% YoY while Indian exports during the year grew by 9% YoY, indicating a gain in export market share. Key takeaways from the call are – a) company expects margin pressure in 2Q given a burden share of increased tariff and a seasonally weak quarter b) company expects recently imposed tariff on India to pose challenges in 2HFY26 – believes margins to be back to normal by early FY27 once additional costs are passed on to consumers c) revenue for acquired entities during the quarter came in at INR2.82bn with an EBITDA margin of 11% d) BTPL ramp-up remains on track; decision on BTPL merger to be announced soon. Even though near-term challenges persist, long-term outlook for the company remains stable given a) excellent execution (delivering good margins even in turbulent times) b) increasing addressable market with UK FTA in place c) Africa business to remain at an advantage with 10% tariff on Kenya and d) ongoing FTA negotiations with the EU-27 and bilateral discussions with the US. Given the near-term uncertainty, we revise our earnings downwards by 37% / 35% / 18% for FY26E / FY27E / FY28E. We roll-forward our target price to FY28E at a P/E multiple of 23x. Maintain BUY.

* Margins expand given lower RM costs: Consolidated revenue for the quarter came in at INR9.6bn, up 3% YoY. Excluding the acquisitions, Gokaldas Exports total revenue increased by 20% YoY while Indian exports during the year grew by 9% YoY, indicating a gain in export market share. Consol. EBITDA Margins came in at 10.2% vs 8.0% in 1QFY25 primarily on account of lower raw material costs vis-à-vis sales. Net debt as at end of 1Q stood at INR2.36bn, up INR780mn as compared to end of 4Q – driven by equity investment in BTPL, capex investments, and working capital.

* Near-term challenges persist; long-term outlook stable: The recently announced revised reciprocal tariff by the US on India is expected to pose a challenge in 2HFY26, as most of the order bookings for the next quarter are already closed. US brands are adopting various strategies for cost optimisation amidst the uncertain situation including a) raising end-retail prices (potentially dampening demand) b) absorbing part of the cost internally and c) negotiating discounts from manufacturers. Even though near-term challenges persist, long-term outlook for the company remains stable given a) excellent execution (delivering good margins even in turbulent times) b) increasing addressable market with UK FTA in place c) Africa business to remain at an advantage with 10% tariff on Kenya and d) ongoing FTA negotiations with the EU-27 and bilateral discussions with the US. Any positive outcome on the US-India trade deal might abate the near-term impact and turn out to be a growth driver for the company.

* Cautious approach with capex; new expansions to aid capacity constraints: The company is cautious with capex spending in the near-term and had guided for a capex of INR1.5bn for FY26 with INR410mn incurred in 1Q. The ongoing capacity expansions in Madhya Pradesh (1,100 machines), Karnataka (750 machines) and Jharkhand (200 machines with 2 shifts) are expected to materialize in 3QFY26. In the long-term, sourcing diversification remains a key theme for global retailers, and India remains one of the top contenders.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

2.jpg)

.jpg)