Buy Tata Motors Ltd For Target Rs. 872 By Elara Capital Ltd

JLR: EBIT margin guidance intact

We attended a meeting with Tata Motors’ (TTMT IN) CFO, Mr. PB Balaji on 11 March 2025. Key takeaways were: 1) TTMT seemed confident of meeting Jaguar Land Rover’s (JLR) FY25 EBIT margin guidance of ≥8.5% and net debt free. 2) JLR’s focus will remain building on brands and superior mix-led growth – TTMT expects Land Rover (LR) to top global growth. 3) In India, TTMT’s target of achieving double-digit EBITDA margin in the PV segment remains – Sierra’s ICE version is likely in the festival season. 4) The SCV segment may see some revival with TTMT acknowledging certain issues. We maintain estimates and reiterate Buy, with SoTP-TP pared to INR 872 (from INR 909).

‘House of Brands’ strategy intact; VME and warranty to be fine-tuned: JLR continues to focus on its strategy of building on the ‘House of Brands’ and expects mix-led benefits to continue. Quality, residual value and preserving the luxury brand pedigree are some key pillars for luxury brands. JLR is confident of meeting its FY25 EBIT margin guidance of ≥8.5% and turning net debt free. It is yet to decide on positioning of Discovery as a brand. Warranty cost is a bigger concern, mainly for Jaguar – For Range Rover and Defender, warranty cost is much lower than JLR average. With Jaguar ICE to be phased out, expect positive impact on margin. Warranty cost may ebb from Q4; A reason for rising warranty issues in other global brands has been rising tech in software-defined vehicles and issues related to that.

TTMT cautious on global demand; expects LR to outperform: Europe has elongated the timelines for meeting emission regulations – Expect the UK to follow suit. Demand in the US is holding up well (monitor the direction of tariffs), in the EU is seeing some positive notes, in the UK is reviving and in China seems still stressed, albeit at a lesser clip than for global peers. TTMT sees concerns in China as more cyclical than structural. TTMT expects LR volumes to outperform global auto volume, given its positioning and branding strategy.

India PV: TTMT targets double-digit margin; focus on marketing to revive brands: TTMT has maintained its target of double-digit EBITDA margin for its India PV business (9MFY25 EBITDA margin at 6.6%). Also, it will focus on branding and marketing of the portfolio than just pricing and market share. Per TTMT, this renewed strategy will help it gain market share, eventually. Curvv is expected to be relaunched during the IPL and ICE Sierra during the festival season (Sep-Oct). Worst seems behind for the PV EV business and EV contribution in FY27-28 should at least touch 15-20%. TTMT will relook its distribution channel strategy.

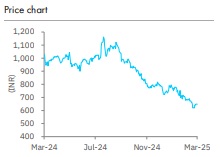

Maintain Buy; TP cut to INR 872: Monitor how JLR balances premiumization (positive impact on margin from mix) with volume growth (operating leverage), even as global growth slows and order backlog exhausts. While Q4FY25 EBIT margin for JLR may be strong at ~10%, await FY26 EBIT margin guidance (currently 10%; Elara Estimate 9%). For India business, Sierra ICE launch during the festival season may arrest the market share dip from H2FY26. We are cautious on India CV cycle. Valuations are comfortable. We reiterate Buy, but cut SoTP-TP to INR 872 from INR 909, as we pare EV/EBTIDA for CV and PV segments to 10x/ 13x (from 11x/ 14x), respectively, on muted outlook.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)